Question

d) Now suppose that in addition to the eight risky portfolios above Richard can borrow and lend at a risk-free interest rate of 2% thanks

d) Now suppose that in addition to the eight risky portfolios above Richard can borrow and lend at a risk-free interest rate of 2% thanks to some special connections he has with Raviga Capital. Which of the risky portfolios is best when taking into consideration this additional opportunity?

e) If Richard can borrow or lend at 2% and is willing to tolerate a standard deviation of 22%, what is the optimal portfolio choice? (To help Richard as much as possible, the optimal portfolio choice should clearly specify the weight in each investment.)

f) What return can Richard expect if he follows your advice from part (e)?

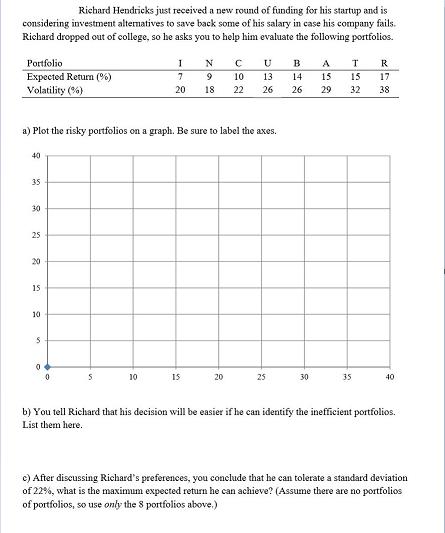

Richard Hendricks just received a new round of funding for his startup and is considering investment alternatives to save back some of his salary in case his company fails. Richard dropped out of college, so he asks you to help him evaluate the following portfolios. Portfolio Expected Return (%) Volatility (%) 40 35 30 25 a) Plot the risky portfolios on a graph. Be sure to label the axes. 20 15 10 S 0 0 5 I 7 10 N 9 15 10 13 20 18 22 26 U B 20 25 14 15 26 29 30 T R 15 17 32 38 35 40 b) You tell Richard that his decision will be easier if he can identify the inefficient portfolios. List them here. c) After discussing Richard's preferences, you conclude that he can tolerate a standard deviation of 22%, what is the maximum expected return he can achieve? (Assume there are no portfolios of portfolios, so use only the 8 portfolios above.)

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Open a new Excel sheet In cell A1 type Expected Return and in cell B1 type Volatility In cells A2 to A9 enter the expected returns for each portfolio 7 9 10 13 14 15 15 17 In cells B2 to B9 enter th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started