Answered step by step

Verified Expert Solution

Question

1 Approved Answer

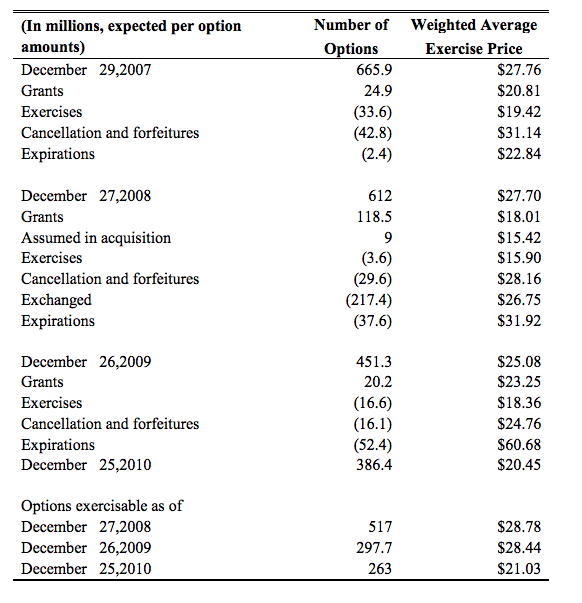

d. What was the intrinsic value per share of the option exercised in 2010? If employees who exercised options in 2010 immediately sold them, what

d. What was the intrinsic value per share of the option exercised in 2010? If employees who exercised options in 2010 immediately sold them, what profit did they make from the share?

f. What was the average exercise price of the options that expired in 2010? Explain why employees might have let these options expire without exercising them.

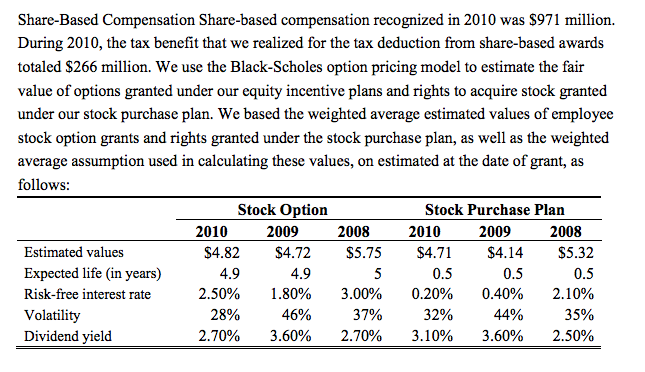

Share-Based Compensation Share-based compensation recognized in 2010 was S971 million. During 2010, the tax benefit that we realized for the tax deduction from share-based awards totaled S266 million. We use the Black-Scholes option pricing model to estimate the fair value of options granted under our equity incentive plans and rights to acquire stock granted under our stock purchase plan. We based the weighted average estimated values of employee stock option grants and rights granted under the stock purchase plan, as well as the weighted average assumption used in calculating these values, on estimated at the date of grant, as follows: Stock Purchase Plan Stock option 2010 2009 2008 2010 2009 2008 Estimated values $4.82 $4.72 $5.75 $4.71 $4.14 $5.32 Expected life (in years) 4.9 4.9 0.5 0.5 0.5 Risk-free interest rate 2.50% 1.80% 3.000% 0.20% 0.40% 2.10% 28% 46 37% 32% 44% 35% Volatility Dividend yield 2.70% 3.60% 2.70% 3.10% 3.60% 2.50%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started