Answered step by step

Verified Expert Solution

Question

1 Approved Answer

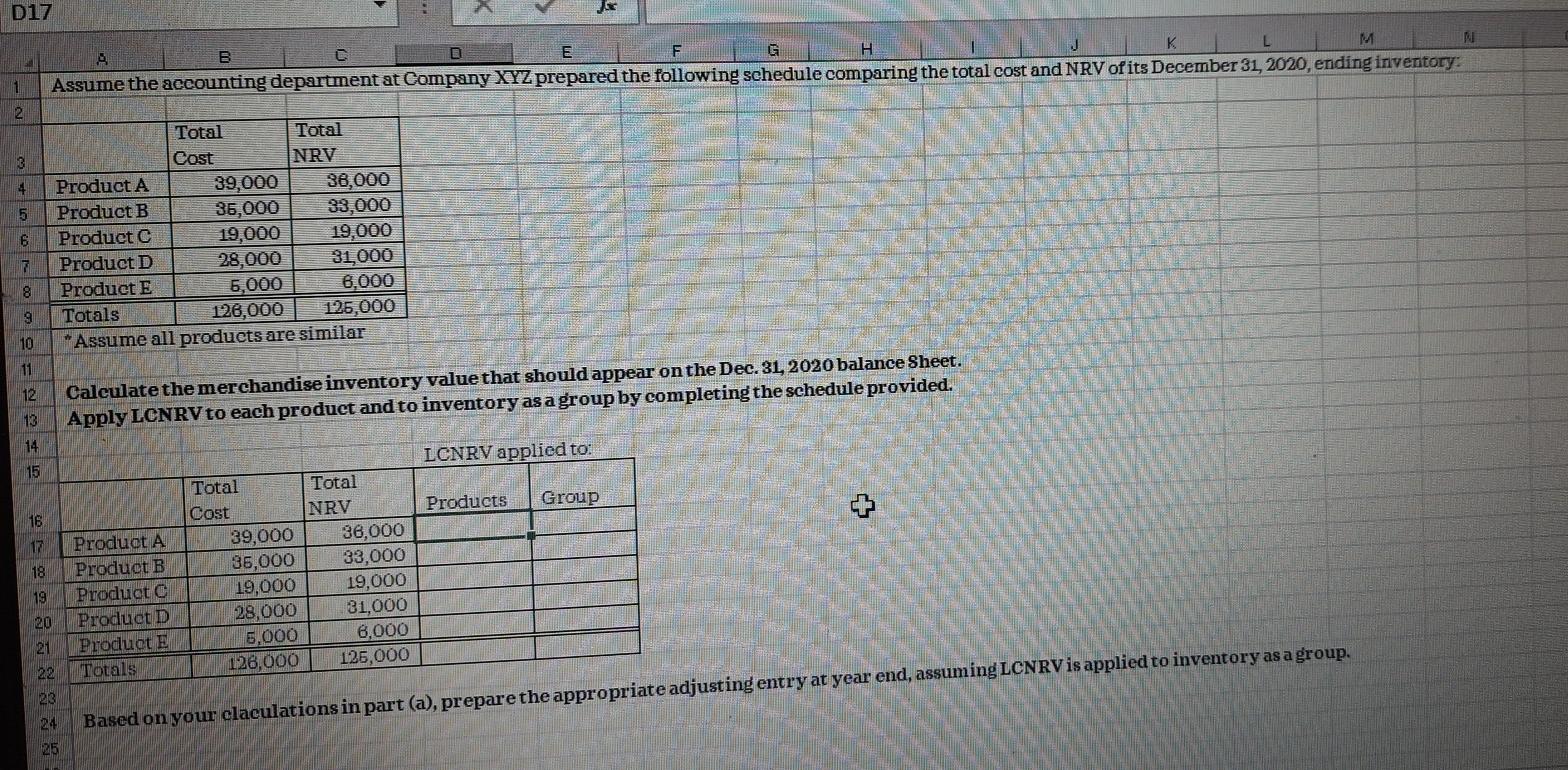

D17 B E H M 1 Assume the accounting department at Company XYZ prepared the following schedule comparing the total cost and NRV of its

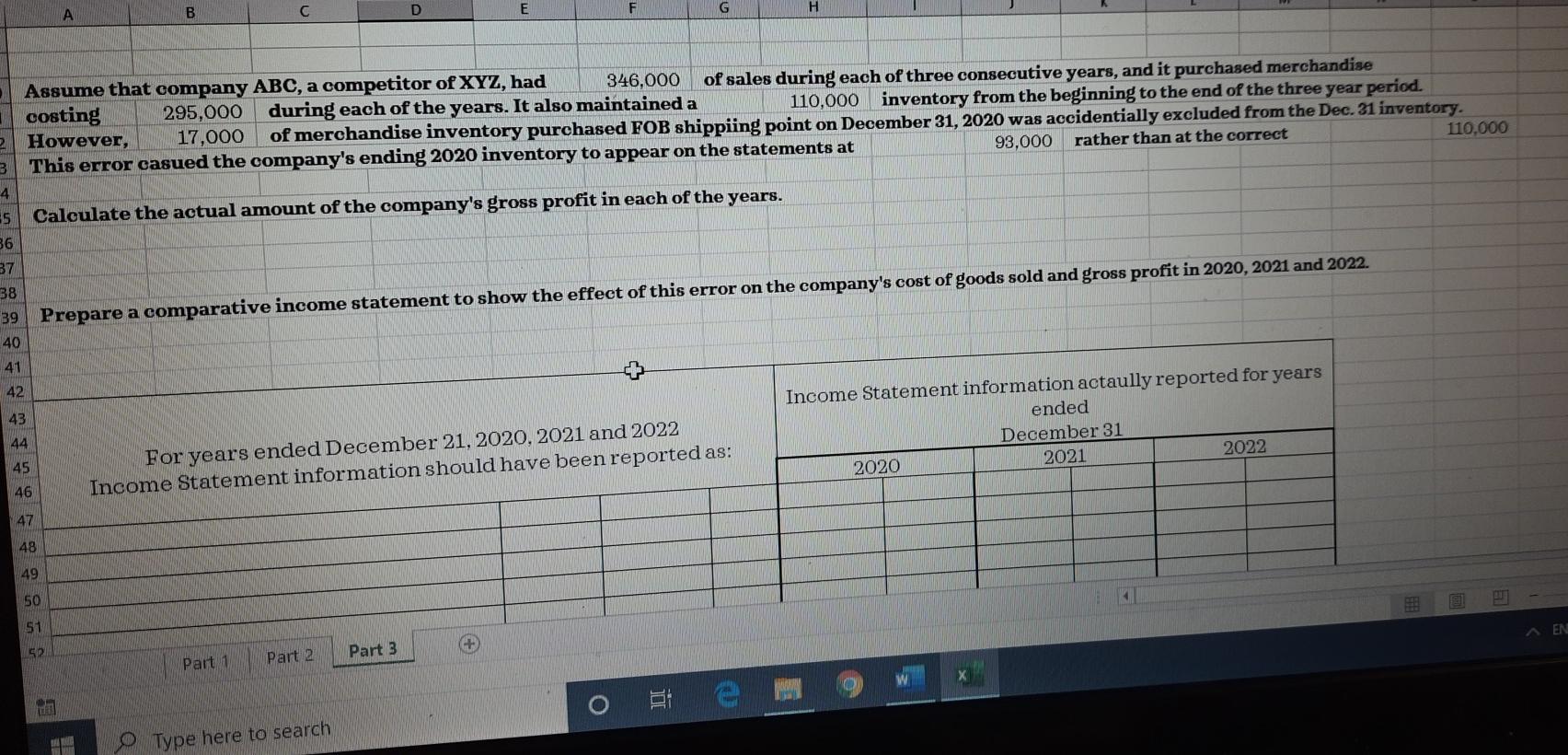

D17 B E H M 1 Assume the accounting department at Company XYZ prepared the following schedule comparing the total cost and NRV of its December 31, 2020, ending inventory: 2 Total Total 3 Cost NRV 4 Product A 39,000 38,000 5 Product B 36,000 33,000 6 Product C 19,000 19,000 7 Product D 28,000 31,000 8 Product E 6,000 6,000 9 Totals 126,000 126,000 10 "Assume all products are similar 11 12 Calculate the merchandise inventory value that should appear on the Dec. 31, 2020 balance Sheet. 13 Apply LCNRV to each product and to inventory as a group by completing the schedule provided. 14 15 LCNRV applied to: Total Total Cost Products NRV 16 Group Product A 39,000 36,000 18 Product B 35,000 33,000 19 Product C 19,000 19,000 20 Product D 28,000 31,000 21 Product E 6,000 6,000 22 Totals 126,000 125,000 23 24 Based on your claculations in part (a), prepare the appropriate adjusting entry at year end, assuming LCNRV is applied to inventory as a group. 25 B D E G H Assume that company ABC, a competitor of XYZ, had 346.000 of sales during each of three consecutive years, and it purchased merchandise costing 295,000 during each of the years. It also maintained a 110,000 inventory from the beginning to the end of the three year period. However, 17,000 of merchandise inventory purchased FOB shippiing point on December 31, 2020 was accidentially excluded from the Dec. 31 inventory. 3 This error casued the company's ending 2020 inventory to appear on the statements at 93,000 rather than the correct 110,000 4 5 Calculate the actual amount of the company's gross profit in each of the years. 36 37 38 39 Prepare a comparative income statement to show the effect of this error on the company's cost of goods sold and gross profit in 2020, 2021 and 2022. 40 41 42 43 Income Statement information actaully reported for years ended December 31 2020 2021 2022 44 45 For years ended December 21, 2020 2021 and 2022 Income Statement information should have been reported as: 46 47 48 49 50 51 A EN 152 Part 2 Part 3 Part 1 E Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started