Answered step by step

Verified Expert Solution

Question

1 Approved Answer

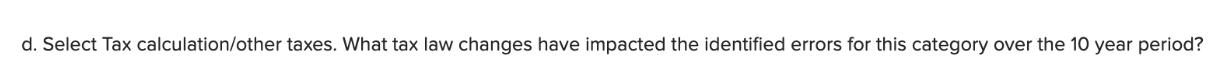

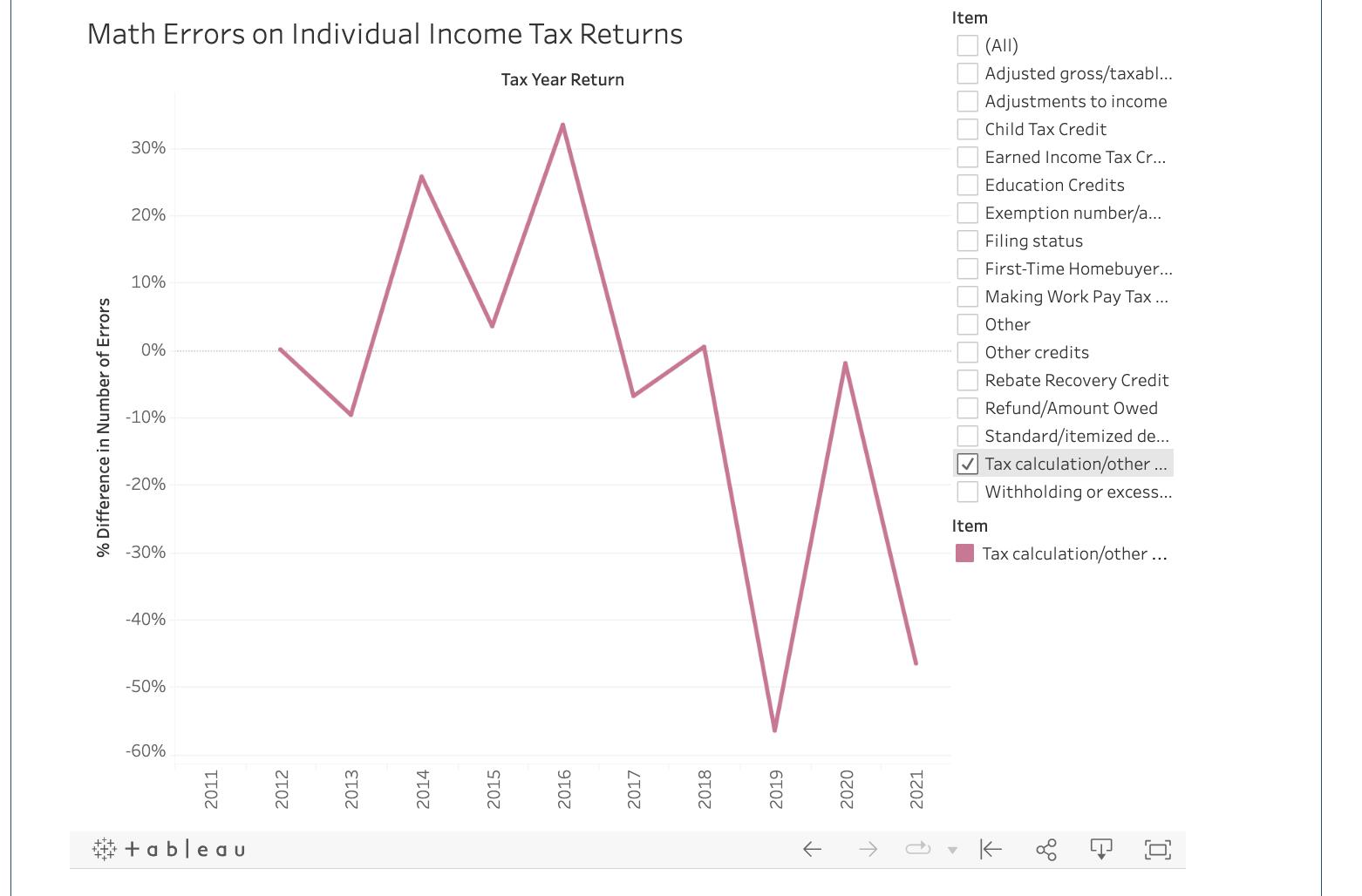

d. Select Tax calculation/other taxes. What tax law changes have impacted the identified errors for this category over the 10 year period? +ableau -60%

d. Select Tax calculation/other taxes. What tax law changes have impacted the identified errors for this category over the 10 year period? +ableau -60% 2011 -50% 2012 -40% 2013 Math Errors on Individual Income Tax Returns % Difference in Number of Errors 30% 20% 10% 0% -10% -20% -30% Tax Year Return Item (All) Adjusted gross/taxabl... Adjustments to income Child Tax Credit Earned Income Tax Cr... Education Credits Exemption number/a... Filing status First-Time Homebuyer... Making Work Pay Tax.... Other Other credits Rebate Recovery Credit Refund/Amount Owed Standard/itemized de... Tax calculation/other... Item Withholding or excess... Tax calculation/other... 2014 2015 2016 2017 2018 2019 2020 2021 K C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started