Answered step by step

Verified Expert Solution

Question

1 Approved Answer

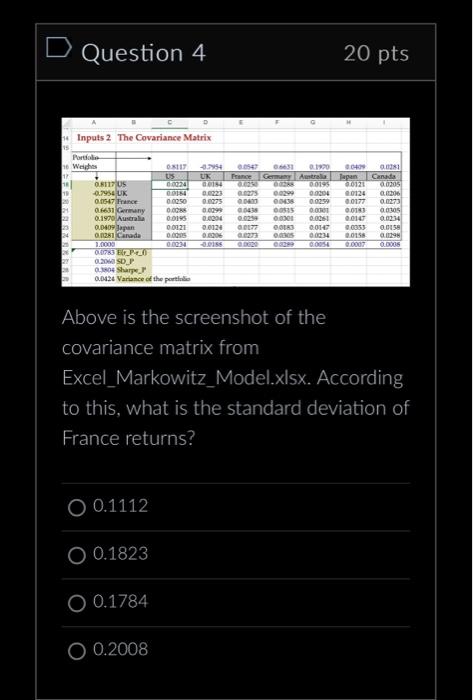

D Question 4 A Portfolio 16 Weights 17 18 19 20 21 22 23 24 25 26 27 28 29 B 14 Inputs 2 The

D Question 4 A Portfolio 16 Weights 17 18 19 20 21 22 23 24 25 26 27 28 29 B 14 Inputs 2 The Covariance Matrix 15 0.8117 US -0.7954 UK 0.0547 France 0.6631 Germany 0.1970 Australia 0.0409 Japan 0.0281 Canada 1.0000 0.0783 E(r_P-r_f) O 0.1112 C 0.2060 SD P 0.3804 Sharpe P 0.0424 Variance of the portfolio O 0.1823 O 0.1784 O 0.2008 D 0.8117 -0.7954 US 0.0224 UK 0.0184 0.0184 0.0223 0.0250 0.0275 0.0288 0.0195 0.0121 0.0205 0.0234 0.0299 0.0204 0.0124 0.0206 -0.0188 E 0.0438 0.0259 F 0.0177 0.0273 0.0020 0.6631 0.1970 0.0409 0.0547 France Germany Australia Japan 0.0250 0.0288 0.0195 0.0121 0.0275 0.0299 0.0204 0.0124 0.0403 0.0438 0.0259 0.0177 0.0515 0.0301 G 0.0183 0.0305 0.0289 0.0301 0.0261 20 pts 0.0147 0.0234 0.0054 H 0.0183 0.0147 0.0353 0.0158 0.0007 1 Above is the screenshot of the covariance matrix from Excel_Markowitz_Model.xlsx. According to this, what is the standard deviation of France returns? 0.0281 Canada 0.0205 0.0206 0.0273 0.0305 0.0234 0.0158 0.0298 0.0008

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started