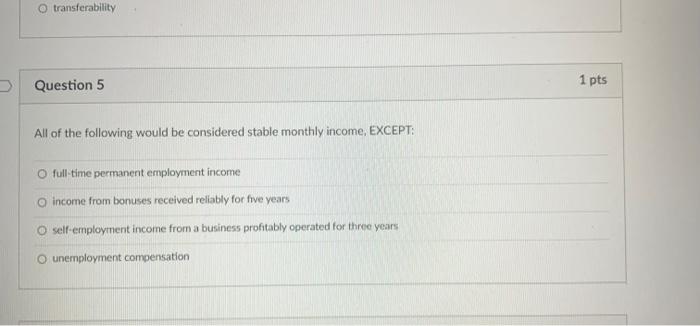

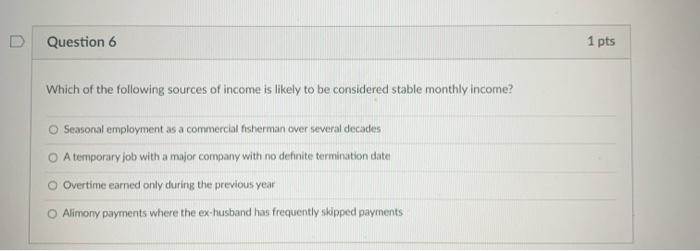

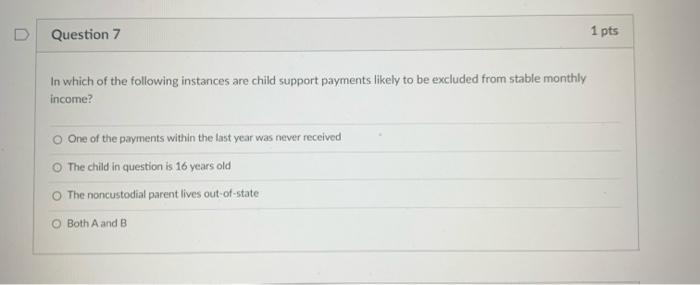

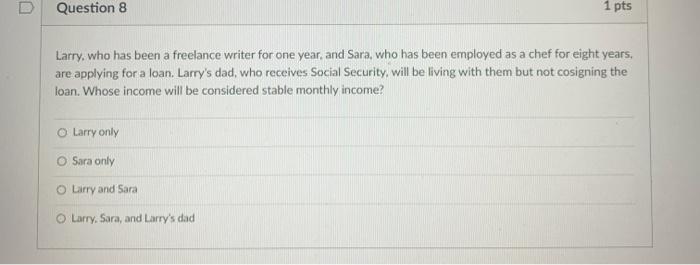

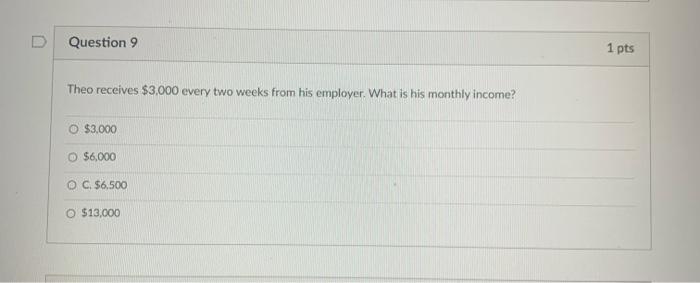

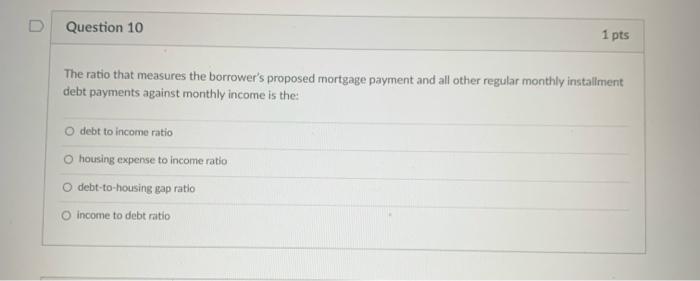

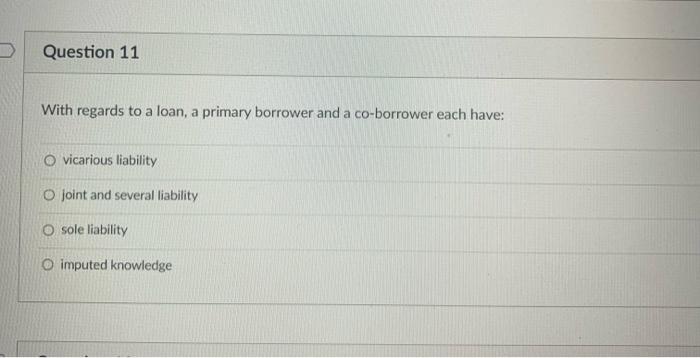

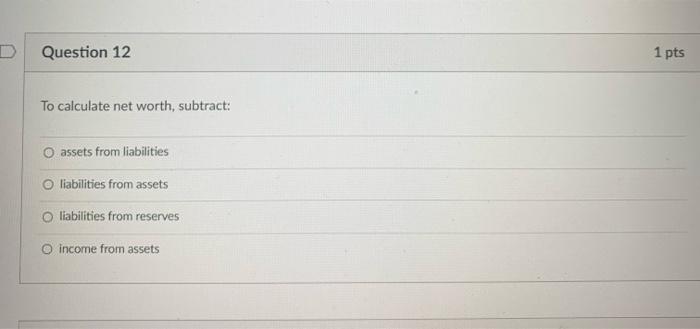

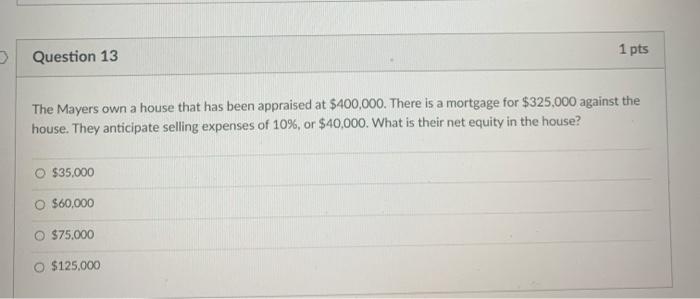

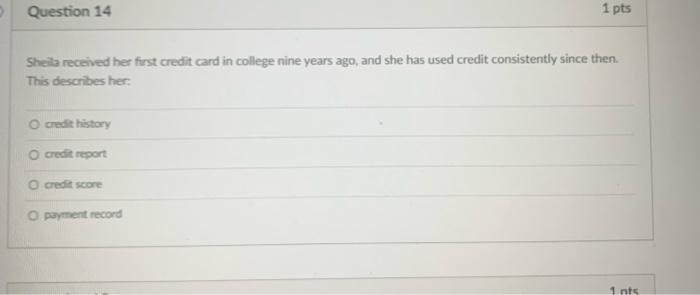

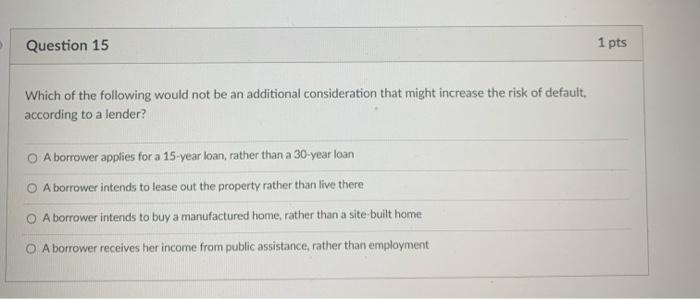

D Question 1 1 pts All of the following are among the tasks an underwriter will perform when evaluating a mortgage loan, EXCEPT: O verifying information provided by the loan applicant evaluating the appraisal of the property making a recommendation for or against loan approval O arranging for title insurance Question 2 1 pts A report generated by an automated underwriting system will include recommendations in all of the following categories, EXCEPT: risk classification O document classification property classification appraisal classification D Question 3 1 pts Question 3 1 pts All of the following are primary aspects of a borrower's financial situation, EXCEPT: income net worth O credit reputation earnings potential D Question 4 1 pts The dependability of the sources of an applicant's income is known as its: O quantity o quality O durability transferability Question 5 1 pts O transferability Question 5 1 pts All of the following would be considered stable monthly income, EXCEPT: O full-time permanent employment income o income from bonuses received reliably for five years O self-employment income from a business profitably operated for three years O unemployment compensation Question 6 1 pts Which of the following sources of income is likely to be considered stable monthly income? O Seasonal employment as a commercial fisherman over several decades A temporary job with a major company with no definite termination dater o Overtime eamed only during the previous year O Alimony payments where the ex-husband has frequently skipped payments D Question 7 1 pts In which of the following instances are child support payments likely to be excluded from stable monthly Income? o One of the payments within the last year was never received The child in question is 16 years old The noncustodial parent lives out-of-state O Both A and B Question 8 1 pts Larry, who has been a freelance writer for one year, and Sara, who has been employed as a chef for eight years, are applying for a loan. Larry's dad, who receives Social Security, will be living with them but not cosigning the loan. Whose income will be considered stable monthly income? Larry only O Sara only O Larry and Sara Larry, Sara, and Larry's dad Question 9 1 pts Theo receives $3,000 every two weeks from his employer. What is his monthly income? O $3.000 O $6,000 C. $6,500 O $13,000 D Question 10 1 pts The ratio that measures the borrower's proposed mortgage payment and all other regular monthly installment debt payments against monthly income is the O debt to income ratio O housing expense to income ratio O debt-to-housing rap ratio income to debt ratio Question 11 With regards to a loan, a primary borrower and a co-borrower each have: O vicarious liability O joint and several liability O sole liability O imputed knowledge D Question 12 1 pts To calculate net worth, subtract: assets from liabilities liabilities from assets liabilities from reserves o income from assets 1 pts Question 13 The Mayers own a house that has been appraised at $400,000. There is a mortgage for $325,000 against the house. They anticipate selling expenses of 10%, or $40,000. What is their net equity in the house? O $35,000 O $60,000 $75.000 O $125.000 Question 14 1 pts Sheila received her first credit card in college nine years ago, and she has used credit consistently since then. This describes her: O credit history credit report credit score O payment record 1 nts Question 15 1 pts Which of the following would not be an additional consideration that might increase the risk of default according to a lender? A borrower applies for a 15-year loan, rather than a 30-year loan A borrower intends to lease out the property rather than live there A borrower intends to buy a manufactured home, rather than a site-built home O A borrower receives her income from public assistance, rather than employment