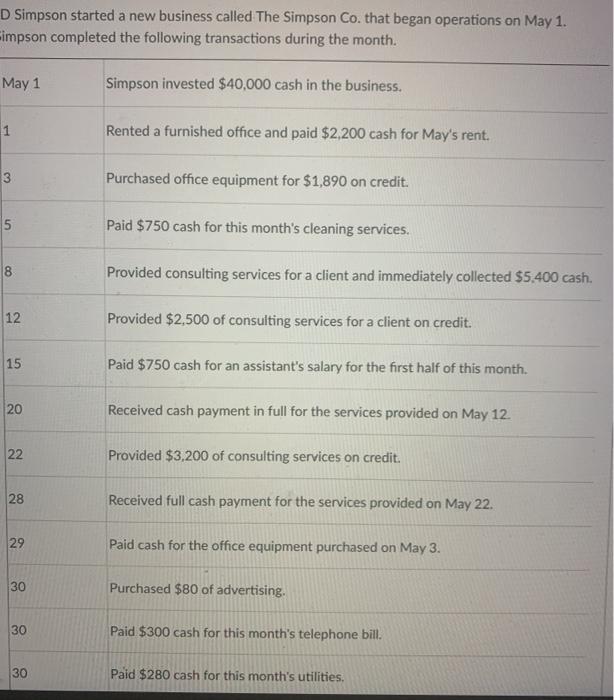

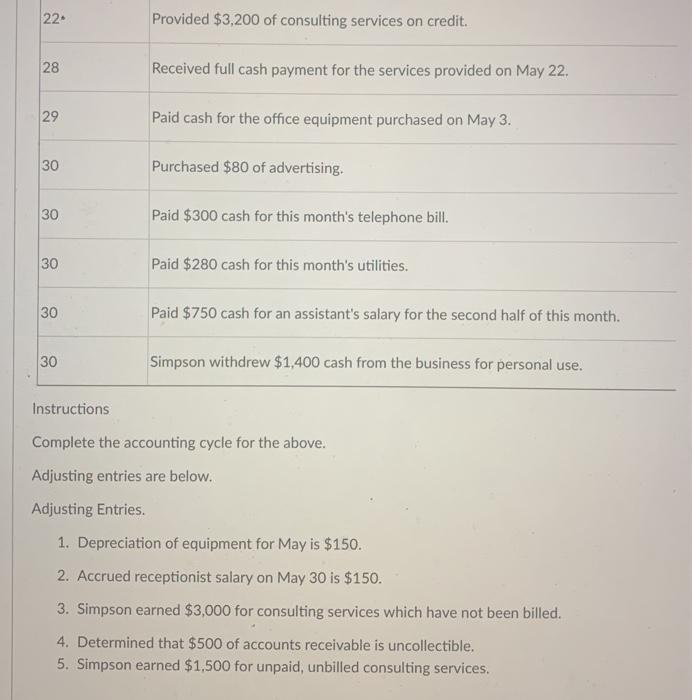

D Simpson started a new business called The Simpson Co. that began operations on May 1. impson completed the following transactions during the month. May 1 Simpson invested $40,000 cash in the business. 1 Rented a furnished office and paid $2,200 cash for May's rent. 3 3 Purchased office equipment for $1,890 on credit. 5 5 Paid $750 cash for this month's cleaning services. 8 Provided consulting services for a client and immediately collected $5.400 cash. 12 Provided $2,500 of consulting services for a client on credit. 15 Paid $750 cash for an assistant's salary for the first half of this month. 20 Received cash payment in full for the services provided on May 12 22 Provided $3,200 of consulting services on credit. 28 Received full cash payment for the services provided on May 22. 29 Paid cash for the office equipment purchased on May 3. 30 Purchased $80 of advertising. 30 Paid $300 cash for this month's telephone bill. 30 Paid $280 cash for this month's utilities. 22. Provided $3,200 of consulting services on credit. 28 Received full cash payment for the services provided on May 22 29 Paid cash for the office equipment purchased on May 3. 30 Purchased $80 of advertising. 30 Paid $300 cash for this month's telephone bill. 30 Paid $280 cash for this month's utilities. 30 Paid $750 cash for an assistant's salary for the second half of this month. 30 Simpson withdrew $1,400 cash from the business for personal use. Instructions Complete the accounting cycle for the above. Adjusting entries are below. Adjusting Entries 1. Depreciation of equipment for May is $150. 2. Accrued receptionist salary on May 30 is $150. 3. Simpson earned $3,000 for consulting services which have not been billed. 4. Determined that $500 of accounts receivable is uncollectible. 5. Simpson earned $1,500 for unpaid, unbilled consulting services. D Simpson started a new business called The Simpson Co. that began operations on May 1. impson completed the following transactions during the month. May 1 Simpson invested $40,000 cash in the business. 1 Rented a furnished office and paid $2,200 cash for May's rent. 3 3 Purchased office equipment for $1,890 on credit. 5 5 Paid $750 cash for this month's cleaning services. 8 Provided consulting services for a client and immediately collected $5.400 cash. 12 Provided $2,500 of consulting services for a client on credit. 15 Paid $750 cash for an assistant's salary for the first half of this month. 20 Received cash payment in full for the services provided on May 12 22 Provided $3,200 of consulting services on credit. 28 Received full cash payment for the services provided on May 22. 29 Paid cash for the office equipment purchased on May 3. 30 Purchased $80 of advertising. 30 Paid $300 cash for this month's telephone bill. 30 Paid $280 cash for this month's utilities. 22. Provided $3,200 of consulting services on credit. 28 Received full cash payment for the services provided on May 22 29 Paid cash for the office equipment purchased on May 3. 30 Purchased $80 of advertising. 30 Paid $300 cash for this month's telephone bill. 30 Paid $280 cash for this month's utilities. 30 Paid $750 cash for an assistant's salary for the second half of this month. 30 Simpson withdrew $1,400 cash from the business for personal use. Instructions Complete the accounting cycle for the above. Adjusting entries are below. Adjusting Entries 1. Depreciation of equipment for May is $150. 2. Accrued receptionist salary on May 30 is $150. 3. Simpson earned $3,000 for consulting services which have not been billed. 4. Determined that $500 of accounts receivable is uncollectible. 5. Simpson earned $1,500 for unpaid, unbilled consulting services