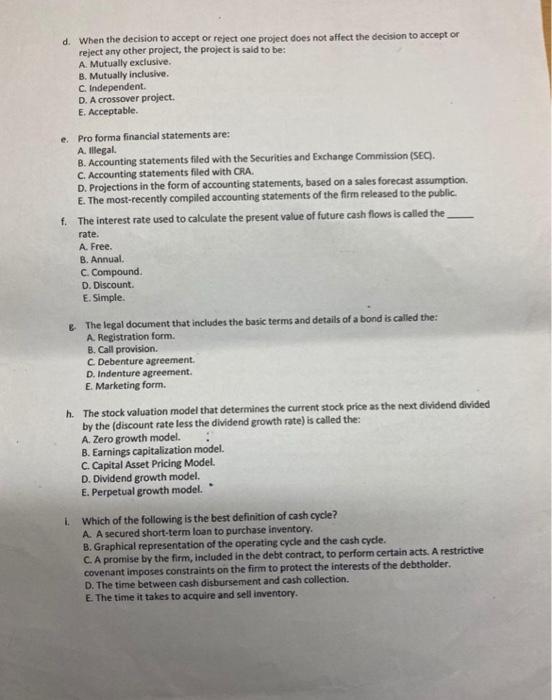

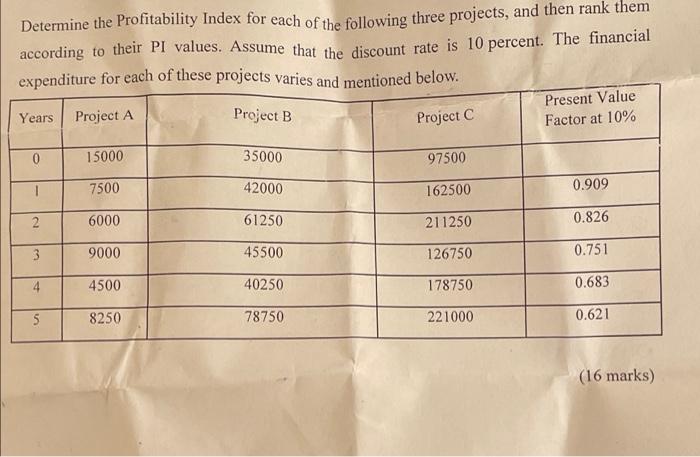

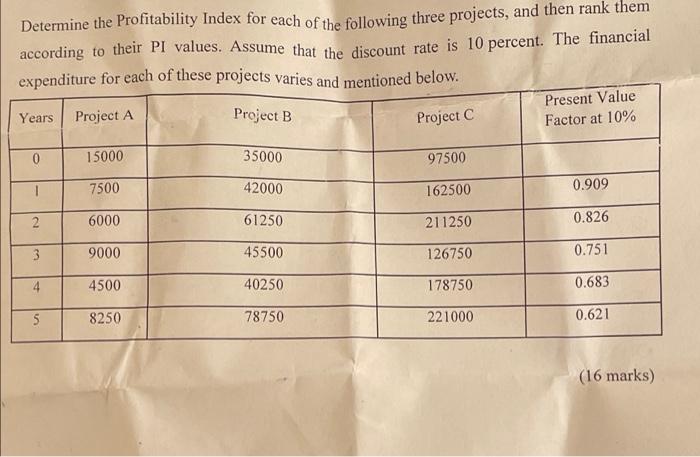

d. When the decision to accept or reject one project does not affect the decision to accept or reject any other project, the project is said to be: A. Mutually exclusive. B. Mutually inclusive. C. Independent. D. A crossover project. E. Acceptable. e. Pro forma financial statements are: A. Illegal. B. Accounting statements filed with the Securities and Exchange Commission (SEC). C. Accounting statements filed with CRA. D. Projections in the form of accounting statements, based on a sales forecast assumption. E. The most-recently compiled accounting statements of the firm released to the public. f. The interest rate used to calculate the present value of future cash flows is called the rate. A. Free. B. Annual.. C. Compound. D. Discount. E. Simple. & The legal document that includes the basic terms and details of a bond is called the: A. Registration form. B. Call provision. C. Debenture agreement. D. Indenture agreement. E. Marketing form. h. The stock valuation model that determines the current stock price as the next dividend divided by the (discount rate less the dividend growth rate) is called the: A. Zero growth model. B. Earnings capitalization model. C. Capital Asset Pricing Model. D. Dividend growth model. E. Perpetual growth model. 1. Which of the following is the best definition of cash cycle? A. A secured short-term loan to purchase inventory. B. Graphical representation of the operating cycle and the cash cycle. C. A promise by the firm, included in the debt contract, to perform certain acts. A restrictive covenant imposes constraints on the firm to protect the interests of the debtholder. D. The time between cash disbursement and cash collection. E. The time it takes to acquire and sell inventory. Determine the Profitability Index for each of the following three projects, and then rank them according to their PI values. Assume that the discount rate is 10 percent. The financial expenditure for each of these projects varies and mentioned below. Years Project A Project B Present Value Factor at 10% Project C 0 15000 35000 97500 7500 42000 162500 0.909 6000 61250 211250 0.826 9000 45500 126750 0.751 4500 40250 178750 0.683 8250 78750 221000 0.621 (16 marks) 2 3 5