Answered step by step

Verified Expert Solution

Question

1 Approved Answer

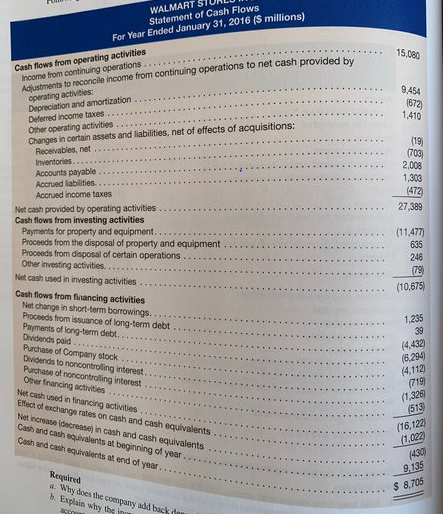

d). Walmart indicates it paid $4112 million to repurchase its common stock in fiscal 2016 and, in addition, paid dividends of $6294 million. Thus, it

d). Walmart indicates it paid $4112 million to repurchase its common stock in fiscal 2016 and, in addition, paid dividends of $6294 million. Thus, it paid $10406 million of cash to its stockholders during the year. How do we evaluate that cash relative to other possible uses for the company's cash?

e) Provide an overall assessment of the company's cash flows for fiscal 2016. In the analysis consider the sources and uses of cash.

WALMART STURL Statement of Cash Flows For Year Ended January 31, 2016 (S millions) Income from continuing operations Adjustments to reconcile income from continuing operations to net cash provided by 150 Cash flows from operating activities 9,454 operating activities Depreciation and amortization Deferred income taxes Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions 1,410 Receivables, net Inventories Accounts payable (19 ..7003) ...2,008 1,303 Accrued income taxes .. 27,389 (11,477) 246 Net cash provided by operating activities Cash flows from investing activities Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from disposal of certain operations Other investing activities. Net cash used in investing activities Cash flows from flnancing activities (10,675) Net change in short-term borrowings Proceeds from issuance of long-term debt . . . Payments of long-term debt Dividends paid Purchase of Company stock Dividends to noncontrolling interest Purchase of noncontrolling interest Other financing activities 1,235 39 (4,432) (6,294) (4,112) (719) 1,326 Net cash used in financing activities Effect of exchange rates on cash and cash equivalents .. Net increase (decrease) in cash and cash equivalents. Cash and cash equivalents at beginning of year.... (16,122) 1,022 (430) 9,135 8,705 Cash and cash equivalents at end of year Required a. Why does the company add bac b. Explain why the pany addback WALMART STURL Statement of Cash Flows For Year Ended January 31, 2016 (S millions) Income from continuing operations Adjustments to reconcile income from continuing operations to net cash provided by 150 Cash flows from operating activities 9,454 operating activities Depreciation and amortization Deferred income taxes Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions 1,410 Receivables, net Inventories Accounts payable (19 ..7003) ...2,008 1,303 Accrued income taxes .. 27,389 (11,477) 246 Net cash provided by operating activities Cash flows from investing activities Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from disposal of certain operations Other investing activities. Net cash used in investing activities Cash flows from flnancing activities (10,675) Net change in short-term borrowings Proceeds from issuance of long-term debt . . . Payments of long-term debt Dividends paid Purchase of Company stock Dividends to noncontrolling interest Purchase of noncontrolling interest Other financing activities 1,235 39 (4,432) (6,294) (4,112) (719) 1,326 Net cash used in financing activities Effect of exchange rates on cash and cash equivalents .. Net increase (decrease) in cash and cash equivalents. Cash and cash equivalents at beginning of year.... (16,122) 1,022 (430) 9,135 8,705 Cash and cash equivalents at end of year Required a. Why does the company add bac b. Explain why the pany addback

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started