Answered step by step

Verified Expert Solution

Question

1 Approved Answer

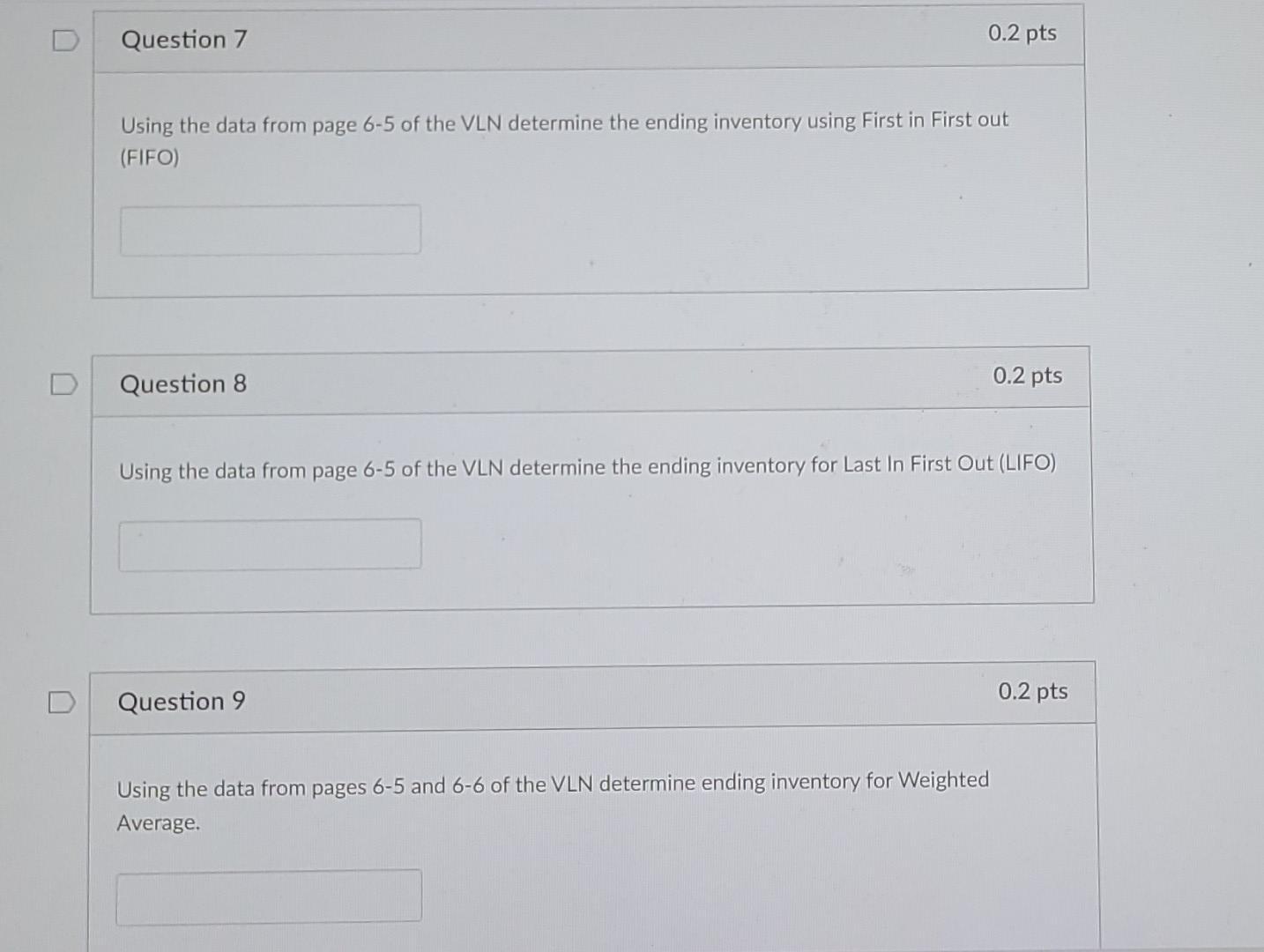

,,, D Question 7 0.2 pts Using the data from page 6-5 of the VLN determine the ending inventory using First in First out (FIFO)

,,,

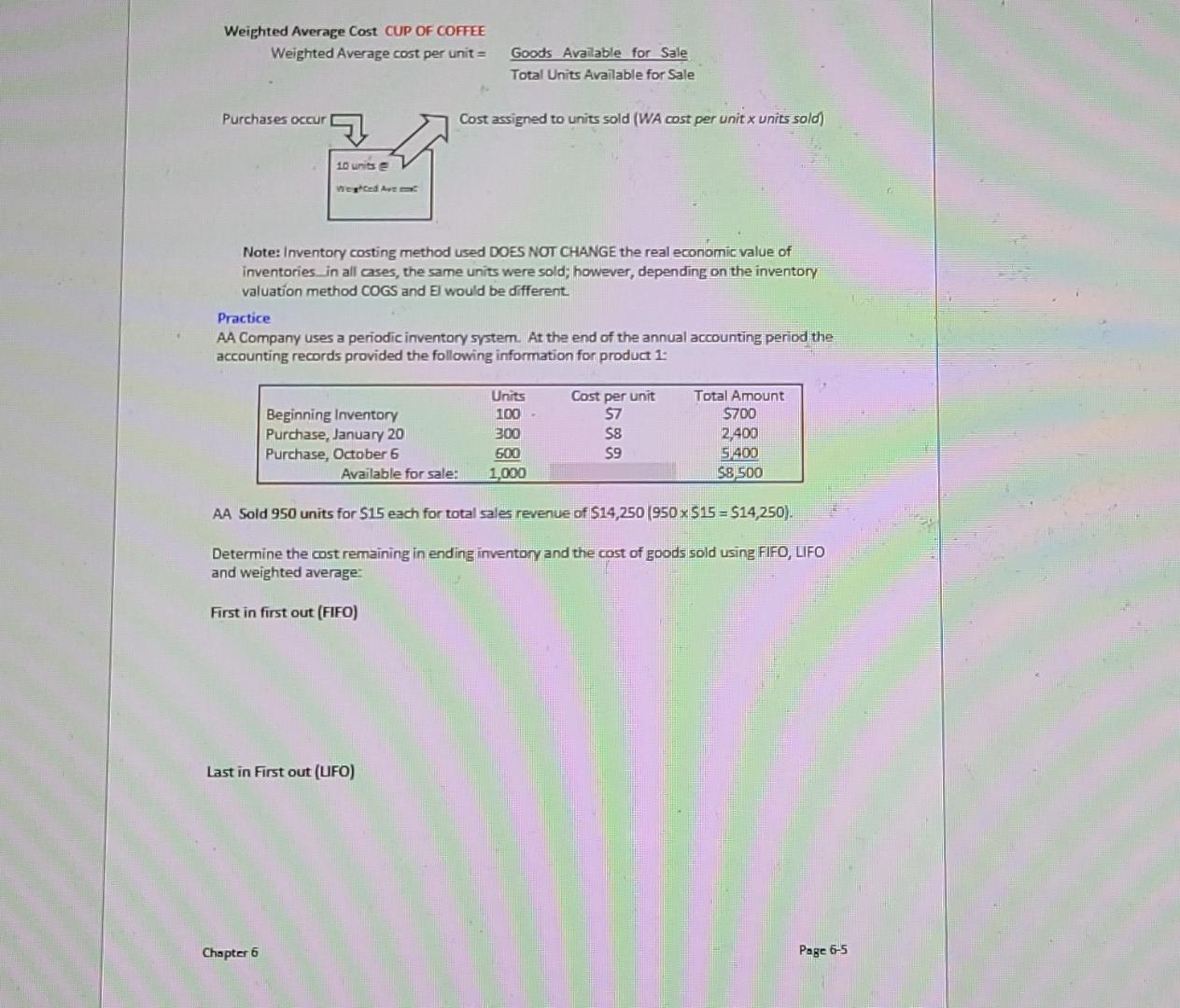

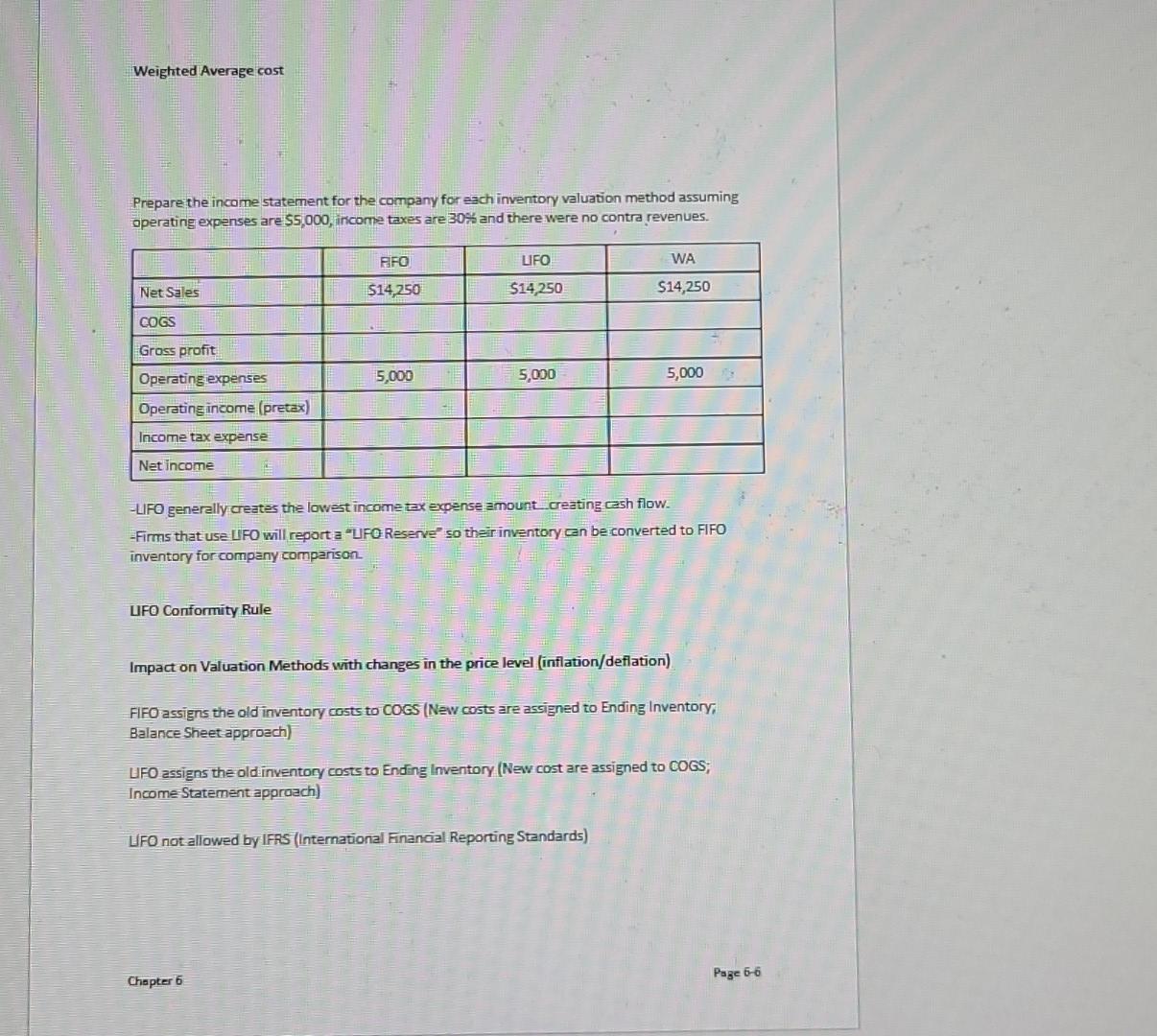

D Question 7 0.2 pts Using the data from page 6-5 of the VLN determine the ending inventory using First in First out (FIFO) D Question 8 0.2 pts Using the data from page 6-5 of the VLN determine the ending inventory for Last In First Out (LIFO) Question 9 0.2 pts Using the data from pages 6-5 and 6-6 of the VLN determine ending inventory for Weighted Average. Weighted Average Cost CUP OF COFFEE Weighted Average cost per unit Goods Available for Sale Total Units Available for Sale Purchases occur Cost assigned to units sold (WA cost per unit x units sold 10 units Vedves Note: Inventory costing method used DOES NOT CHANGE the real economic value of inventories in all cases, the same units were sold; however, depending on the inventory valuation method COGS and El would be different Practice AA Company uses a periodic inventory system. At the end of the annual accounting period the accounting records provided the following information for product 1: Beginning Inventory Purchase, January 20 Purchase, October 6 Available for sale: Units 100 300 600 1,000 Cost per unit 57 SS 59 Total Amount $700 2,400 5400 $8.500 AA Sold 950 units for $115 each for total sales revenue of $14,250 (950x515 = $14,250). Determine the cost remaining in ending inventory and the cost of goods sold using FIFO, LIFO and weighted average: First in first out (FIFO) Last in First out (UFO) Chapter 6 Page 6-5 Weighted Average cost Prepare the income statement for the company for each inventory valuation method assuming operating expenses are $5,000, income taxes are 30% and there were no contra revenues. FIFO UFO WA Net Sales $14,250 $14,250 $14,250 COGS Gross profit Operating expenses 5,000 5,000 5,000 Operating income (pretax) Income tax expense Net income -LIFO generally creates the lowest income tax expense amount creating cash flow. =Firms that use UFO will report a "UFO Reserve so their inventory can be converted to FIFO inventory for company comparison LIFO Conformity Rule Impact on Valuation Methods with changes in the price level (inflation/deflation) FIFO assigns the old inventory costs to COGS (New costs are assigned to Ending Inventory, Balance Sheet approach LIFO assigns the old inventory costs to Ending Inventory (New cost are assigned to COGS Income Statement approach) UFO not allowed by IFRS (International Financial Reporting Standards) Page 66 Chapter 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started