Answered step by step

Verified Expert Solution

Question

1 Approved Answer

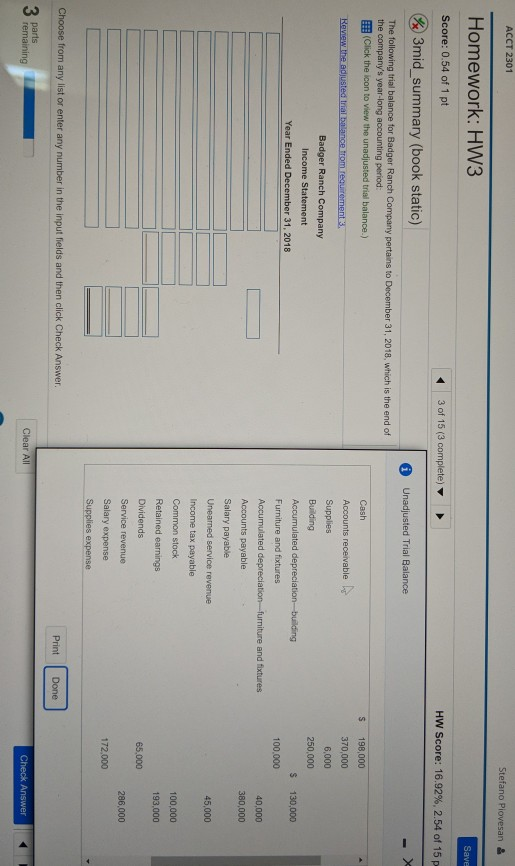

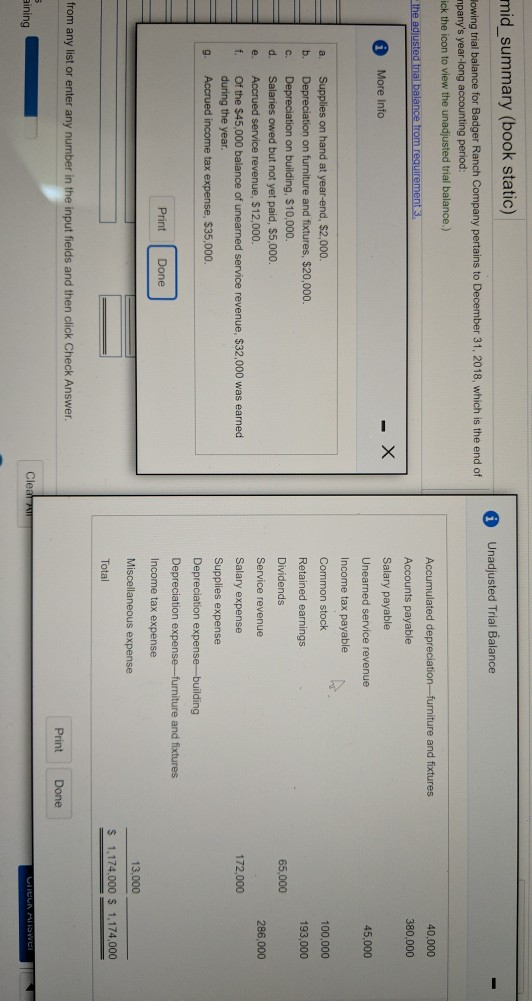

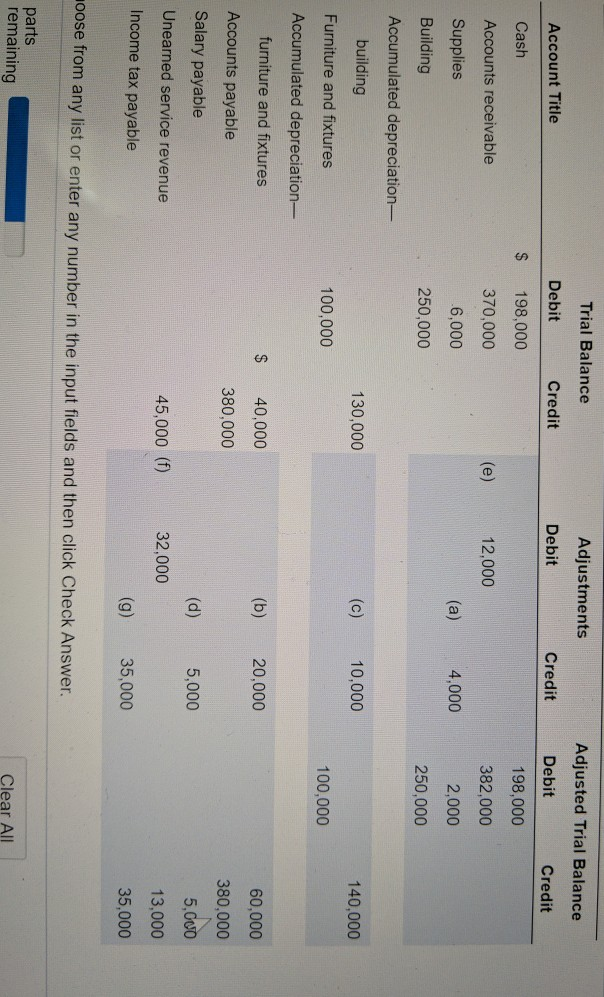

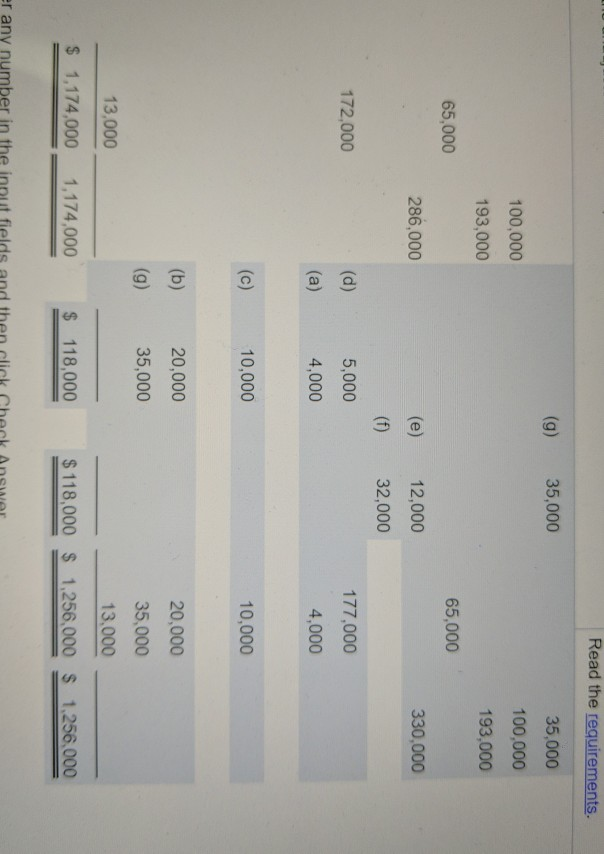

D on't want the answer, just the procedure please. ACCT 2301 Stefano Piovesan Homework: HW3 Save Score: 0.54 of 1 pt 3 of 15 (3

Don't want the answer, just the procedure please.

ACCT 2301 Stefano Piovesan Homework: HW3 Save Score: 0.54 of 1 pt 3 of 15 (3 complete) HW Score: 16.92%, 2.54 of 15 p %3mid_summary (book static) Unadjusted Trial Balance The following trial balance for Badger Ranch Company pertains to December 31, 2018, which is the end of the company's year-long accounting period: (Click the icon to view the unadjusted trial balance.) S 198,000 Review the adjusted trial balance from requirement 3. Badger Ranch Company Income Statement Year Ended December 31, 2018 370,000 6.000 250,000 $ 130,000 100.000 Cash Accounts receivable Supplies Building Accumulated depreciation building Furniture and fixtures Accumulated depreciation-furniture and fixtures Accounts payable Salary payable Unearned service revenue Income tax payable Common stock Retained earnings Dividends Service revenue 40,000 380,000 45,000 100.000 193,000 65,000 286,000 172,000 Salary expense Supplies expense Choose from any list or enter any number in the input fields and then click Check Answer Print Done 3 parts remaining Clear All Check Answer mid_summary (book static) Unadjusted Trial Balance Howing trial balance for Badger Ranch Company pertains to December 31, 2018, which is the end of mpany's year-long accounting period: ick the icon to view the unadjusted trial balance.) 40.000 the adjusted trial balance from requirement 3. Accumulated depreciation-furniture and fixtures Accounts payable Salary payable 380,000 More Info - X 45,000 Unearned service revenue Income tax payable a Common stock 100,000 b. Retained earnings 193,000 Dividends 65,000 c. d e. f Supplies on hand at year-end, $2,000. Depreciation on furniture and fixtures, $20,000 Depreciation on building. 10,000 Salaries owed but not yet paid, $5,000. Accrued service revenue, $12,000. Of the $45,000 balance of unearned service revenue, $32,000 was earned during the year. Accrued income tax expense, $35,000 Service revenue 286,000 172,000 9 Salary expense Supplies expense Depreciation expense building Depreciation expense-furniture and fixtures Print Done Income tax expense Miscellaneous expense 13,000 Total $ 1,174,000 $ 1,174,000 from any list or enter any number in the input fields and then click Check Answer Print Done aining Cleat LCUN AISI Trial Balance Adjustments Adjusted Trial Balance Account Title Debit Credit Debit Credit Debit Credit Cash 198.000 198,000 Accounts receivable 370,000 (e) 12.000 382,000 6,000 (a) 4,000 2.000 Supplies Building Accumulated depreciation- 250,000 250,000 building 130,000 (C) 10,000 140,000 Furniture and fixtures 100,000 100,000 $ 40.000 (b) 20,000 60,000 Accumulated depreciation- furniture and fixtures Accounts payable Salary payable Unearned service revenue 380,000 380,000 5.000 (d) 5,000 45,000 (f) 32,000 13,000 Income tax payable (g) 35,000 35,000 hoose from any list or enter any number in the input fields and then click Check Answer. parts remaining Clear All Read the requirements. (g) 35,000 35,000 100,000 100.000 193,000 193,000 65,000 65,000 286,000 12,000 330.000 32,000 172.000 (d) 5,000 177,000 (a) 4,000 4,000 (c) 10,000 10,000 (b) 20,000 20,000 (g) 35,000 35,000 13,000 13,000 $ 1,174,000 1,174,000 $ 118,000 $ 118,000 $ 1,256,000 $ 1.256.000 er any number in the ACCT 2301 Stefano Piovesan Homework: HW3 Save Score: 0.54 of 1 pt 3 of 15 (3 complete) HW Score: 16.92%, 2.54 of 15 p %3mid_summary (book static) Unadjusted Trial Balance The following trial balance for Badger Ranch Company pertains to December 31, 2018, which is the end of the company's year-long accounting period: (Click the icon to view the unadjusted trial balance.) S 198,000 Review the adjusted trial balance from requirement 3. Badger Ranch Company Income Statement Year Ended December 31, 2018 370,000 6.000 250,000 $ 130,000 100.000 Cash Accounts receivable Supplies Building Accumulated depreciation building Furniture and fixtures Accumulated depreciation-furniture and fixtures Accounts payable Salary payable Unearned service revenue Income tax payable Common stock Retained earnings Dividends Service revenue 40,000 380,000 45,000 100.000 193,000 65,000 286,000 172,000 Salary expense Supplies expense Choose from any list or enter any number in the input fields and then click Check Answer Print Done 3 parts remaining Clear All Check Answer mid_summary (book static) Unadjusted Trial Balance Howing trial balance for Badger Ranch Company pertains to December 31, 2018, which is the end of mpany's year-long accounting period: ick the icon to view the unadjusted trial balance.) 40.000 the adjusted trial balance from requirement 3. Accumulated depreciation-furniture and fixtures Accounts payable Salary payable 380,000 More Info - X 45,000 Unearned service revenue Income tax payable a Common stock 100,000 b. Retained earnings 193,000 Dividends 65,000 c. d e. f Supplies on hand at year-end, $2,000. Depreciation on furniture and fixtures, $20,000 Depreciation on building. 10,000 Salaries owed but not yet paid, $5,000. Accrued service revenue, $12,000. Of the $45,000 balance of unearned service revenue, $32,000 was earned during the year. Accrued income tax expense, $35,000 Service revenue 286,000 172,000 9 Salary expense Supplies expense Depreciation expense building Depreciation expense-furniture and fixtures Print Done Income tax expense Miscellaneous expense 13,000 Total $ 1,174,000 $ 1,174,000 from any list or enter any number in the input fields and then click Check Answer Print Done aining Cleat LCUN AISI Trial Balance Adjustments Adjusted Trial Balance Account Title Debit Credit Debit Credit Debit Credit Cash 198.000 198,000 Accounts receivable 370,000 (e) 12.000 382,000 6,000 (a) 4,000 2.000 Supplies Building Accumulated depreciation- 250,000 250,000 building 130,000 (C) 10,000 140,000 Furniture and fixtures 100,000 100,000 $ 40.000 (b) 20,000 60,000 Accumulated depreciation- furniture and fixtures Accounts payable Salary payable Unearned service revenue 380,000 380,000 5.000 (d) 5,000 45,000 (f) 32,000 13,000 Income tax payable (g) 35,000 35,000 hoose from any list or enter any number in the input fields and then click Check Answer. parts remaining Clear All Read the requirements. (g) 35,000 35,000 100,000 100.000 193,000 193,000 65,000 65,000 286,000 12,000 330.000 32,000 172.000 (d) 5,000 177,000 (a) 4,000 4,000 (c) 10,000 10,000 (b) 20,000 20,000 (g) 35,000 35,000 13,000 13,000 $ 1,174,000 1,174,000 $ 118,000 $ 118,000 $ 1,256,000 $ 1.256.000 er any number in theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started