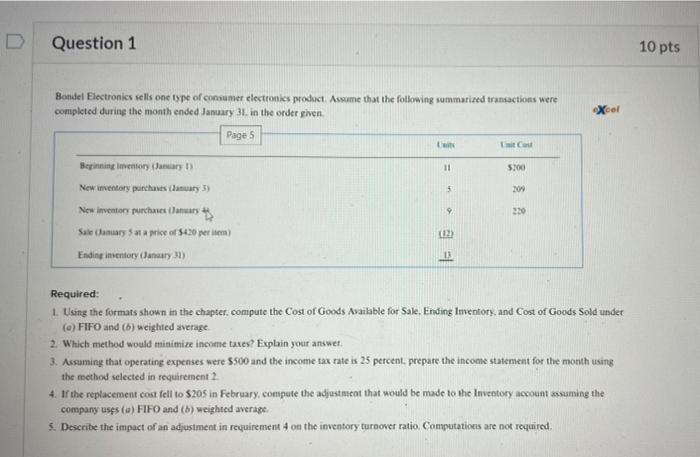

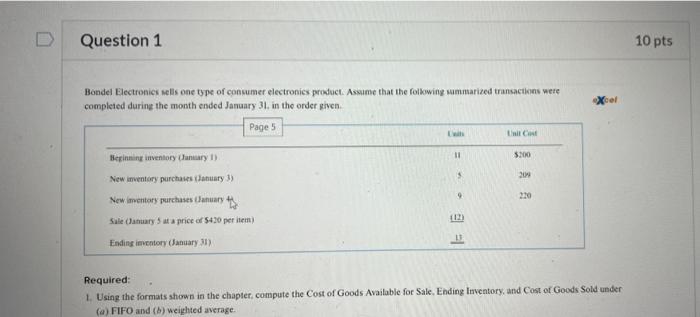

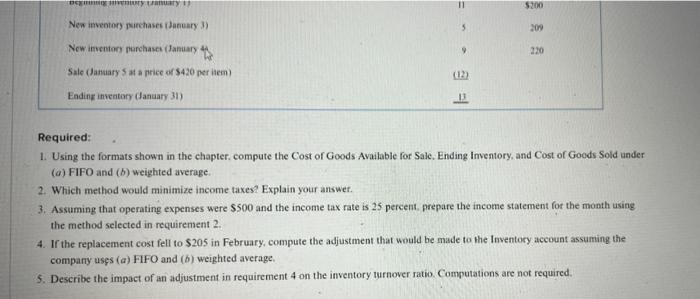

D Question 1 10 pts Bondel Electronics sells one type of consumer electronics product. Assume that the following summarized transactions were completed during the month ended January 31, in the order given Xool Page 5 Beginning mentory (January 1) 11 5:00 5 204 New inventory purchases Sanuary 3) New inventor purchases (January Sale Canuary 5 Mice of $40 perem) 220 (12) Ending inventory (January 31) Required: 1. Using the formats shown in the chapter, compute the Cost of Goods Available for Sale. Ending Inventory and Cost of Goods Sold under () FIFO and (b) weighted average 2. Which method would minimize income taxes? Explain your answer. 3. Assuming that operating expenses were $500 and the income tax rate is 25 percent, prepare the income statement for the month using the method selected in requirement 2 4. If the replacement cost fell to $205 in February, compute the adjustment that would be made to the Inventory account assuming the company uses (a) FIFO and (b) weighted average. 5. Describe the impact of an adjustment in requirement on the inventory turnover ratio Computations are not required. D Question 1 10 pts Bondel Electronics sells one type of consumer electronics product. Assume that the following summarized transactions were completed during the month ended January 31, in the order given Xor Page 5 it C 11 3200 Beginning inventory January 1) $ 2014 New inventory purchases January 3) 210 12 New inventory purchases (January Sale January at a price of 5430 per item) Ending inventory (January 311 1= Required: 1. Using the formats shown in the chapter, compute the Cost of Goods Available for Sale Ending Inventory, and Cost of Goods Sold under (a) FIFO and (h) weighted average D. 5200 New inventory Nirehases January 3) 209 220 New inventory purchase (January thy Sale (January 5 at a price of $420 per item) (12) Ending inventory (January 31) . Required: 1. Using the formats shown in the chapter, compute the Cost of Goods Available for Sale. Ending Inventory, and Cost of Goods Sold under (6) FIFO and (b) weighted average. 2. Which method would minimize income taxes? Explain your answer. 3. Assuming that operating expenses were $500 and the income tax rate is 25 percent, prepare the income statement for the month using the method selected in requirement 2. 4. If the replacement cost fell to $205 in February, compute the adjustment that would be made to the Inventory account assuming the company uses (a) FIFO and (b) weighted average. 5. Describe the impact of an adjustment in requirement 4 on the inventory turnover ratio. Computations are not required. HTML Editor VA-AI: EE11 Bo? NV 12pt x *, Paragraph Extend Second een only Canned to a wueless deplay O words