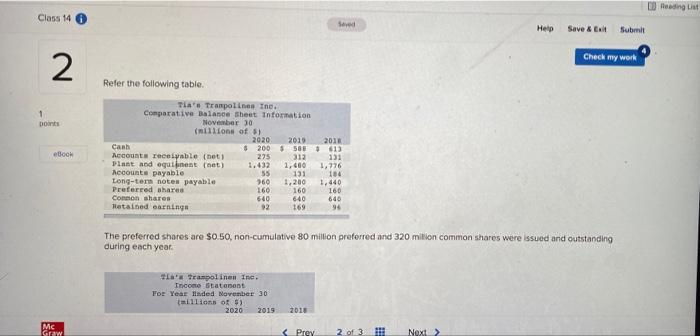

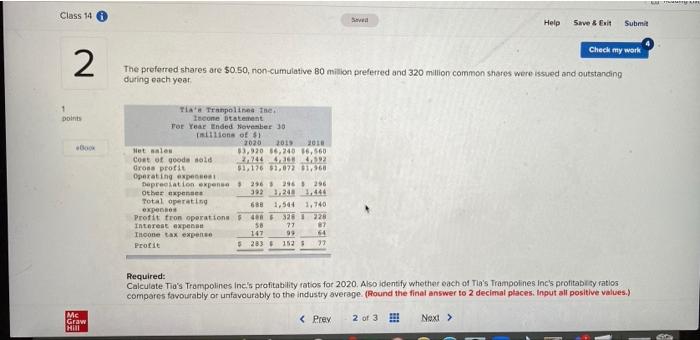

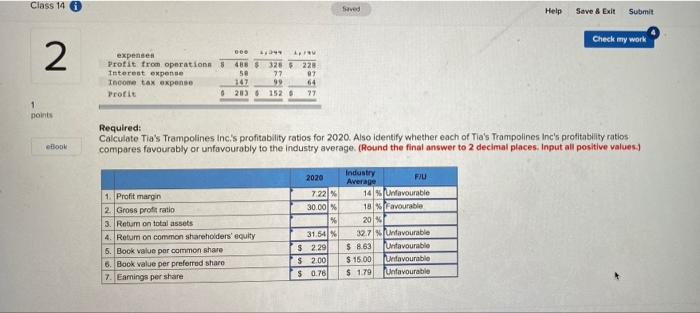

D Reading List Class 14 See Help Save & E Submit Check my work 2 Refer the following table 1 Doints eBook TA' Trampoline The. Comparative Balance sheet Information November 30 (millions of 5) 2020 2010 2011 Cash $ 200 $ 588 613 Accounts receivable (net) 312 131 Plant and outlinent (net) 1.432 1.400 1,776 Accounts payable 55 131 184 Long-tem notes payable 960 1,200 1.440 Preferred shares 160 160 160 Common shares 640 640 640 Retained earnings 92 169 96 275 The preferred shares are $0.50, non-cumulative 80 million preferred and 320 million common shares were issued and outstanding during each year La Trampolinen Ine. Income statement For Year Faded November 30 #111ons of $) 2020 2015 2010 M Graw Class 14 Saved Help Save & Exit Submit Check my work ee 2 expenses Profit from operation 3 488 $328228 Interest expense se 77 07 Income tax expense 147 99 64 Profit 620) 6 152 77 1 points Required: Calculate Tia's Trampolines inc's profitability ratios for 2020. Also identify whether each of Tia's Trampolines Inc's profitability ratios compares favourably or unfavourably to the industry average. (Round the final answer to 2 decimal places. Input all positive values.) ook 2020 FIU 35 1. Profit margin 2. Gross profit ratio 3. Return on total assets 4. Return on common shareholders' equity 5. Book value por common share 6. Book value per preferred share 7. Earnings per share 7 22% 30.00% % 31 54% $ 229 $ 200 $ 0.76 Industry Average 14 Unfavourable 18 Favourable 20% 327 unfavourable $ 8.63 Untavourable $ 15.00 unfavourable $ 1.79 Unfavourable D Reading List Class 14 See Help Save & E Submit Check my work 2 Refer the following table 1 Doints eBook TA' Trampoline The. Comparative Balance sheet Information November 30 (millions of 5) 2020 2010 2011 Cash $ 200 $ 588 613 Accounts receivable (net) 312 131 Plant and outlinent (net) 1.432 1.400 1,776 Accounts payable 55 131 184 Long-tem notes payable 960 1,200 1.440 Preferred shares 160 160 160 Common shares 640 640 640 Retained earnings 92 169 96 275 The preferred shares are $0.50, non-cumulative 80 million preferred and 320 million common shares were issued and outstanding during each year La Trampolinen Ine. Income statement For Year Faded November 30 #111ons of $) 2020 2015 2010 M Graw Class 14 Saved Help Save & Exit Submit Check my work ee 2 expenses Profit from operation 3 488 $328228 Interest expense se 77 07 Income tax expense 147 99 64 Profit 620) 6 152 77 1 points Required: Calculate Tia's Trampolines inc's profitability ratios for 2020. Also identify whether each of Tia's Trampolines Inc's profitability ratios compares favourably or unfavourably to the industry average. (Round the final answer to 2 decimal places. Input all positive values.) ook 2020 FIU 35 1. Profit margin 2. Gross profit ratio 3. Return on total assets 4. Return on common shareholders' equity 5. Book value por common share 6. Book value per preferred share 7. Earnings per share 7 22% 30.00% % 31 54% $ 229 $ 200 $ 0.76 Industry Average 14 Unfavourable 18 Favourable 20% 327 unfavourable $ 8.63 Untavourable $ 15.00 unfavourable $ 1.79 Unfavourable