Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(d) What was Soo Anns GOPPAR this year? (2 marks) (e) With a 10% ADR increase, what would be the forecasted percentage change in GOPPAR?

(d) What was Soo Anns GOPPAR this year? (2 marks)

(e) With a 10% ADR increase, what would be the forecasted percentage change in GOPPAR? (2 marks)

(f) With a 20% ADR increase, what would be the forecasted percentage change in GOPPAR? (2 marks)

(g) If Soo Ann implements a 20% ADR increase, what is the implication? (4 marks)

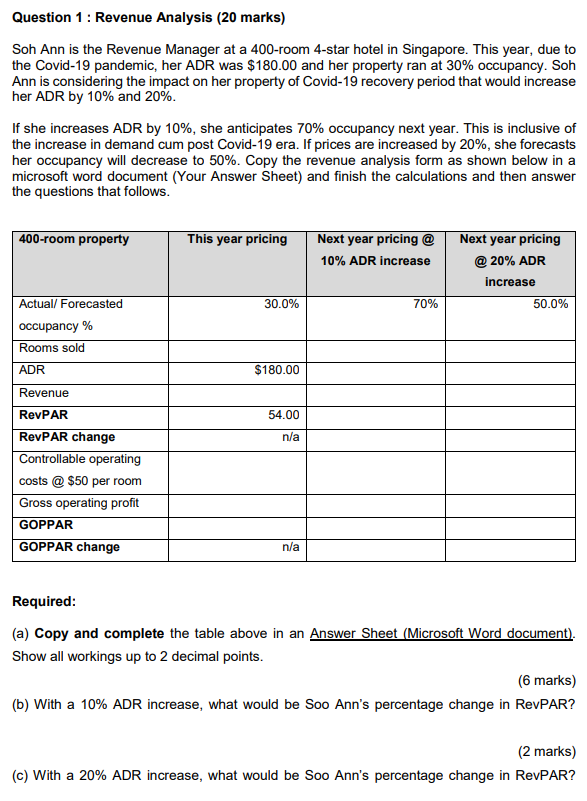

Question 1 : Revenue Analysis (20 marks) Soh Ann is the Revenue Manager at a 400-room 4-star hotel in Singapore. This year, due to the Covid-19 pandemic, her ADR was $180.00 and her property ran at 30% occupancy. Soh Ann is considering the impact on her property of Covid-19 recovery period that would increase her ADR by 10% and 20%. If she increases ADR by 10%, she anticipates 70% occupancy next year. This is inclusive of the increase in demand cum post Covid-19 era. If prices are increased by 20%, she forecasts her occupancy will decrease to 50%. Copy the revenue analysis form as shown below in a microsoft word document (Your Answer Sheet) and finish the calculations and then answer the questions that follows. 400-room property This year pricing Next year pricing @ 10% ADR increase Next year pricing @ 20% ADR increase 30.0% 70% 50.0% Actual/ Forecasted occupancy % Rooms sold ADR $180.00 54.00 n/a Revenue RevPAR RevPAR change Controllable operating costs @ $50 per room Gross operating profit GOPPAR GOPPAR change n/a Required: (a) Copy and complete the table above in an Answer Sheet (Microsoft Word document). Show all workings up to 2 decimal points. (6 marks) (b) With a 10% ADR increase, what would be Soo Ann's percentage change in RevPAR? (2 marks) (c) With a 20% ADR increase, what would be Soo Ann's percentage change in RevPAR? Question 1 : Revenue Analysis (20 marks) Soh Ann is the Revenue Manager at a 400-room 4-star hotel in Singapore. This year, due to the Covid-19 pandemic, her ADR was $180.00 and her property ran at 30% occupancy. Soh Ann is considering the impact on her property of Covid-19 recovery period that would increase her ADR by 10% and 20%. If she increases ADR by 10%, she anticipates 70% occupancy next year. This is inclusive of the increase in demand cum post Covid-19 era. If prices are increased by 20%, she forecasts her occupancy will decrease to 50%. Copy the revenue analysis form as shown below in a microsoft word document (Your Answer Sheet) and finish the calculations and then answer the questions that follows. 400-room property This year pricing Next year pricing @ 10% ADR increase Next year pricing @ 20% ADR increase 30.0% 70% 50.0% Actual/ Forecasted occupancy % Rooms sold ADR $180.00 54.00 n/a Revenue RevPAR RevPAR change Controllable operating costs @ $50 per room Gross operating profit GOPPAR GOPPAR change n/a Required: (a) Copy and complete the table above in an Answer Sheet (Microsoft Word document). Show all workings up to 2 decimal points. (6 marks) (b) With a 10% ADR increase, what would be Soo Ann's percentage change in RevPAR? (2 marks) (c) With a 20% ADR increase, what would be Soo Ann's percentage change in RevPARStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started