D leon inc part 2 : answer F- k.

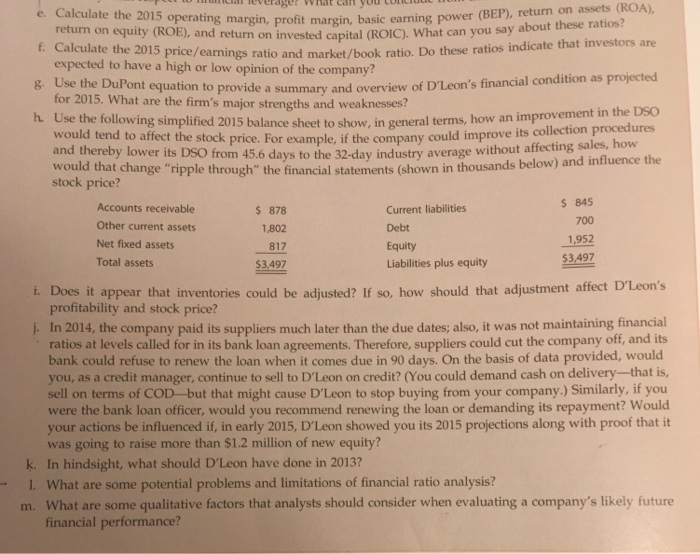

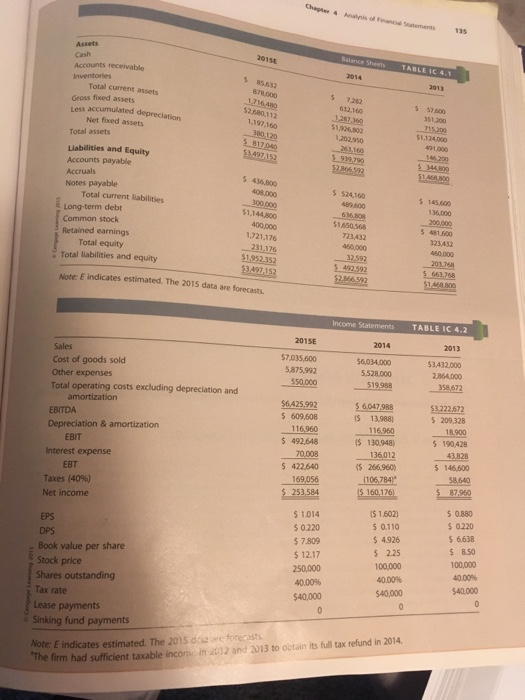

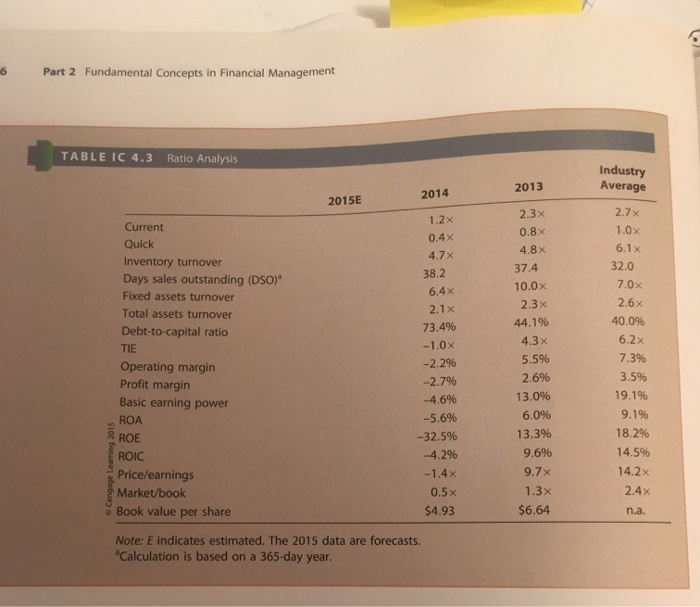

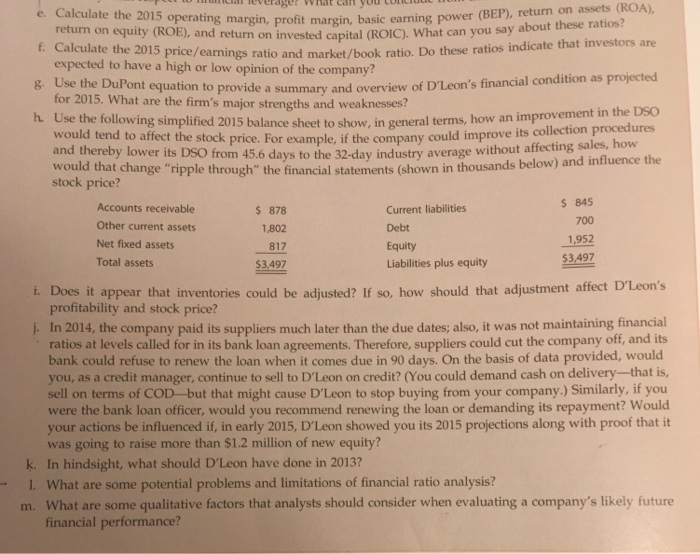

ng margin, profit margin, basic earning power (BEP), return on assets (ROA), return on equity (ROE), and return on invested capital (ROIC). What can you say a f Calculate the 2015 price/ear expected to have a high or low opinion of the company 8. Use the DuPont equation to provide a summary and overview of D'Leon's fina for 2015. What are the firm's major strengths and weaknesses? h. Use the following simplified 2015 balance sheet to show, in general terms, how an impro would tend to affect the stock price. For example, if the company could improve its collection and thereby lower its DSO from 45.6 days to the 32-day industry average without affecting sales, how would that change "ripple through" the financial statements (shown in thousands below) stock price? nings ratio and market/book ratio. Do these ratios indicate that investors in the DSO S 845 Accounts receivable s 878 Current liabilities 700 Other current assets 1,802 Debt 1,952 Net fixed assets Equity 817 $3,497 Total assets Liabilities plus equity i. Does it appear that inventories could be adjusted? If so, how should that adjustment affecet D'Leon's profitability and stock price? j. In 2014, the company paid its suppliers much later than the due dates; also, it was not maintaining financial ratios at levels called for in its bank loan agreements. Therefore, suppliers could cut the company off, and its bank could refuse to renew the loan when it comes due in 90 days. On the basis of data provided, would you, as a credit manager, continue to sell to D'Leon on credit? (You could demand cash on delivery-that is sell on terms of COD-but that might ause D'Leon to stop buying from your company.) Similarly, if you were the bank loan officer, would you recommend renewing the loan or demanding its repayment? Would our actions be influenced if, in early 2015, D'Leon showed you its 2015 projections along with proof that it was going to raise more than $1.2 million of new equity? In hindsight, what should D'Leon have done in 2013? . What are some potential problems and limitations of financial ratio analysis? m. What are some qualitative factors that analysts should consider when evaluating a company's likely future financial performance? atements 135 Inventories Total current assets Gross fixed assets 51 200 Net fixed assets Total assets Liabilities and Equity 146200 Accounts payable S 436,800 Total current liabilities 5 145.600 36.000 Long-term debt Common stock Retained earnings 51450.56 481,600 1,721,176 Total equity Total alabilities and equity Note E indicates estimated. The 2015 data are forecasts Income StatementsTABLE IC 4.2 201SE $7035,600 Cost of goods sold 5,875,992 Other expenses Total operating costs excluding depreciation and 609,508 EBITDA 5 209328 Depreciation & amortization 5 190,428 $ 492,648 EBIT Interest expense 146,600 $ 422.640 5 266,960) EBT Net income $ 1.014 0.220 6.638 4926 7.809 e Book value per share Stock price Shares outstanding Tax rate s 225 12.17 100,000 40.00% Sinking fund payments Note: E indicates estimated. The 2015 dci are forecasts The firm had sufficient taxable income in 2012 and 2013 to octain its full tax refund in 2014 6 Part 2 Fundamental Concepts in Financial Management TABLE IC 4.3 Ratio Analysis Industry Average 2013 2014 2015E 2.7 2.3x 1.2x Current 0.8x 1.0 0.4x Quick 6.1 4.8x 4.7x Inventory turnover 32.0 37.4 38.2 Days sales outstanding (DSO)* 7.0 10.0x 6.4x Fixed assets turnover 2.6 2.3x 2.1 Total assets turnover 40.0% 44.1% 73.4% Debt-to-capital ratico 6.2x 4.3x TIE 7.3% 5.5% -2.2% Operating margin Profit margin 3.5% 2.6% 19.1% 13.0% -4.6% Basic earning power n ROA & ROE 9.1% 6.096 -5.6% 18.2% 13.3% -32.5% 14.5% -4.2% 9.6% ROIC 9.7x 14.2x Price/earnings 1.3x 2.4x Market/book $6.64 o Book value per share $4.93 n.a. Note: E indicates estimated. The 2015 data are forecasts. Calculation is based on a 365-day year