Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dale DePriest looked from one term sheet to the other. It was May 2003, and DePriest had just received two term sheets from Wally

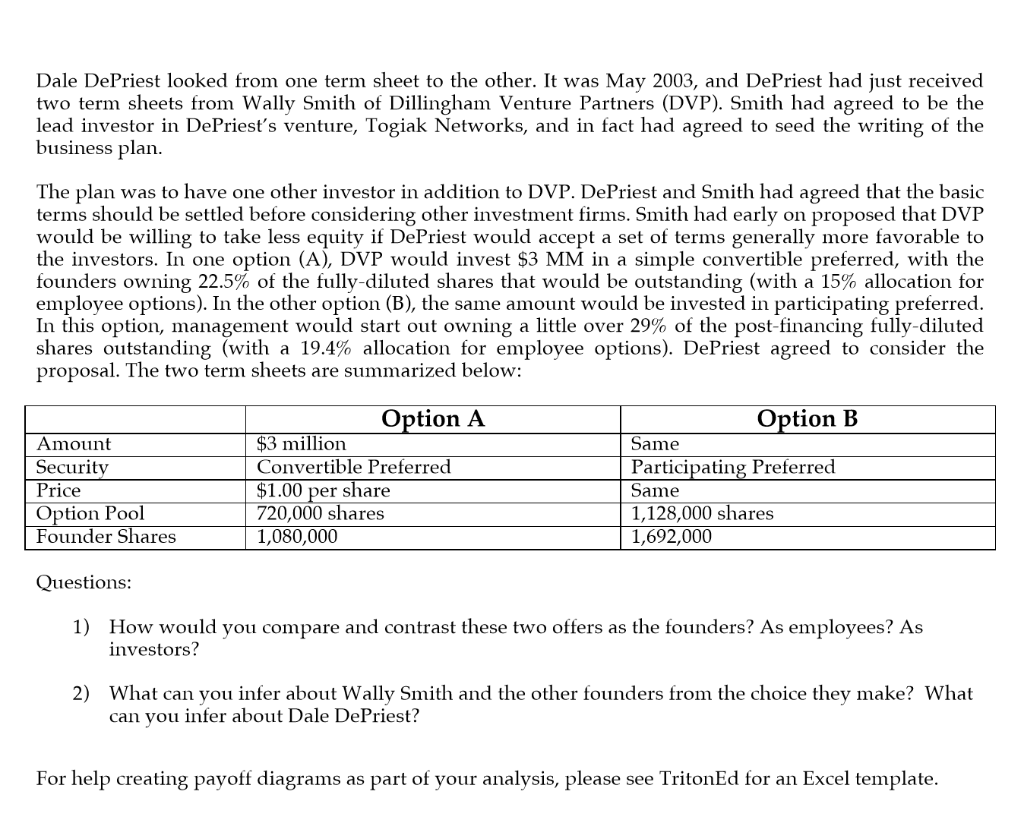

Dale DePriest looked from one term sheet to the other. It was May 2003, and DePriest had just received two term sheets from Wally Smith of Dillingham Venture Partners (DVP). Smith had agreed to be the lead investor in DePriest's venture, Togiak Networks, and in fact had agreed to seed the writing of the business plan. The plan was to have one other investor in addition to DVP. DePriest and Smith had agreed that the basic terms should be settled before considering other investment firms. Smith had early on proposed that DVP would be willing to take less equity if DePriest would accept a set of terms generally more favorable to the investors. In one option (A), DVP would invest $3 MM in a simple convertible preferred, with the founders owning 22.5% of the fully-diluted shares that would be outstanding (with a 15% allocation for employee options). In the other option (B), the same amount would be invested in participating preferred. In this option, management would start out owning a little over 29% of the post-financing fully-diluted shares outstanding (with a 19.4% allocation for employee options). DePriest agreed to consider the proposal. The two term sheets are summarized below: Option A Amount Security Price Option Pool Founder Shares $3 million Convertible Preferred $1.00 per share 720,000 shares 1,080,000 Option B Same Participating Preferred Same 1,128,000 shares 1,692,000 Questions: 1) How would you compare and contrast these two offers as the founders? As employees? As investors? 2) What can you infer about Wally Smith and the other founders from the choice they make? What can you infer about Dale DePriest? For help creating payoff diagrams as part of your analysis, please see TritonEd for an Excel template.

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Founders The founders would be losing the controlling interest to the two investors who would be collectively holding 6250 equity in Option A and 5150 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started