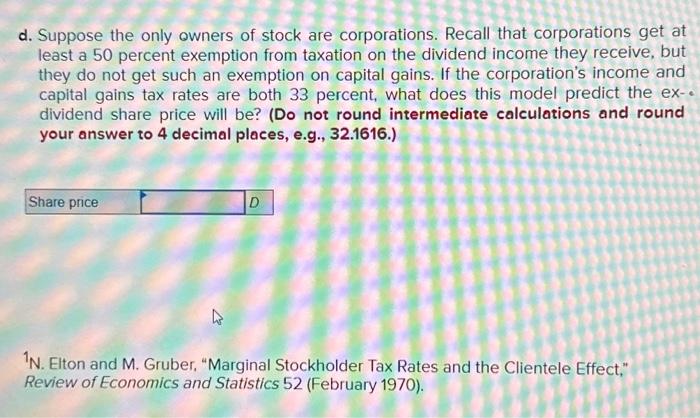

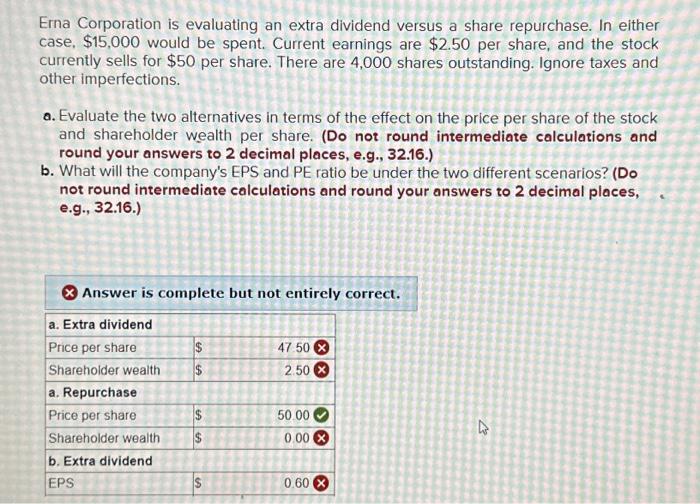

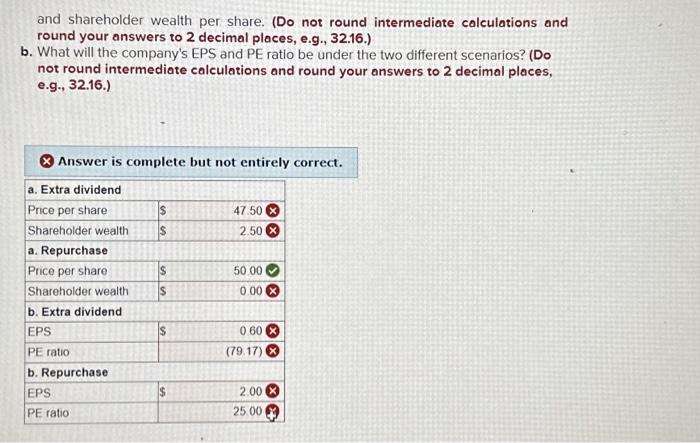

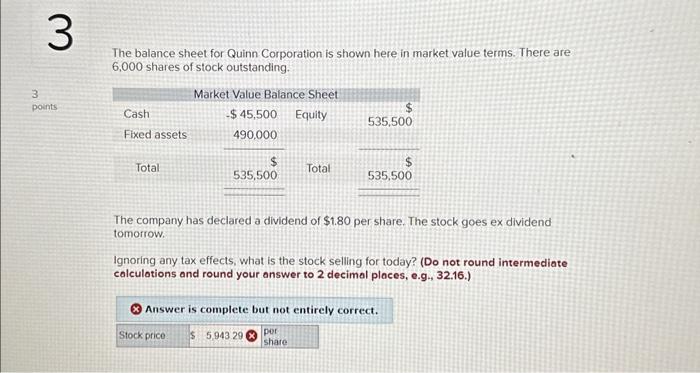

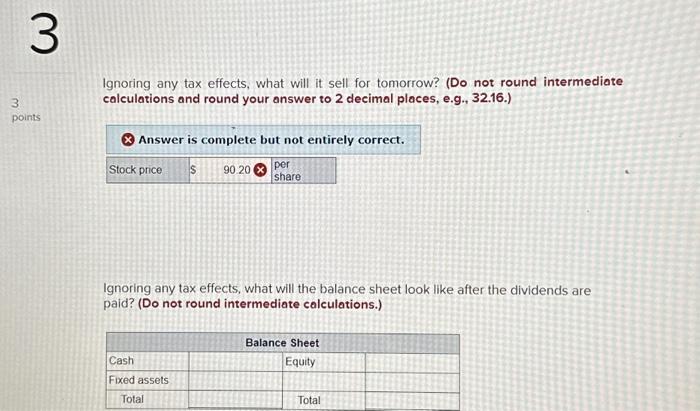

d. Suppose the only owners of stock are corporations. Recall that corporations get at least a 50 percent exemption from taxation on the dividend income they receive, but they do not get such an exemption on capital gains. If the corporation's income and capital gains tax rates are both 33 percent, what does this model predict the exdividend share price will be? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) 1 N. Elton and M. Gruber, "Marginal Stockholder Tax Rates and the Clientele Effect," Review of Economics and Statistics 52 (February 1970). Erna Corporation is evaluating an extra dividend versus a share repurchase. In either case, $15,000 would be spent. Current earnings are $2.50 per share, and the stock currently sells for $50 per share. There are 4,000 shares outstanding. Ignore taxes and other imperfections. a. Evaluate the two alternatives in terms of the effect on the price per share of the stock and shareholder wealth per share. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What will the company's EPS and PE ratio be under the two different scenarios? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. and shareholder wealth per share. (Do not round intermediate colculations and round your answers to 2 decimal places, e.g., 32.16.) b. What will the company's EPS and PE ratio be under the two different scenarios? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. The balance sheet for Quinn Corporation is shown here in market value terms. There are 6,000 shares of stock outstanding. The company has declared a dividend of $1.80 per share. The stock goes ex dividend tomorrow. Ignoring any tax effects, what is the stock selling for today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Ignoring any tax effects, what will it sell for tomorrow? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. \begin{tabular}{|l|l|l|} \hline Stock price & $ & 90.20 \\ \hline \end{tabular} Ignoring any tax effects, what will the balance sheet look like after the dividends are paid? (Do not round intermediate calculations.) d. Suppose the only owners of stock are corporations. Recall that corporations get at least a 50 percent exemption from taxation on the dividend income they receive, but they do not get such an exemption on capital gains. If the corporation's income and capital gains tax rates are both 33 percent, what does this model predict the exdividend share price will be? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) 1 N. Elton and M. Gruber, "Marginal Stockholder Tax Rates and the Clientele Effect," Review of Economics and Statistics 52 (February 1970). Erna Corporation is evaluating an extra dividend versus a share repurchase. In either case, $15,000 would be spent. Current earnings are $2.50 per share, and the stock currently sells for $50 per share. There are 4,000 shares outstanding. Ignore taxes and other imperfections. a. Evaluate the two alternatives in terms of the effect on the price per share of the stock and shareholder wealth per share. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What will the company's EPS and PE ratio be under the two different scenarios? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. and shareholder wealth per share. (Do not round intermediate colculations and round your answers to 2 decimal places, e.g., 32.16.) b. What will the company's EPS and PE ratio be under the two different scenarios? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. The balance sheet for Quinn Corporation is shown here in market value terms. There are 6,000 shares of stock outstanding. The company has declared a dividend of $1.80 per share. The stock goes ex dividend tomorrow. Ignoring any tax effects, what is the stock selling for today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Ignoring any tax effects, what will it sell for tomorrow? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. \begin{tabular}{|l|l|l|} \hline Stock price & $ & 90.20 \\ \hline \end{tabular} Ignoring any tax effects, what will the balance sheet look like after the dividends are paid? (Do not round intermediate calculations.)