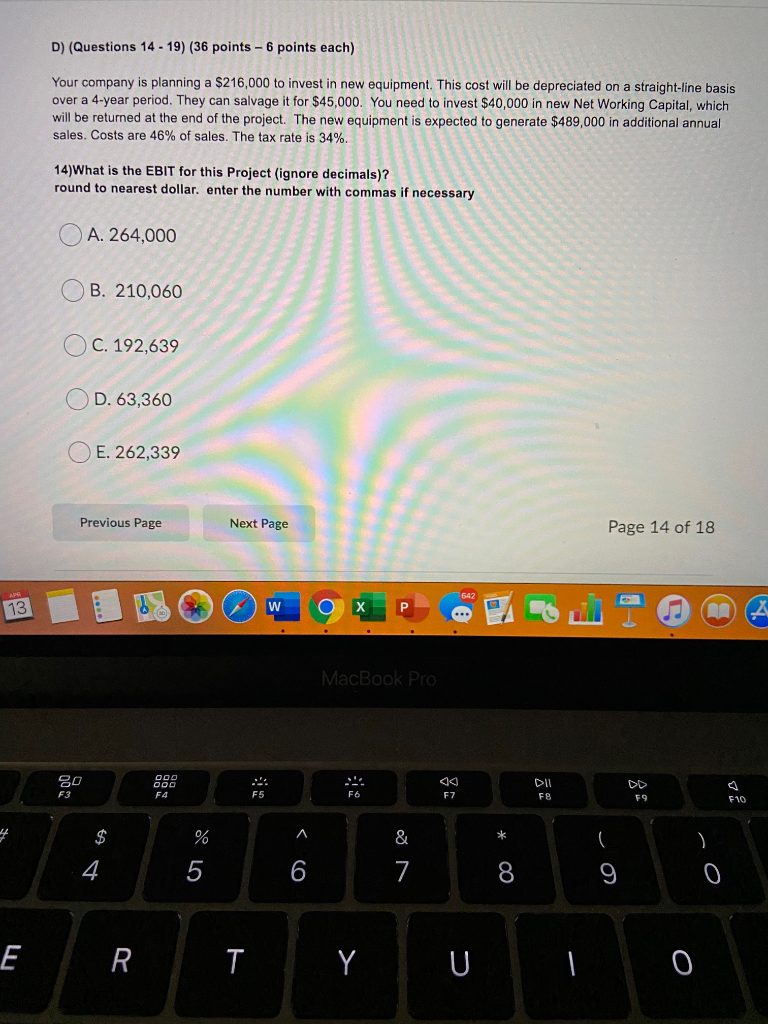

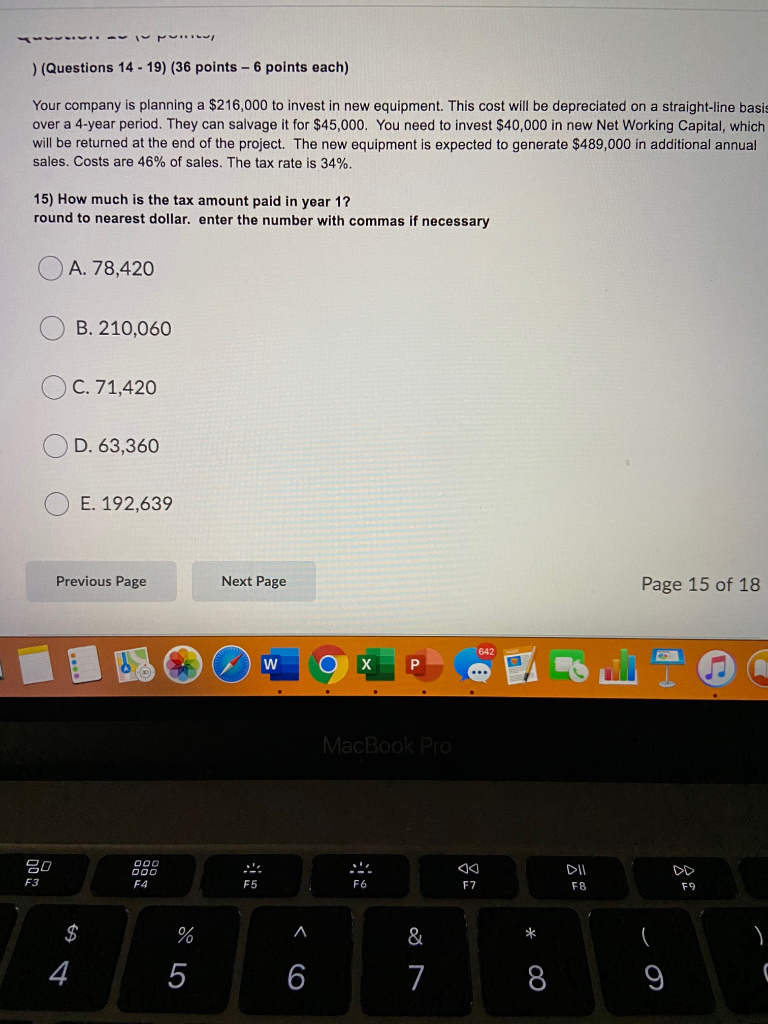

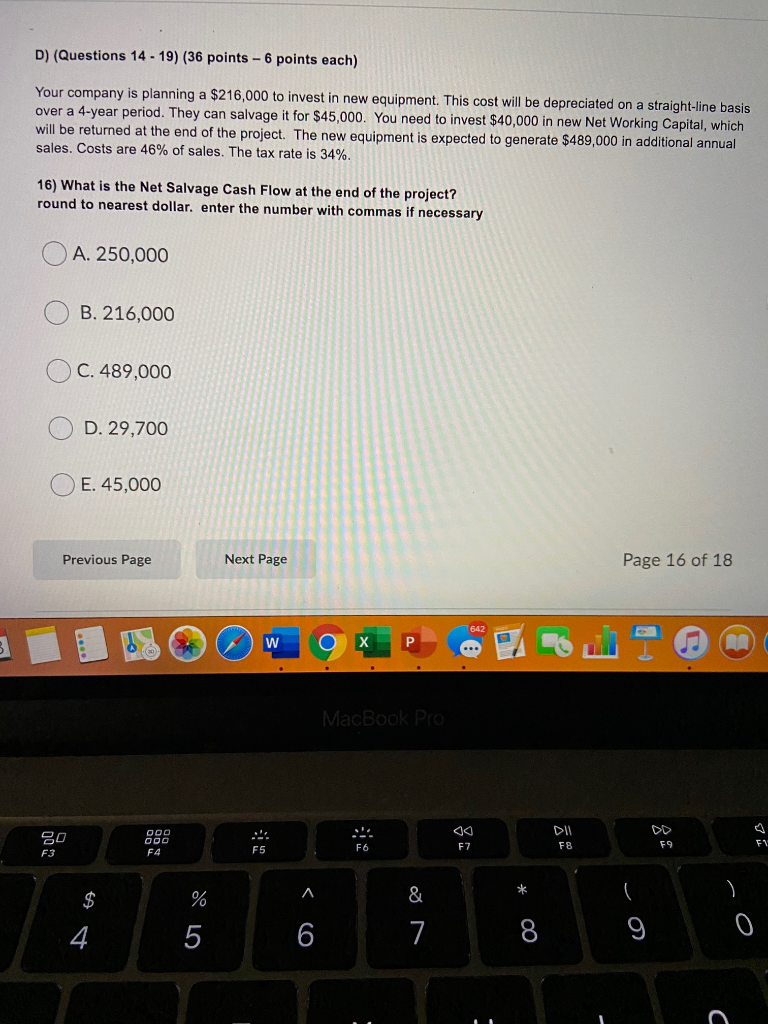

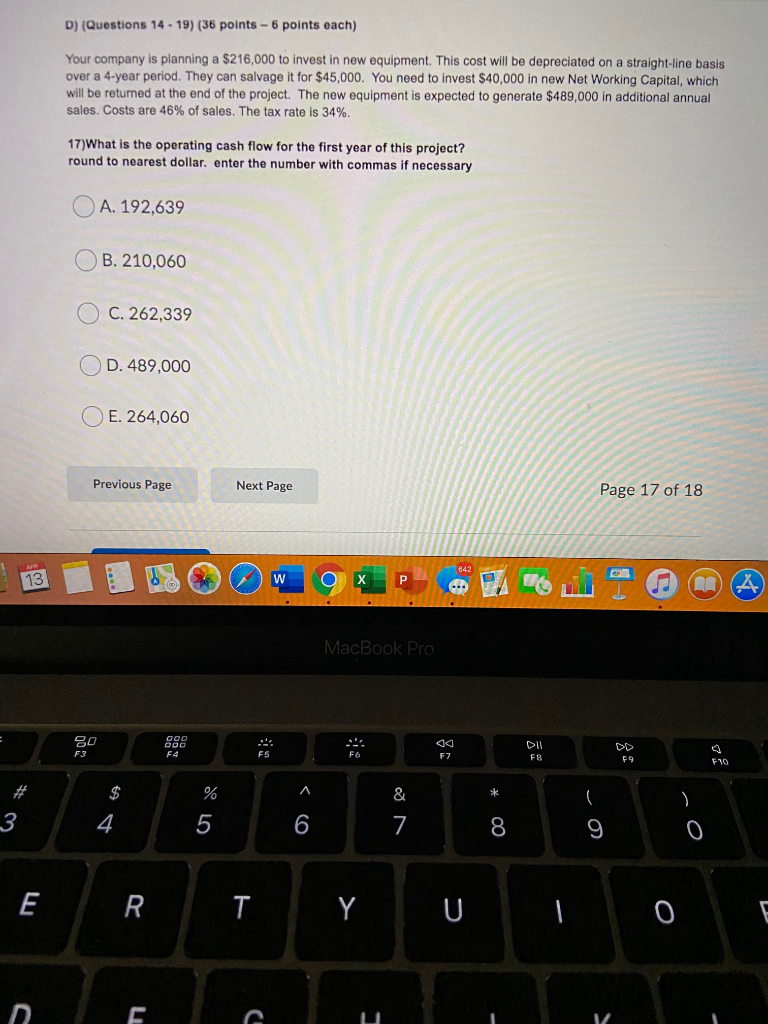

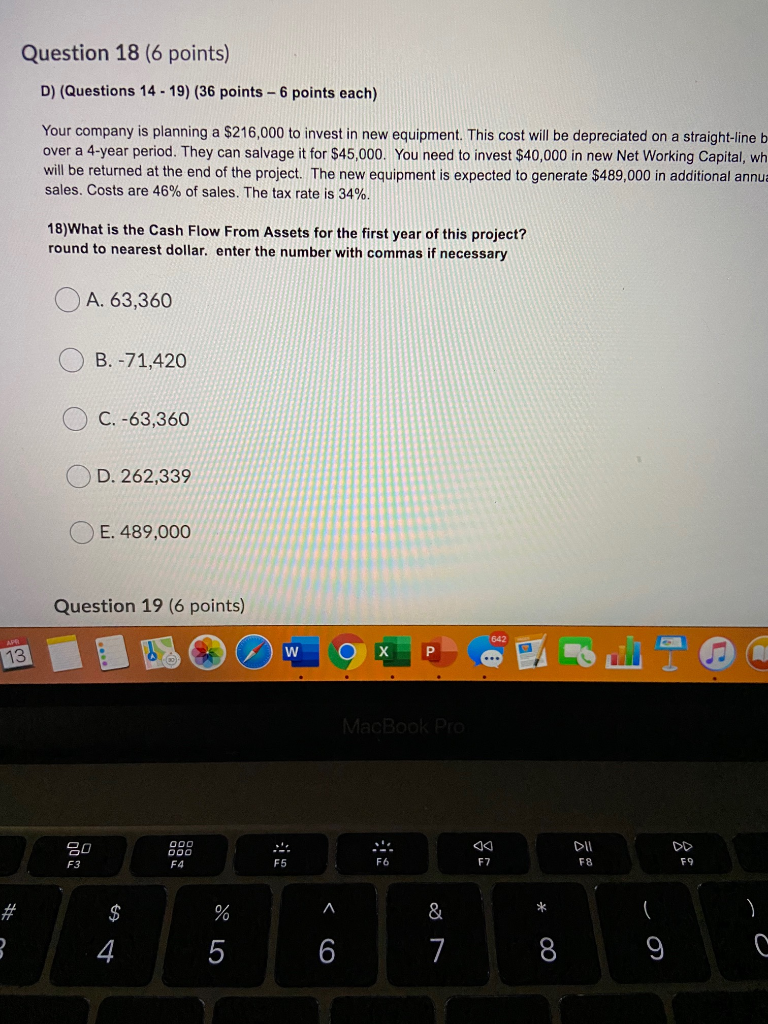

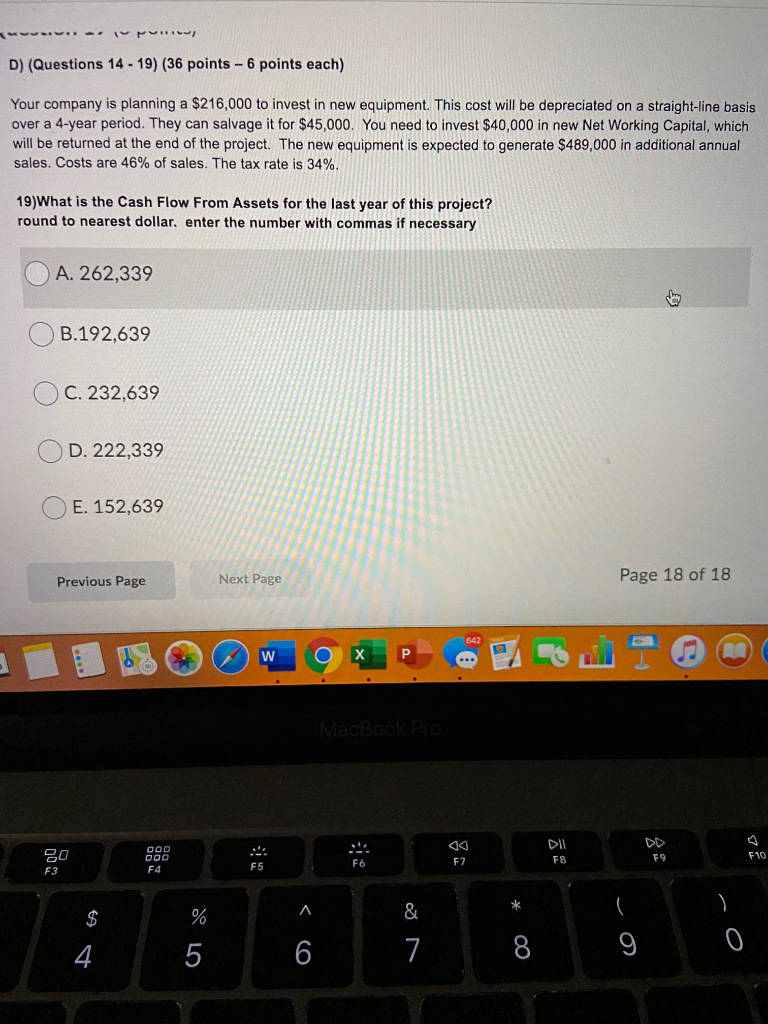

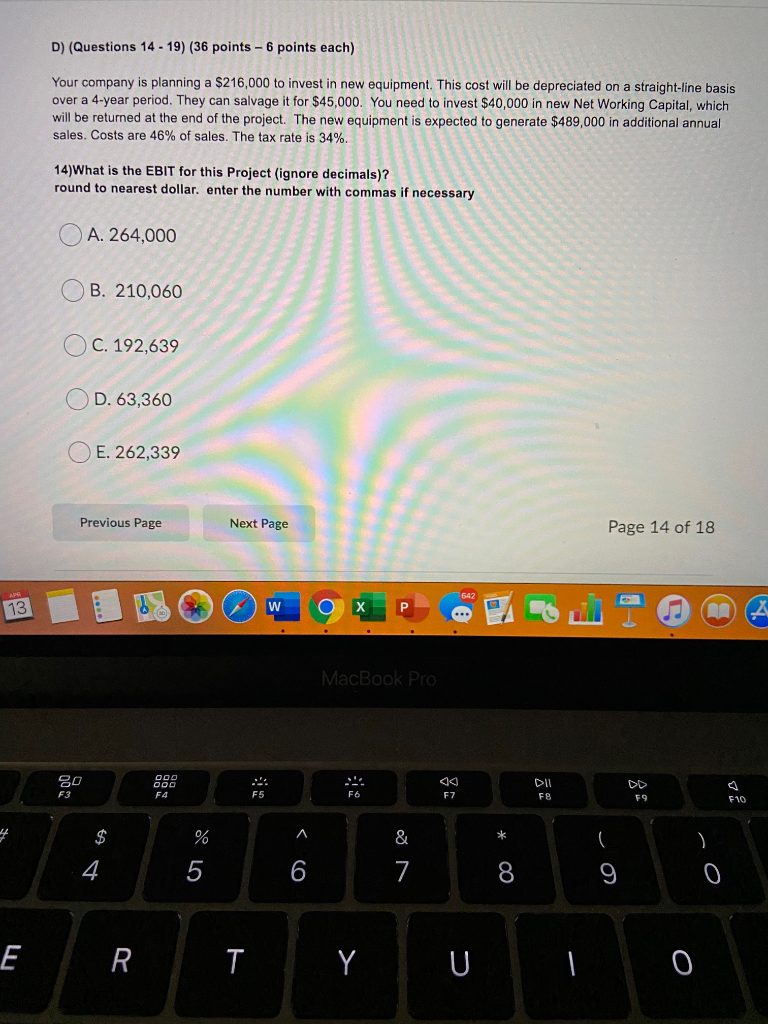

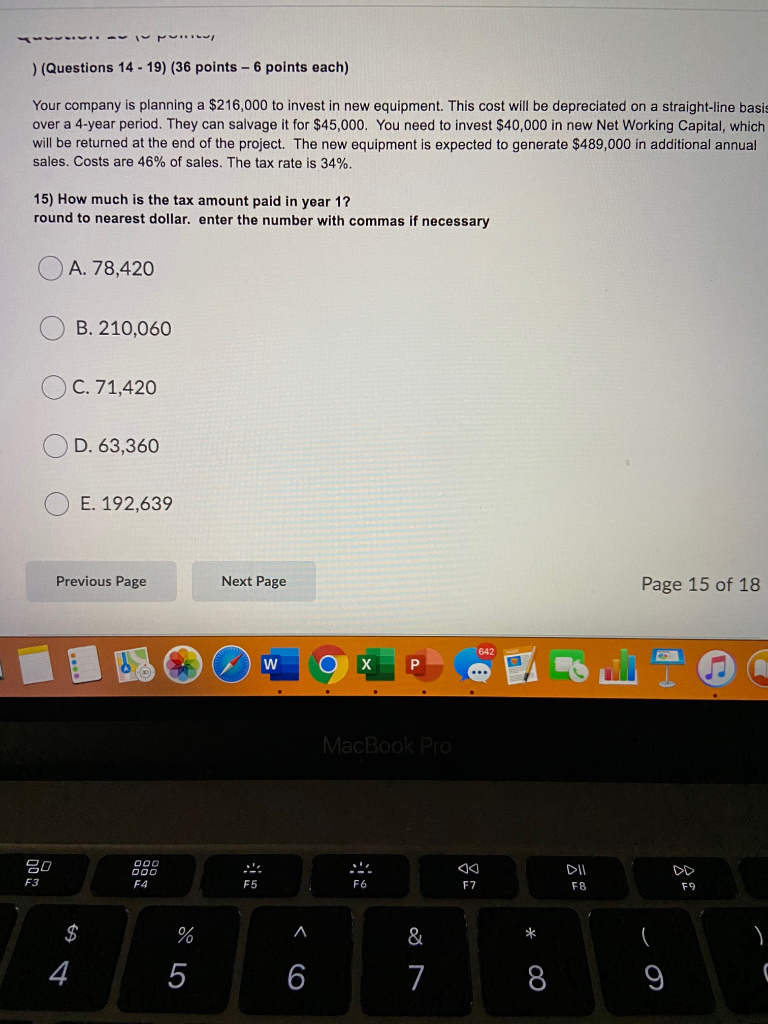

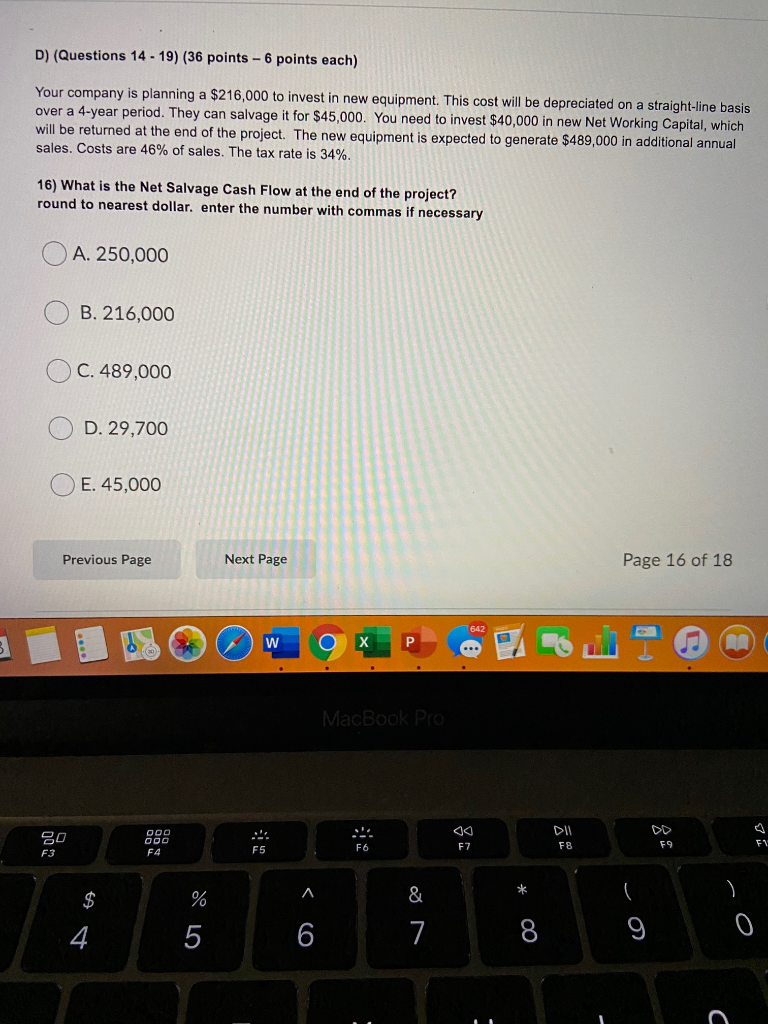

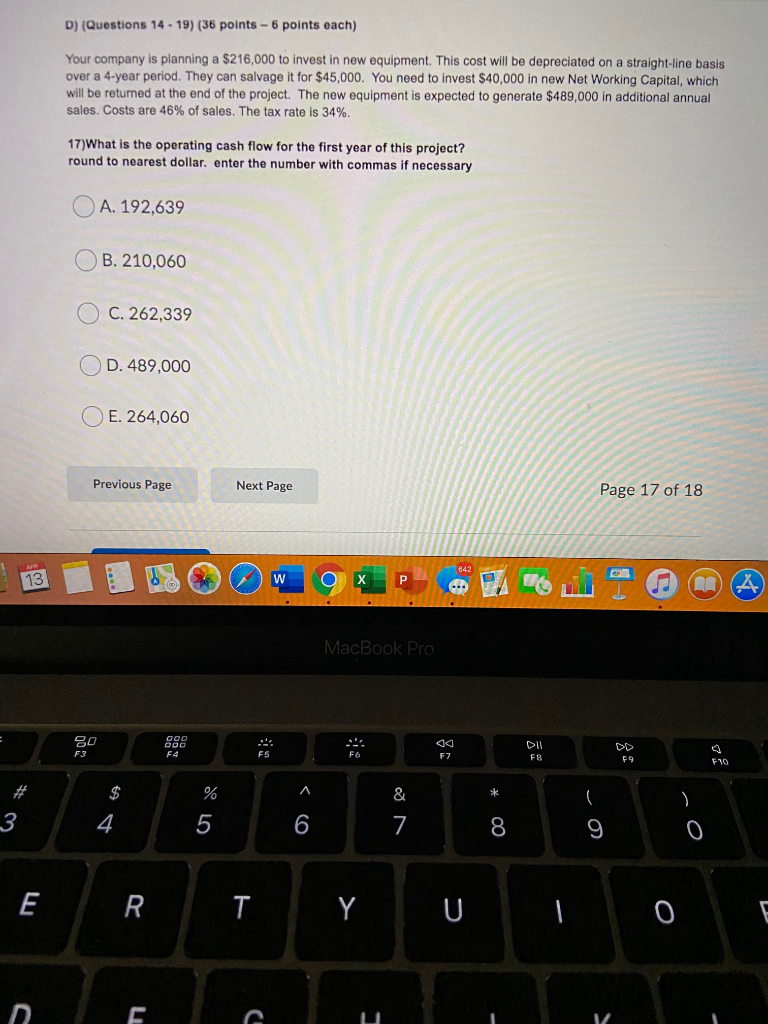

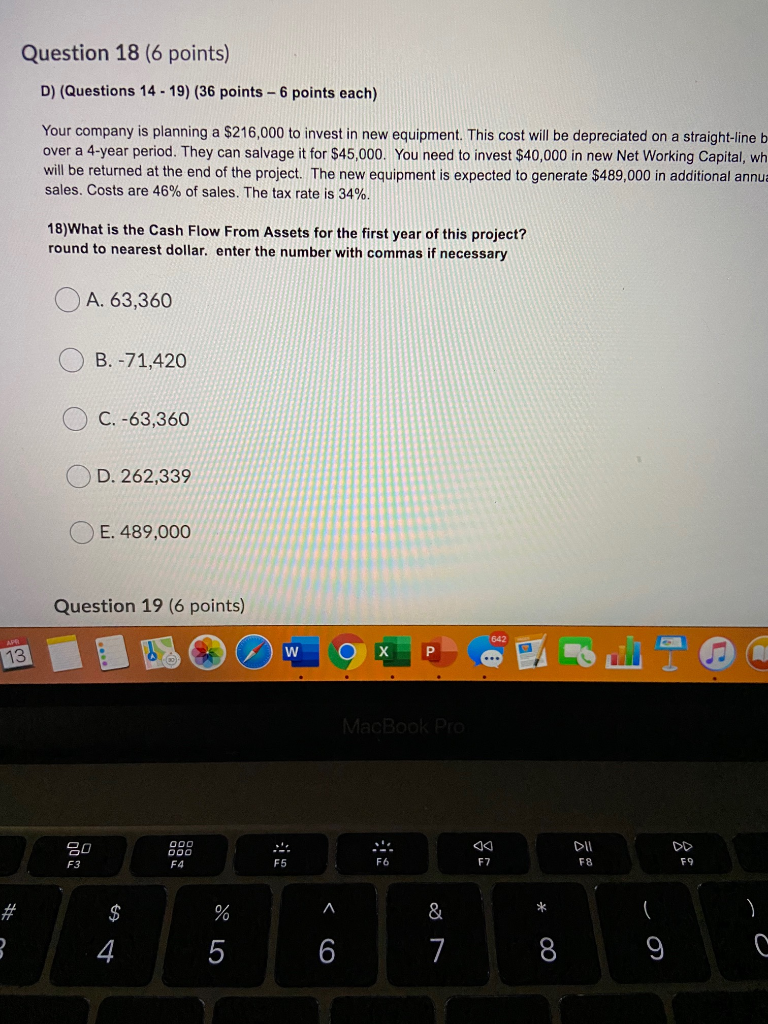

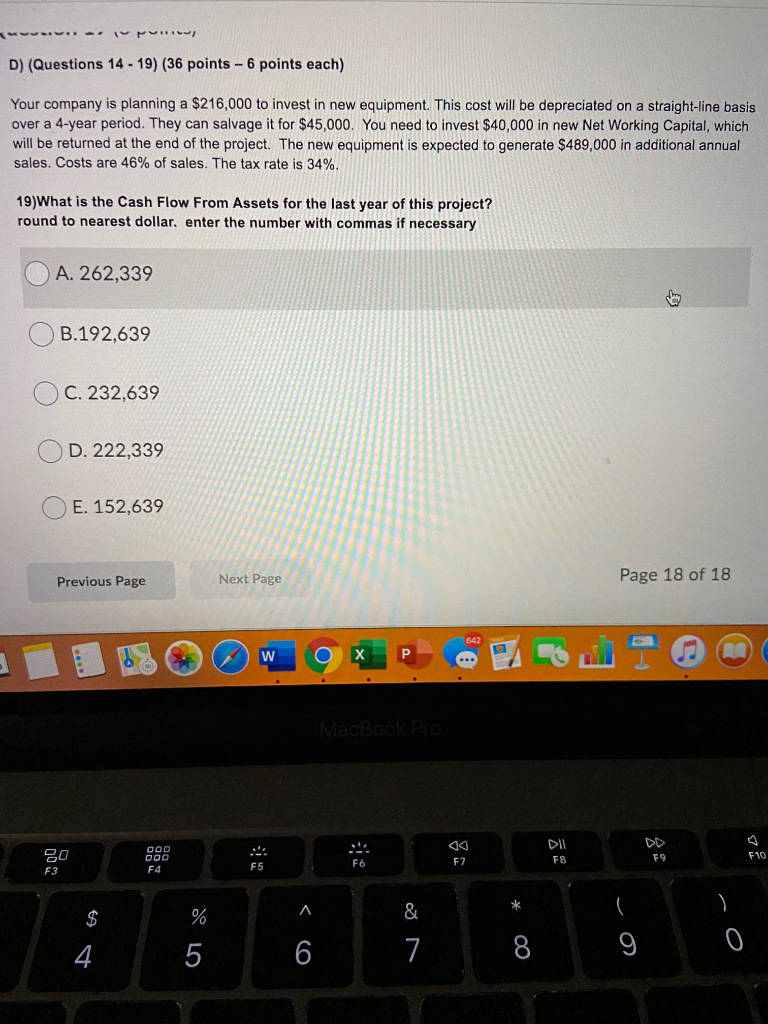

D) (Questions 14 - 19) (36 points - 6 points each) Your company is planning a $216,000 to invest in new equipment. This cost will be depreciated on a straight-line basis over a 4-year period. They can salvage it for $45,000. You need to invest $40,000 in new Net Working Capital, which will be returned at the end of the project. The new equipment is expected to generate $489,000 in additional annual sales. Costs are 46% of sales. The tax rate is 34%. 14)What is the EBIT for this Project (ignore decimals)? round to nearest dollar. enter the number with commas if necessary O A. 264,000 OB. 210,060 OC. 192,639 OD. 63,360 E. 262,339 Previous Page Next Page Page 14 of 18 MacBook Pro 20 F6 F8 510 ... Por ) (Questions 14 - 19) (36 points - 6 points each) Your company is planning a $216,000 to invest in new equipment. This cost will be depreciated on a straight-line basi: over a 4-year period. They can salvage it for $45,000. You need to invest $40,000 in new Net Working Capital, which will be returned at the end of the project. The new equipment is expected to generate $489,000 in additional annual sales. Costs are 46% of sales. The tax rate is 34%. 15) How much is the tax amount paid in year 1? round to nearest dollar, enter the number with commas if necessary O A. 78,420 O B.210,060 OC. 71,420 OD. 63,360 O E. 192,639 Previous Page Next Page Page 15 of 18 MacBook Pro 80 F4 To F6 D) (Questions 14 - 19) (36 points - 6 points each) Your company is planning a $216,000 to invest in new equipment. This cost will be depreciated on a straight-line basis over a 4-year period. They can salvage it for $45,000. You need to invest $40,000 in new Net Working Capital, which will be returned at the end of the project. The new equipment is expected to generate $489,000 in additional annual sales. Costs are 46% of sales. The tax rate is 34%. 16) What is the Net Salvage Cash Flow at the end of the project? round to nearest dollar, enter the number with commas if necessary O A. 250,000 O B. 216,000 OC. 489,000 OD. 29,700 E. 45,000 Previous Page ext Page 16 of 18 MacBook Pro 000 so 000 79 F3 F6 F4 4 are 6 7 8 8 9 0 D) (Questions 14 - 19) (36 points - 6 points each) Your company is planning a $216,000 to invest in new equipment. This cost will be depreciated on a straight-line basis over a 4-year period. They can salvage it for $45,000. You need to invest $40,000 in new Net Working Capital, which will be returned at the end of the project. The new equipment is expected to generate $489,000 in additional annual sales. Costs are 46% of sales. The tax rate is 34%. 17)What is the operating cash flow for the first year of this project? round to nearest dollar, enter the number with commas if necessary O A. 192,639 O B.210,060 OC. 262,339 OD. 489,000 E. 264,060 Previous Page Next Page Page 17 of 18 MacBook Pro FIO Question 18 (6 points) D) (Questions 14 - 19) (36 points - 6 points each) Your company is planning a $216,000 to invest in new equipment. This cost will be depreciated on a straight-line b over a 4-year period. They can salvage it for $45,000. You need to invest $40,000 in new Net Working Capital, wh will be returned at the end of the project. The new equipment is expected to generate $489,000 in additional annu sales. Costs are 46% of sales. The tax rate is 34%. 18)What is the Cash Flow From Assets for the first year of this project? round to nearest dollar. enter the number with commas if necessary O A. 63,360 O B. -71,420 O C. -63,360 OD. 262,339 OE. 489,000 Question 19 (6 points) F4 4 5 6 6 7 8 9 G D) (Questions 14 - 19) (36 points - 6 points each) Your company is planning a $216,000 to invest in new equipment. This cost will be depreciated on a straight-line basis over a 4-year period. They can salvage it for $45,000. You need to invest $40,000 in new Net Working Capital, which will be returned at the end of the project. The new equipment is expected to generate $489,000 in additional annual sales. Costs are 46% of sales. The tax rate is 34%. 19)What is the Cash Flow From Assets for the last year of this project? round to nearest dollar, enter the number with commas if necessary O A. 262,339 B.192,639 OC. 232,639 OD. 222,339 E. 152,639 Previous Page Next Page Page 18 of 18 F10 4 5 6 7 8 9 0