Answered step by step

Verified Expert Solution

Question

1 Approved Answer

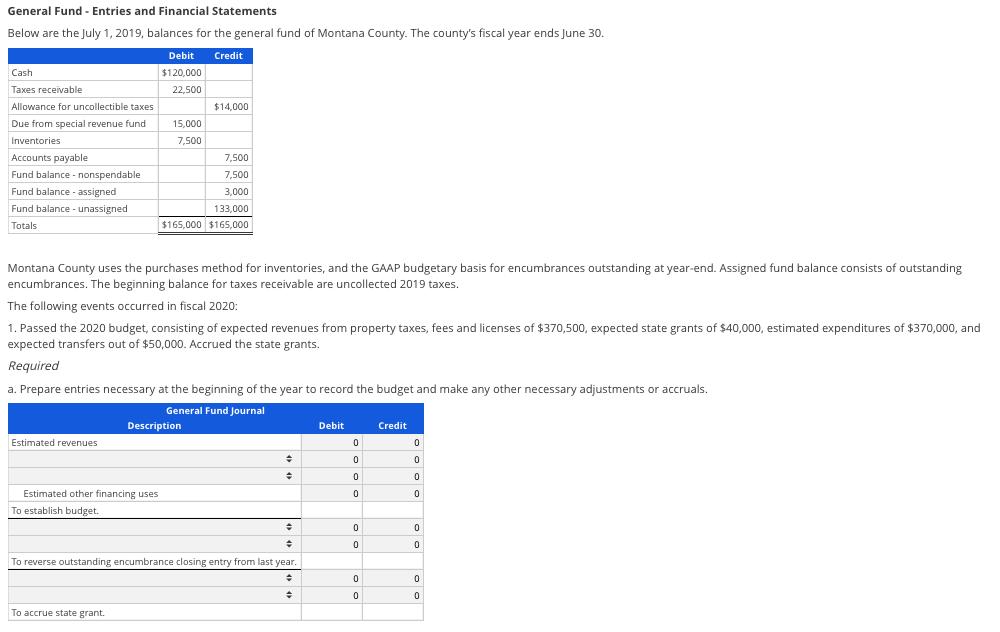

General Fund - Entries and Financial Statements Below are the July 1, 2019, balances for the general fund of Montana County. The county s

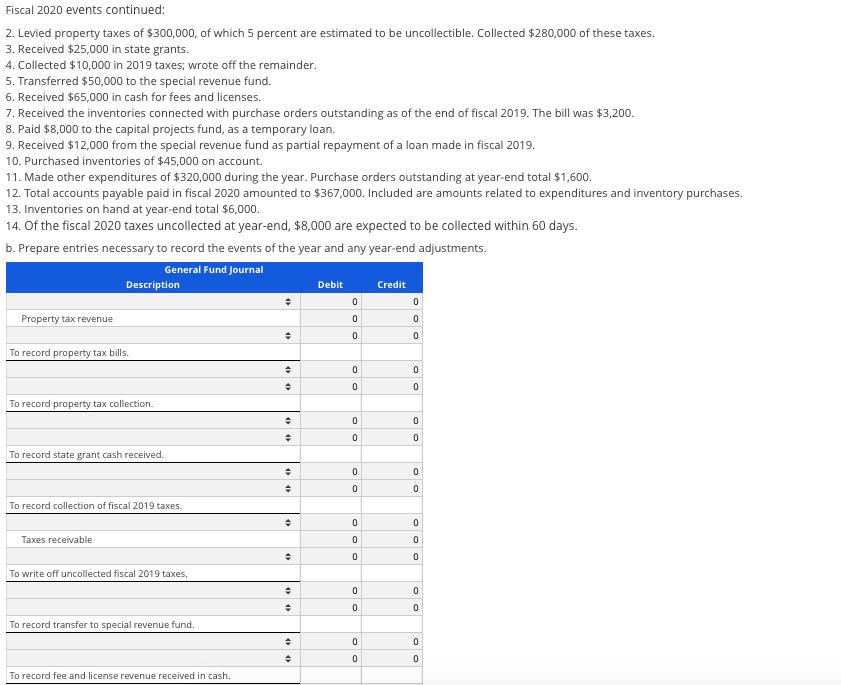

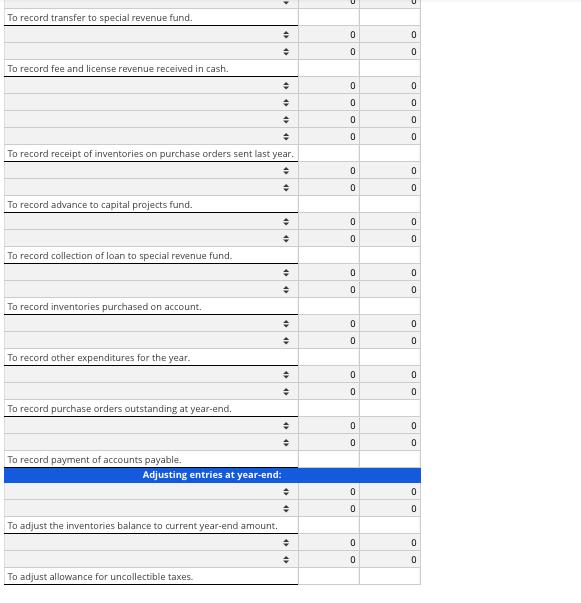

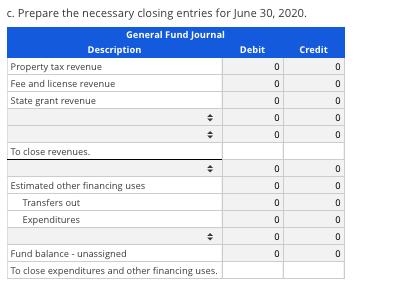

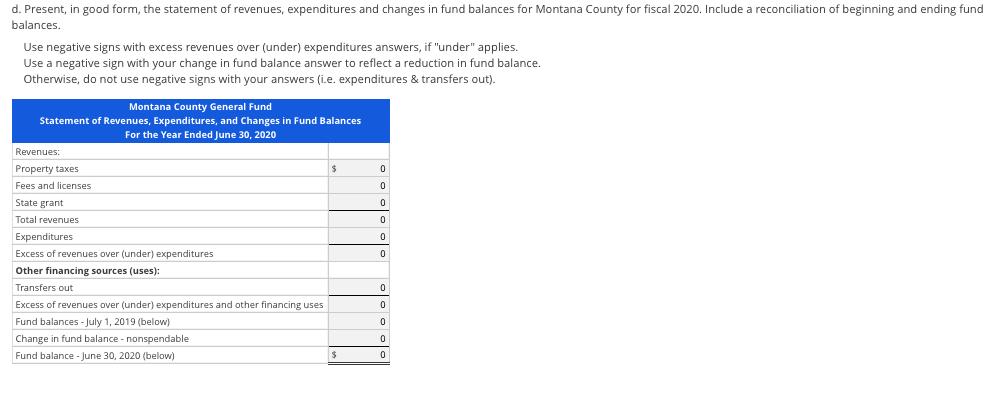

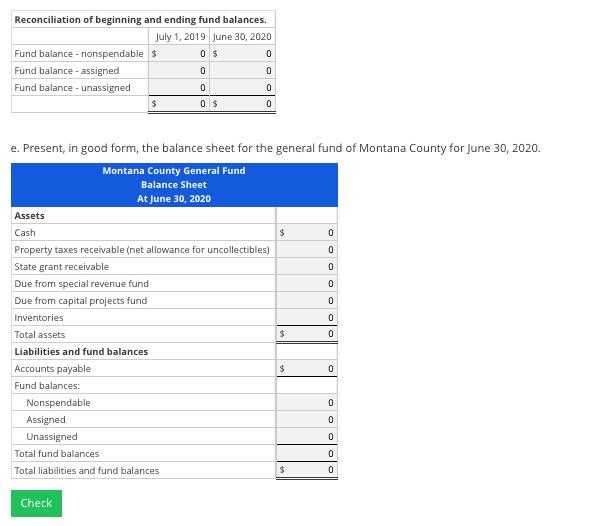

General Fund - Entries and Financial Statements Below are the July 1, 2019, balances for the general fund of Montana County. The county s fiscal year ends June 30. Credit Cash Taxes receivable Allowance for uncollectible taxes Due from special revenue fund Inventories Accounts payable Fund balance - nonspendable Fund balance assigned Fund balance - unassigned Totals Debit $120,000 22,500 Estimated revenues 15,000 7,500 Montana County uses the purchases method for inventories, and the GAAP budgetary basis for encumbrances outstanding at year-end. Assigned fund balance consists of outstanding encumbrances. The beginning balance for taxes receivable are uncollected 2019 taxes. The following events occurred in fiscal 2020: Estimated other financing uses To establish budget. $14,000 1. Passed the 2020 budget, consisting of expected revenues from property taxes, fees and licenses of $370,500, expected state grants of $40,000, estimated expenditures of $370,000, and expected transfers out of $50,000. Accrued the state grants. Required To accrue state grant. 7,500 7,500 3.000 133,000 $165,000 $165,000 a. Prepare entries necessary at the beginning of the year to record the budget and make any other necessary adjustments or accruals. General Fund Journal Description + To reverse outstanding encumbrance closing entry from last year. ***** Debit 0 0 0 0 0 0 0 0 Credit 0 0 0 0 0 0 0 0 Fiscal 2020 events continued: 2. Levied property taxes of $300,000, of which 5 percent are estimated to be uncollectible. Collected $280,000 of these taxes. 3. Received $25,000 in state grants. 4. Collected $10,000 in 2019 taxes; wrote off the remainder. 5. Transferred $50,000 to the special revenue fund. 6. Received $65,000 in cash for fees and licenses. 7. Received the inventories connected with purchase orders outstanding as of the end of fiscal 2019. The bill was $3,200. 8. Paid $8,000 to the capital projects fund, as a temporary loan. 9. Received $12,000 from the special revenue fund as partial repayment of a loan made in fiscal 2019. 10. Purchased inventories of $45,000 on account. 11. Made other expenditures of $320,000 during the year. Purchase orders outstanding at year-end total $1,600. 12. Total accounts payable paid in fiscal 2020 amounted to $367,000. Included are amounts related to expenditures and inventory purchases. 13. Inventories on hand at year-end total $6,000. 14. Of the fiscal 2020 taxes uncollected at year-end, $8,000 are expected to be collected within 60 days. b. Prepare entries necessary to record the events of the year and any year-end adjustments. General Fund Journal Property tax revenue Description To record property tax bills. To record property tax collection. To record state grant cash received. To record collection of fiscal 2019 taxes. Taxes receivable To write off uncollected fiscal 2019 taxes. To record transfer to special revenue fund. To record fee and license revenue received in cash. ( ( ** ( th + 4P th 00 + 00 + + Debit OOO 0 0 0 0 0 0 0 0 OOO 0 0 0 0 0 0 Credit 0 0 0 0 0 0 0 0 0 0 OOO 0 0 0 0 0 0 To record transfer to special revenue fund. To record fee and license revenue received in cash. To record advance to capital projects fund. To record collection of loan to special revenue fund. + + + + To record receipt of inventories on purchase orders sent last year. + To record inventories purchased on account. To record other expenditures for the year. To record purchase orders outstanding at year-end. To record payment of accounts payable. To adjust the inventories balance to current year-end amount. + To adjust allowance for uncollectible taxes. Adjusting entries at year-end: ** ** + + ** + 474) IM + + + 47 47 + 0 0 OOOO 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 bl 0 0 0 0 OOO 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 c. Prepare the necessary closing entries for June 30, 2020. General Fund Journal Description Property tax revenue Fee and license revenue State grant revenue To close revenues. Estimated other financing uses Transfers out Expenditures 4 4 + Fund balance - unassigned To close expenditures and other financing uses. Debit 0 0 0 0 0 0 0 0 0 0 0 Credit 0 0 0 0 0 0 0 0 0 0 0 d. Present, in good form, the statement of revenues, expenditures and changes in fund balances for Montana County for fiscal 2020. Include a reconciliation of beginning and ending fund balances. Use negative signs with excess revenues over (under) expenditures answers, if under applies. Use a negative sign with your change in fund balance answer to reflect a reduction in fund balance. Otherwise, do not use negative signs with your answers (i.e. expenditures & transfers out). Montana County General Fund Statement of Revenues, Expenditures, and Changes in Fund Balances For the Year Ended June 30, 2020 Revenues: Property taxes Fees and licenses State grant Total revenues Expenditures Excess of revenues over (under) expenditures Other financing sources (uses): Transfers out Excess of revenues over (under) expenditures and other financing uses Fund balances - July 1, 2019 (below) Change in fund balance - nonspendable Fund balance - June 30, 2020 (below) $ $ 0 0 0 0 0 0 0 0 0 0 0 Reconciliation of beginning and ending fund balances. July 1, 2019 June 30, 2020 $ 0 $ 0 0 0 $ Fund balance-nonspendable Fund balance assigned Fund balance - unassigned $ e. Present, in good form, the balance sheet for the general fund of Montana County for June 30, 2020. Montana County General Fund Balance Sheet At June 30, 2020 Nonspendable Assets Cash Property taxes receivable (net allowance for uncollectibles) State grant receivable Due from special revenue fund Due from capital projects fund Inventories Total assets Liabilities and fund balances Accounts payable Fund balances: 0 0 0 0 Assigned Unassigned Total fund balances. Total liabilities and fund balances Check $ $ $ $ OOO OO 0 0 0 0 0 0 0 0 0 OOO 0 0 0 0

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started