Answered step by step

Verified Expert Solution

Question

1 Approved Answer

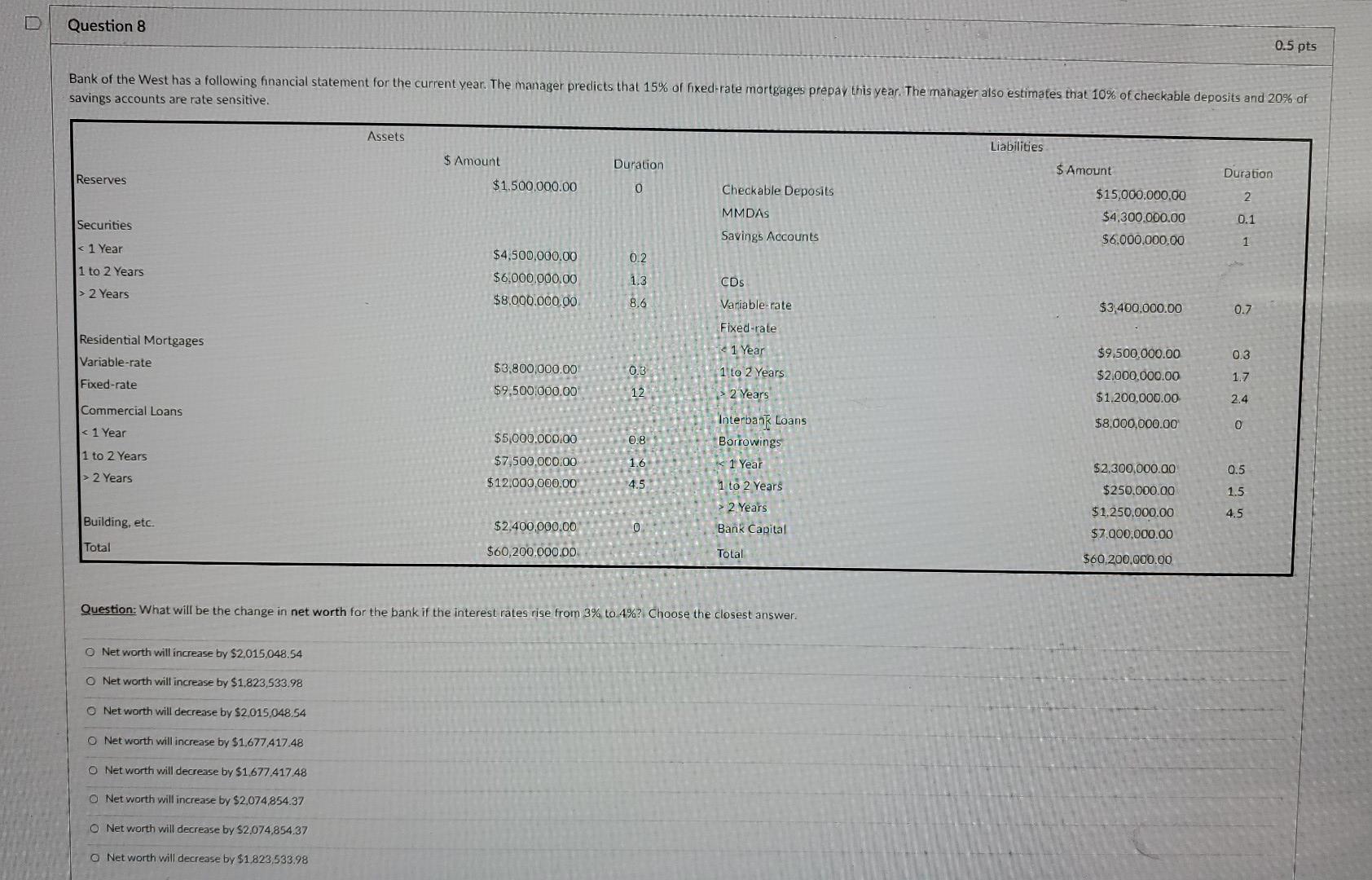

D Question 8 0.5 pts Bank of the West has a following financial statement for the current year. The manager predicts that 15% of fixed-rate

D Question 8 0.5 pts Bank of the West has a following financial statement for the current year. The manager predicts that 15% of fixed-rate mortgages prepay this year. The manager also estimates that 10% of checkable deposits and 20% of savings accounts are rate sensitive. Assets Liabilities $ Amount Duration Reserves Duration $1.500,000.00 0 2 Checkable Deposits MMDAS Savings Accounts $ Amount $15,000.000.00 $4,300,000.00 $6.000.000.00 Securities 0.1 2 Years Variable-rate $3,400,000.00 0.7 Fixed-rate Residential Mortgages Variable-rate 0.3 $3,800,000.00 $9,500,000.00 2 Years Bank Capital 0.5 > 2 Years $12.000.000.00 4.5 1.5 $2,300,000.00 $250.000.00 $1.250.000.00 $7,000,000.00 4.5 Building, etc. $2,400,000.00 0 Total $60,200,000.00 Total $60,200,000.00 Question: What will be the change in net worth for the bank if the interest rates rise from 3% to 4%? Choose the closest answer O Net worth will increase by $2,015.048.54 O Net worth will increase by $1,823,533.98 O Net worth will decrease by $2.015.048.54 O Net worth will increase by $1,677,417.48 O Net worth will decrease by $1.677.417.48 O Net worth will increase by $2,074,854.37 O Net worth will decrease by $2,074,854.37 Net worth will decrease by $1.823,533.98 D Question 8 0.5 pts Bank of the West has a following financial statement for the current year. The manager predicts that 15% of fixed-rate mortgages prepay this year. The manager also estimates that 10% of checkable deposits and 20% of savings accounts are rate sensitive. Assets Liabilities $ Amount Duration Reserves Duration $1.500,000.00 0 2 Checkable Deposits MMDAS Savings Accounts $ Amount $15,000.000.00 $4,300,000.00 $6.000.000.00 Securities 0.1 2 Years Variable-rate $3,400,000.00 0.7 Fixed-rate Residential Mortgages Variable-rate 0.3 $3,800,000.00 $9,500,000.00 2 Years Bank Capital 0.5 > 2 Years $12.000.000.00 4.5 1.5 $2,300,000.00 $250.000.00 $1.250.000.00 $7,000,000.00 4.5 Building, etc. $2,400,000.00 0 Total $60,200,000.00 Total $60,200,000.00 Question: What will be the change in net worth for the bank if the interest rates rise from 3% to 4%? Choose the closest answer O Net worth will increase by $2,015.048.54 O Net worth will increase by $1,823,533.98 O Net worth will decrease by $2.015.048.54 O Net worth will increase by $1,677,417.48 O Net worth will decrease by $1.677.417.48 O Net worth will increase by $2,074,854.37 O Net worth will decrease by $2,074,854.37 Net worth will decrease by $1.823,533.98

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started