Answered step by step

Verified Expert Solution

Question

1 Approved Answer

D plc currently has $20 million in excess cash and no debt. The company expects to generate additional free cash flows of $30 million

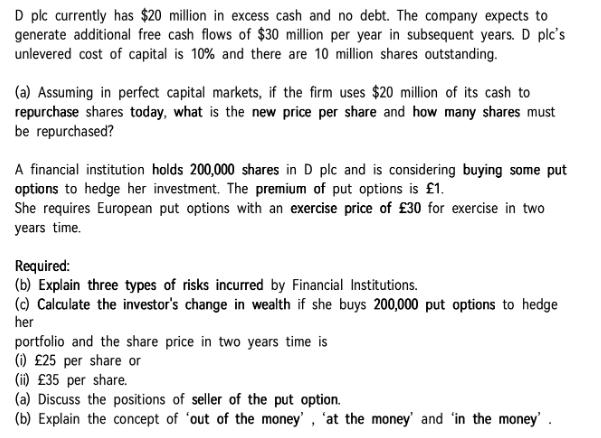

D plc currently has $20 million in excess cash and no debt. The company expects to generate additional free cash flows of $30 million per year in subsequent years. D plc's unlevered cost of capital is 10% and there are 10 million shares outstanding. (a) Assuming in perfect capital markets, if the firm uses $20 million of its cash to repurchase shares today, what is the new price per share and how many shares must be repurchased? A financial institution holds 200,000 shares in D plc and is considering buying some put options to hedge her investment. The premium of put options is 1. She requires European put options with an exercise price of 30 for exercise in two years time. Required: (b) Explain three types of risks incurred by Financial Institutions. (c) Calculate the investor's change in wealth if she buys 200,000 put options to hedge her portfolio and the share price in two years time is (i) 25 per share or (ii) 35 per share. (a) Discuss the positions of seller of the put option. (b) Explain the concept of 'out of the money', 'at the money' and 'in the money'.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Assuming in perfect capital markets if the firm uses 20 million of its cash to repurchase shares today what is the new price per share and how many ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started