Answered step by step

Verified Expert Solution

Question

1 Approved Answer

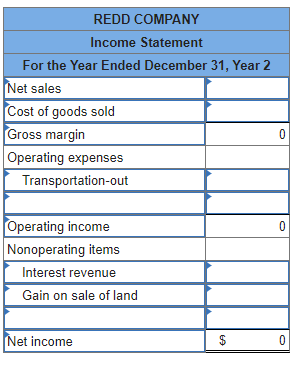

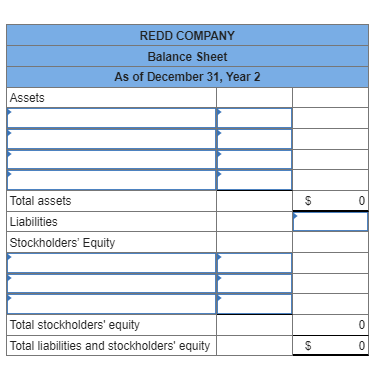

d. Prepare a multistep income statement and a balance sheet for year 2. begin{tabular}{|l|l|} hline multicolumn{2}{|c|}{ REDD COMPANY } hline multicolumn{2}{|c|}{ Income Statement }

d. Prepare a multistep income statement and a balance sheet for year 2.

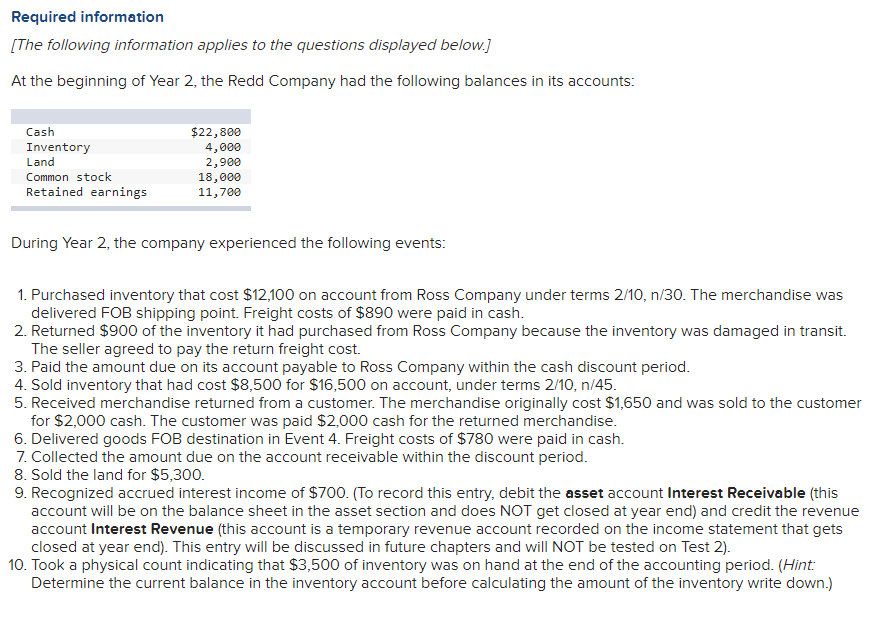

\begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ REDD COMPANY } \\ \hline \multicolumn{2}{|c|}{ Income Statement } \\ \hline For the Year Ended December 31, Year 2 \\ \hline Net sales & \\ \hline Cost of goods sold & \\ \hline Gross margin & \\ \hline Operating expenses & \\ \hline Transportation-out & \\ \hline & \\ \hline Operating income & \\ \hline Nonoperating items & \\ \hline Interest revenue & \\ \hline Gain on sale of land & \\ \hline & \\ \hline Net income & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ BEDD COMPANY } \\ \hline \multicolumn{2}{|c|}{ As of December 31, Year 2 } \\ \hline Assets & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total assets & & \\ \hline Liabilities & & \\ \hline Stockholders' Equity & & \\ \hline & & \\ \hline \hline & & \\ \hline & & \\ \hline Total stockholders' equity & & \\ \hline Total liabilities and stockholders' equity & & 0 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ BEDD COMPANY } \\ \hline \multicolumn{2}{|c|}{ As of December 31, Year 2 } \\ \hline Assets & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total assets & & \\ \hline Liabilities & & \\ \hline Stockholders' Equity & & \\ \hline & & \\ \hline \hline & & \\ \hline & & \\ \hline Total stockholders' equity & & \\ \hline Total liabilities and stockholders' equity & & 0 \\ \hline \end{tabular} Required information [The following information applies to the questions displayed below.] At the beginning of Year 2, the Redd Company had the following balances in its accounts: During Year 2, the company experienced the following events: 1. Purchased inventory that cost $12,100 on account from Ross Company under terms 2/10,n/30. The merchandise was delivered FOB shipping point. Freight costs of $890 were paid in cash. 2. Returned $900 of the inventory it had purchased from Ross Company because the inventory was damaged in transit. The seller agreed to pay the return freight cost. 3. Paid the amount due on its account payable to Ross Company within the cash discount period. 4. Sold inventory that had cost $8,500 for $16,500 on account, under terms 2/10,n/45. 5. Received merchandise returned from a customer. The merchandise originally cost $1,650 and was sold to the customer for $2,000 cash. The customer was paid $2,000 cash for the returned merchandise. 6. Delivered goods FOB destination in Event 4. Freight costs of $780 were paid in cash. 7. Collected the amount due on the account receivable within the discount period. 8. Sold the land for $5,300. 9. Recognized accrued interest income of $700. (To record this entry, debit the asset account Interest Receivable (this account will be on the balance sheet in the asset section and does NOT get closed at year end) and credit the revenue account Interest Revenue (this account is a temporary revenue account recorded on the income statement that gets closed at year end). This entry will be discussed in future chapters and will NOT be tested on Test 2). 10. Took a physical count indicating that $3,500 of inventory was on hand at the end of the accounting period. (Hint: Determine the current balance in the inventory account before calculating the amount of the inventory write down.) \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ REDD COMPANY } \\ \hline \multicolumn{2}{|c|}{ Income Statement } \\ \hline For the Year Ended December 31, Year 2 \\ \hline Net sales & \\ \hline Cost of goods sold & \\ \hline Gross margin & \\ \hline Operating expenses & \\ \hline Transportation-out & \\ \hline & \\ \hline Operating income & \\ \hline Nonoperating items & \\ \hline Interest revenue & \\ \hline Gain on sale of land & \\ \hline & \\ \hline Net income & \\ \hline \end{tabular} Required information [The following information applies to the questions displayed below.] At the beginning of Year 2, the Redd Company had the following balances in its accounts: During Year 2, the company experienced the following events: 1. Purchased inventory that cost $12,100 on account from Ross Company under terms 2/10,n/30. The merchandise was delivered FOB shipping point. Freight costs of $890 were paid in cash. 2. Returned $900 of the inventory it had purchased from Ross Company because the inventory was damaged in transit. The seller agreed to pay the return freight cost. 3. Paid the amount due on its account payable to Ross Company within the cash discount period. 4. Sold inventory that had cost $8,500 for $16,500 on account, under terms 2/10,n/45. 5. Received merchandise returned from a customer. The merchandise originally cost $1,650 and was sold to the customer for $2,000 cash. The customer was paid $2,000 cash for the returned merchandise. 6. Delivered goods FOB destination in Event 4. Freight costs of $780 were paid in cash. 7. Collected the amount due on the account receivable within the discount period. 8. Sold the land for $5,300. 9. Recognized accrued interest income of $700. (To record this entry, debit the asset account Interest Receivable (this account will be on the balance sheet in the asset section and does NOT get closed at year end) and credit the revenue account Interest Revenue (this account is a temporary revenue account recorded on the income statement that gets closed at year end). This entry will be discussed in future chapters and will NOT be tested on Test 2). 10. Took a physical count indicating that $3,500 of inventory was on hand at the end of the accounting period. (Hint: Determine the current balance in the inventory account before calculating the amount of the inventory write down.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started