Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( d ) Your answer is correct. Record current income tax for 2 0 2 3 . ( Credit account titles are automatically indented when

d

Your answer is correct.

Record current income tax for Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. List debit entry before credit entry.

Account Titles and Explanation

Debit

Credit

Current Tax Expense

Income Tax Payable

eTextbook and Media

List of Accounts

e

Your answer is incorrect.

Calculate the amount of any future tax asset andor liability for

Future tax asset

$

Future tax liability

Net future tax asset $

eTextbook and Media

List of Accounts

Attempts: of used

f

The parts of this question must be completed in order. This part will be available when you complete the part above.Current Attempt in Progress

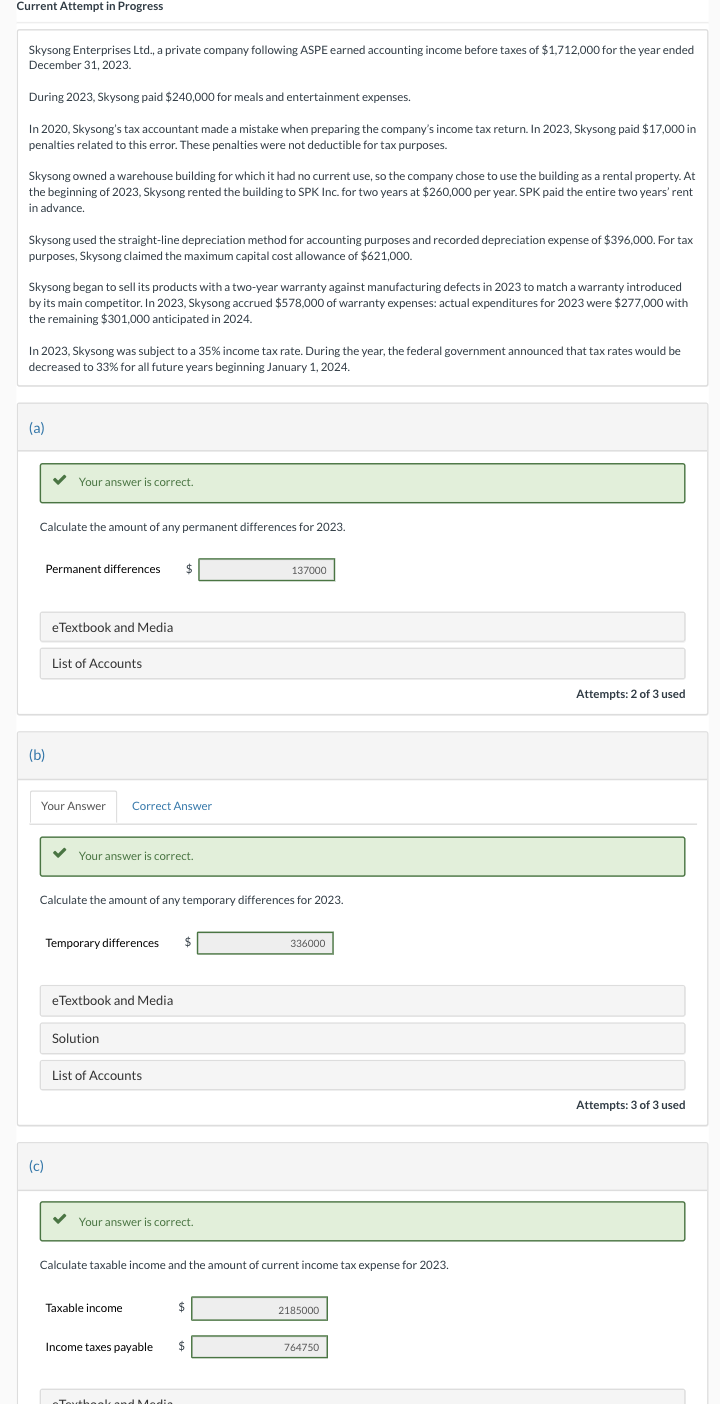

Skysong Enterprises Ltd a private company following ASPE earned accounting income before taxes of $ for the year ended

December

During Skysong paid $ for meals and entertainment expenses.

In Skysong's tax accountant made a mistake when preparing the company's income tax return. In Skysong paid $ in

penalties related to this error. These penalties were not deductible for tax purposes.

Skysong owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At

the beginning of Skysong rented the building to SPK Inc. for two years at $ per year. SPK paid the entire two years' rent

in advance.

Skysong used the straightline depreciation method for accounting purposes and recorded depreciation expense of $ For tax

purposes, Skysong claimed the maximum capital cost allowance of $

Skysong began to sell its products with a twoyear warranty against manufacturing defects in to match a warranty introduced

by its main competitor. In Skysong accrued $ of warranty expenses: actual expenditures for were $ with

the remaining $ anticipated in

In Skysong was subject to a income tax rate. During the year, the federal government announced that tax rates would be

decreased to for all future years beginning January

a

Your answer is correct.

Calculate the amount of any permanent differences for

Permanent differences $

eTextbook and Media

List of Accounts

b

Correct Answer

Your answer is correct.

Calculate the amount of any temporary differences for

Temporary differences $

eTextbook and Media

Solution

List of Accounts

Attempts: of used

c

Your answer is correct.

Calculate taxable income and the amount of current income tax expense for

Taxable income $

Income taxes payable $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started