Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d-1. Suppose immediately after the completion of the merger, everyone realizes that the expected growth rate will not be improved. Reassess the cost of the

d-1. Suppose immediately after the completion of the merger, everyone realizes that the expected growth rate will not be improved. Reassess the cost of the cash offer.

d-2. Reassess the NPV of the cash offer.

d-3. Reassess the cost of the share offer.

d-4. Reassess the NPV of the share offer.

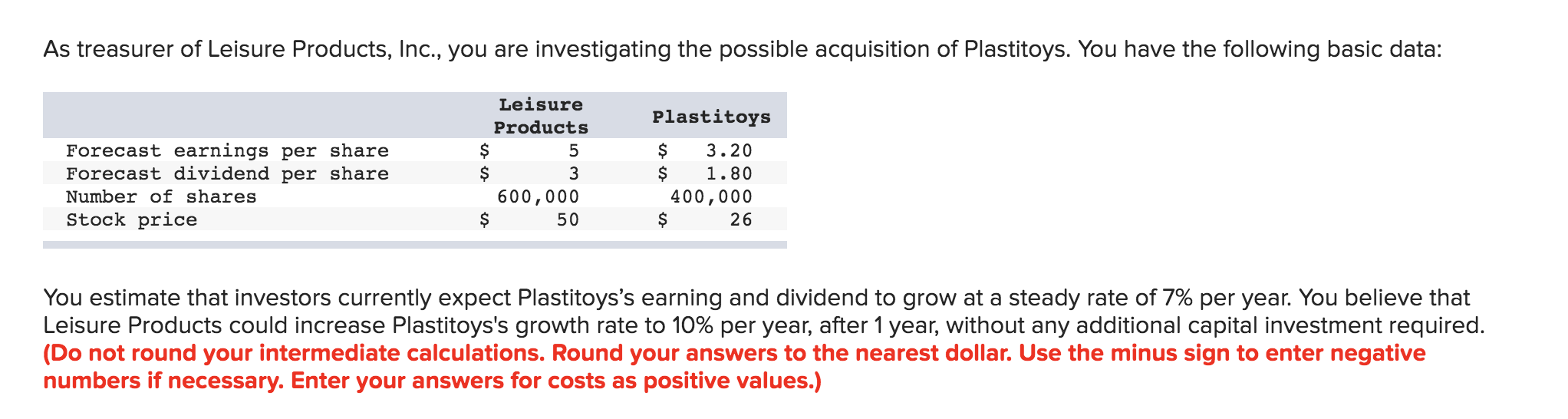

As treasurer of Leisure Products, Inc., you are investigating the possible acquisition of Plastitoys. You have the following basic data: Plastitoys Forecast earnings per share Forecast dividend per share Number of shares Stock price Leisure Products $ 5 $ 3 600,000 $ 50 $ 3.20 $ 1.80 400,000 $ 26 You estimate that investors currently expect Plastitoys's earning and dividend to grow at a steady rate of 7% per year. You believe that Leisure Products could increase Plastitoys's growth rate to 10% per year, after 1 year, without any additional capital investment required. (Do not round your intermediate calculations. Round your answers to the nearest dollar. Use the minus sign to enter negative numbers if necessary. Enter your answers for costs as positive values.) As treasurer of Leisure Products, Inc., you are investigating the possible acquisition of Plastitoys. You have the following basic data: Plastitoys Forecast earnings per share Forecast dividend per share Number of shares Stock price Leisure Products $ 5 $ 3 600,000 $ 50 $ 3.20 $ 1.80 400,000 $ 26 You estimate that investors currently expect Plastitoys's earning and dividend to grow at a steady rate of 7% per year. You believe that Leisure Products could increase Plastitoys's growth rate to 10% per year, after 1 year, without any additional capital investment required. (Do not round your intermediate calculations. Round your answers to the nearest dollar. Use the minus sign to enter negative numbers if necessary. Enter your answers for costs as positive values.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started