Question

Dakota Martin sold a piece of land in 2020 for $350,000. The land was recognized as capital property. The original cost of the land

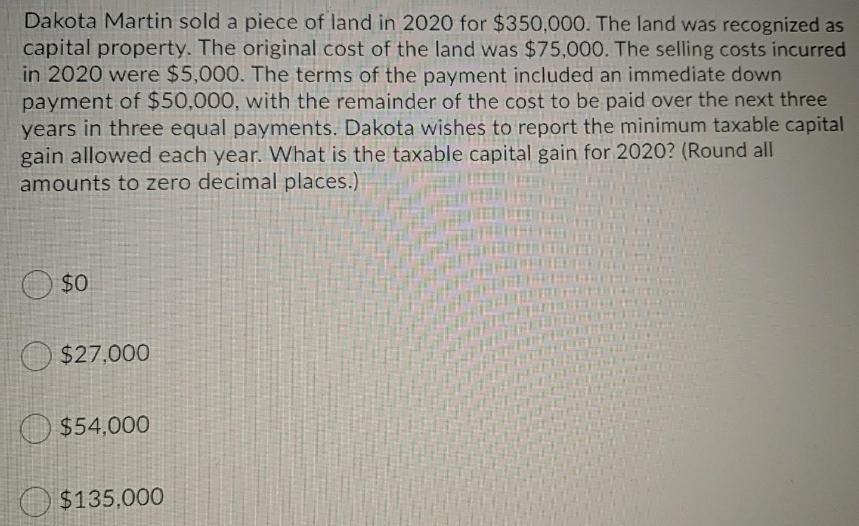

Dakota Martin sold a piece of land in 2020 for $350,000. The land was recognized as capital property. The original cost of the land was $75,000. The selling costs incurred in 2020 were $5,000. The terms of the payment included an immediate down payment of $50,000, with the remainder of the cost to be paid over the next three years in three equal payments. Dakota wishes to report the minimum taxable capital gain allowed each year. What is the taxable capital gain for 2020? (Round all amounts to zero decimal places.) $0 O $27,000 O $54,000 O $135,000

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

27000 is the correct answer the answer is very correct Gain Proceeds o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Physics

Authors: Jerry D. Wilson, Anthony J. Buffa, Bo Lou

7th edition

9780321571113, 321601831, 978-0321601834

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App