Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Daimler Benz AG is a German car manufacturer which makes Mercedes Benz motorcars. It is a taxable person registered in Germany. In February

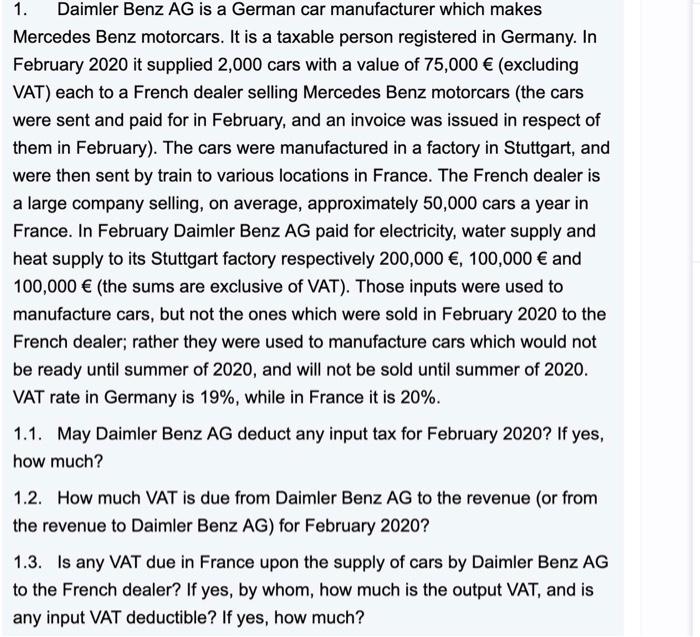

1. Daimler Benz AG is a German car manufacturer which makes Mercedes Benz motorcars. It is a taxable person registered in Germany. In February 2020 it supplied 2,000 cars with a value of 75,000 (excluding VAT) each to a French dealer selling Mercedes Benz motorcars (the cars were sent and paid for in February, and an invoice was issued in respect of them in February). The cars were manufactured in a factory in Stuttgart, and were then sent by train to various locations in France. The French dealer is a large company selling, on average, approximately 50,000 cars a year in France. In February Daimler Benz AG paid for electricity, water supply and heat supply to its Stuttgart factory respectively 200,000 , 100,000 and 100,000 (the sums are exclusive of VAT). Those inputs were used to manufacture cars, but not the ones which were sold in February 2020 to the French dealer; rather they were used to manufacture cars which would not be ready until summer of 2020, and will not be sold until summer of 2020. VAT rate in Germany is 19%, while in France it is 20%. 1.1. May Daimler Benz AG deduct any input tax for February 2020? If yes, how much? 1.2. How much VAT is due from Daimler Benz AG to the revenue (or from the revenue to Daimler Benz AG) for February 2020? 1.3. Is any VAT due in France upon the supply of cars by Daimler Benz AG to the French dealer? If yes, by whom, how much is the output VAT, and is any input VAT deductible? If yes, how much?

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

11 Based on the information given in the question it can be reasonably assumed that Daimler Benz AG has already used the various inputs such as electricity water supply and heat supply to produce the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started