Answered step by step

Verified Expert Solution

Question

1 Approved Answer

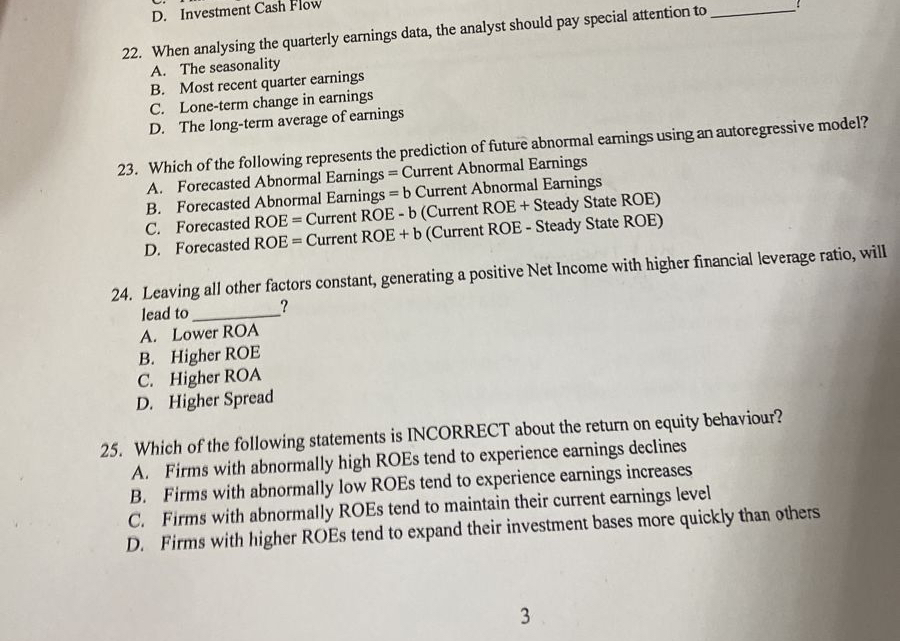

D . Investment Cash Flow 2 2 . When analysing the quarterly earnings data, the analyst should pay special attention to A . The seasonality

D Investment Cash Flow

When analysing the quarterly earnings data, the analyst should pay special attention to

A The seasonality

B Most recent quarter earnings

C Loneterm change in earnings

D The longterm average of earnings

Which of the following represents the prediction of future abnormal eamings using an autoregressive model?

A Forecasted Abnormal Earnings Current Abnormal Earnings

B Forecasted Abnormal Earnings Current Abnormal Earnings

C Forecasted ROE Current ROE Current ROE Steady State ROE

D Forecasted ROE Current ROE Current ROE Steady State ROE

Leaving all other factors constant, generating a positive Net Income with higher financial leverage ratio, will lead to

A Lower ROA

B Higher ROE

C Higher ROA

D Higher Spread

Which of the following statements is INCORRECT about the return on equity behaviour?

A Firms with abnormally high ROEs tend to experience earnings declines

B Firms with abnormally low ROEs tend to experience earnings increases

C Firms with abnormally ROEs tend to maintain their current earnings level

D Firms with higher ROEs tend to expand their investment bases more quickly than others

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started