Answered step by step

Verified Expert Solution

Question

1 Approved Answer

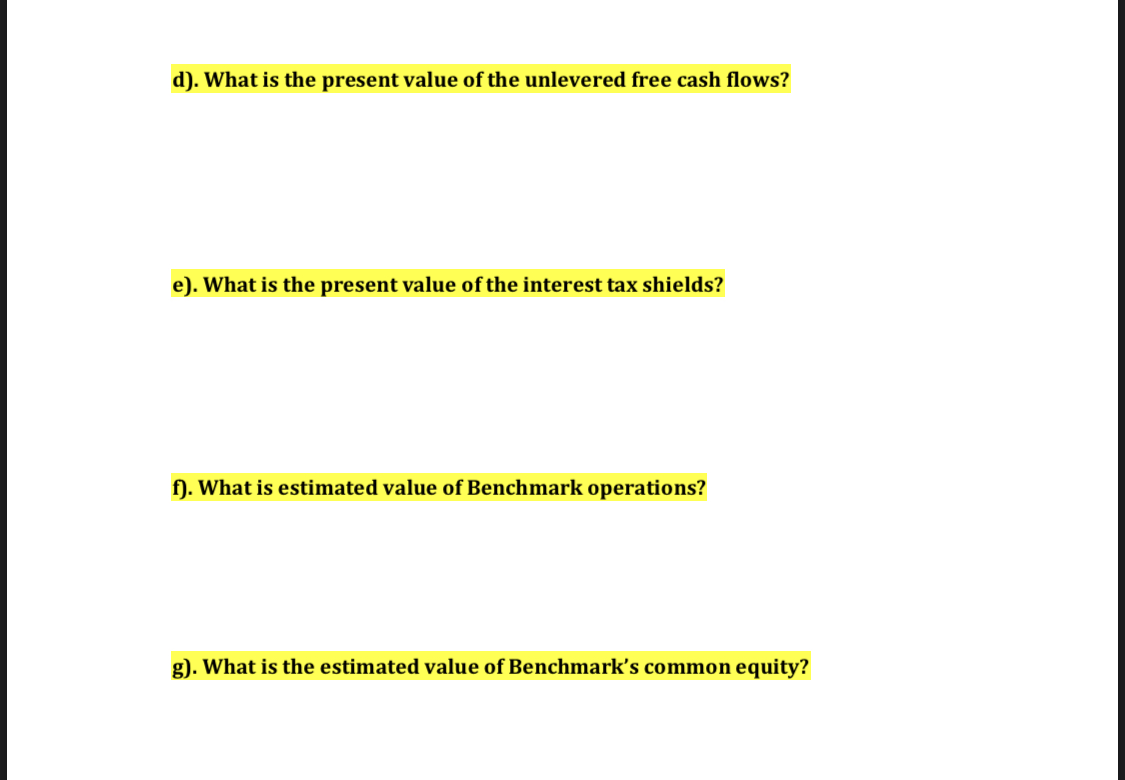

d). What is the present value of the unlevered free cash flows? e). What is the present value of the interest tax shields? f).

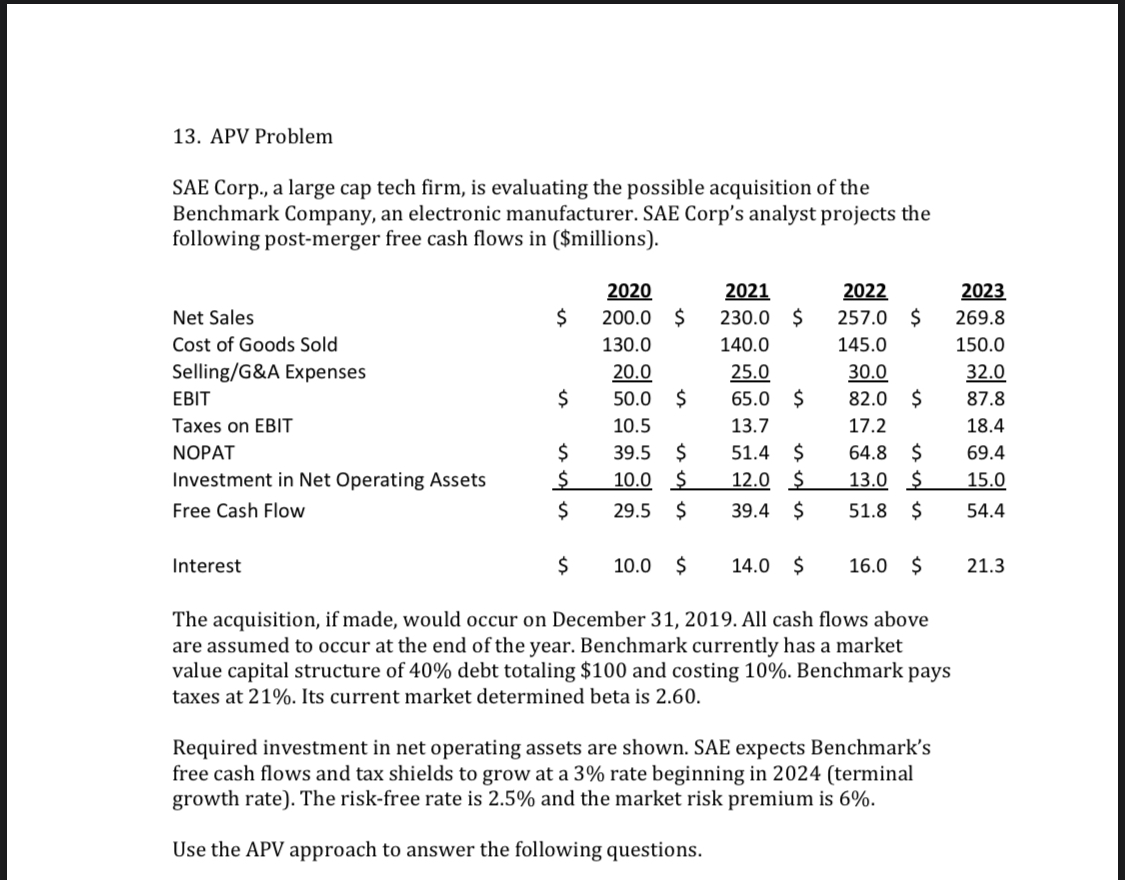

d). What is the present value of the unlevered free cash flows? e). What is the present value of the interest tax shields? f). What is estimated value of Benchmark operations? g). What is the estimated value of Benchmark's common equity? 13. APV Problem SAE Corp., a large cap tech firm, is evaluating the possible acquisition of the Benchmark Company, an electronic manufacturer. SAE Corp's analyst projects the following post-merger free cash flows in ($millions). 2020 2021 2022 2023 Net Sales $ 200.0 $ 230.0 $ 257.0 $ 269.8 Cost of Goods Sold 130.0 140.0 145.0 150.0 Selling/G&A Expenses 20.0 25.0 30.0 32.0 EBIT $ 50.0 $ 65.0 $ 82.0 $ 87.8 Taxes on EBIT 10.5 13.7 17.2 18.4 NOPAT $ 39.5 $ 51.4 $ 64.8 $ 69.4 Investment in Net Operating Assets $ 10.0 $ 12.0 $ 13.0 $ 15.0 Free Cash Flow $ 29.5 $ 39.4 $ 51.8 $ 54.4 Interest $ 10.0 $ 14.0 $ 16.0 $ 21.3 The acquisition, if made, would occur on December 31, 2019. All cash flows above are assumed to occur at the end of the year. Benchmark currently has a market value capital structure of 40% debt totaling $100 and costing 10%. Benchmark pays taxes at 21%. Its current market determined beta is 2.60. Required investment in net operating assets are shown. SAE expects Benchmark's free cash flows and tax shields to grow at a 3% rate beginning in 2024 (terminal growth rate). The risk-free rate is 2.5% and the market risk premium is 6%. Use the APV approach to answer the following questions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer your queries using the Adjusted Present Value APV approach we need to evaluate the unlevered free cash flows UFCF the present value of the t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started