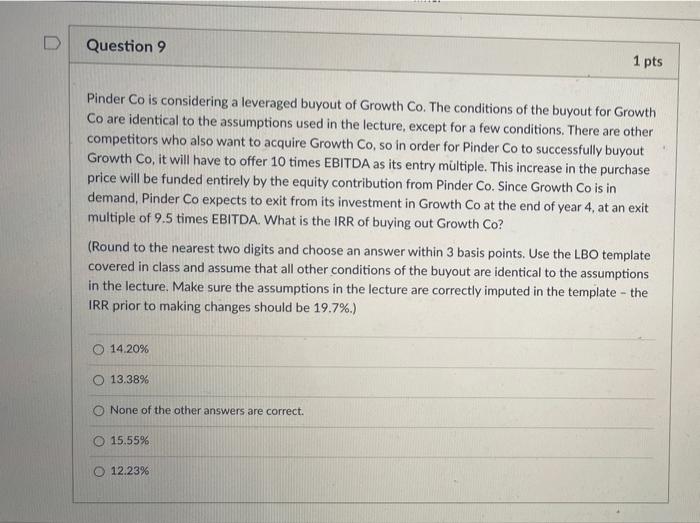

D Question 9 1 pts Pinder Co is considering a leveraged buyout of Growth Co. The conditions of the buyout for Growth Co are identical to the assumptions used in the lecture, except for a few conditions. There are other competitors who also want to acquire Growth Co, so in order for Pinder Co to successfully buyout Growth Co, it will have to offer 10 times EBITDA as its entry multiple. This increase in the purchase price will be funded entirely by the equity contribution from Pinder Co. Since Growth Co is in demand, Pinder Co expects to exit from its investment in Growth Co at the end of year 4, at an exit multiple of 9.5 times EBITDA. What is the IRR of buying out Growth Co? (Round to the nearest two digits and choose an answer within 3 basis points. Use the LBO template covered in class and assume that all other conditions of the buyout are identical to the assumptions in the lecture. Make sure the assumptions in the lecture are correctly imputed in the template - the IRR prior to making changes should be 19.7%.) 14,20% O 13.38% O None of the other answers are correct. O 15.55% 12.23% C. 0 valueCo Corporation Laveragedy Analysis FREE WITH Jy PV Oro RE mm . YA TERIT Preu Yet 1 Yad Ted 28 LE TE de EMA CE w ca LAGE YONE Law LE De Cele SUM HERRE SORTIE w MA TIETOA D Question 9 1 pts Pinder Co is considering a leveraged buyout of Growth Co. The conditions of the buyout for Growth Co are identical to the assumptions used in the lecture, except for a few conditions. There are other competitors who also want to acquire Growth Co, so in order for Pinder Co to successfully buyout Growth Co, it will have to offer 10 times EBITDA as its entry multiple. This increase in the purchase price will be funded entirely by the equity contribution from Pinder Co. Since Growth Co is in demand, Pinder Co expects to exit from its investment in Growth Co at the end of year 4, at an exit multiple of 9.5 times EBITDA. What is the IRR of buying out Growth Co? (Round to the nearest two digits and choose an answer within 3 basis points. Use the LBO template covered in class and assume that all other conditions of the buyout are identical to the assumptions in the lecture. Make sure the assumptions in the lecture are correctly imputed in the template - the IRR prior to making changes should be 19.7%.) 14,20% O 13.38% O None of the other answers are correct. O 15.55% 12.23% C. 0 valueCo Corporation Laveragedy Analysis FREE WITH Jy PV Oro RE mm . YA TERIT Preu Yet 1 Yad Ted 28 LE TE de EMA CE w ca LAGE YONE Law LE De Cele SUM HERRE SORTIE w MA TIETOA