Answered step by step

Verified Expert Solution

Question

1 Approved Answer

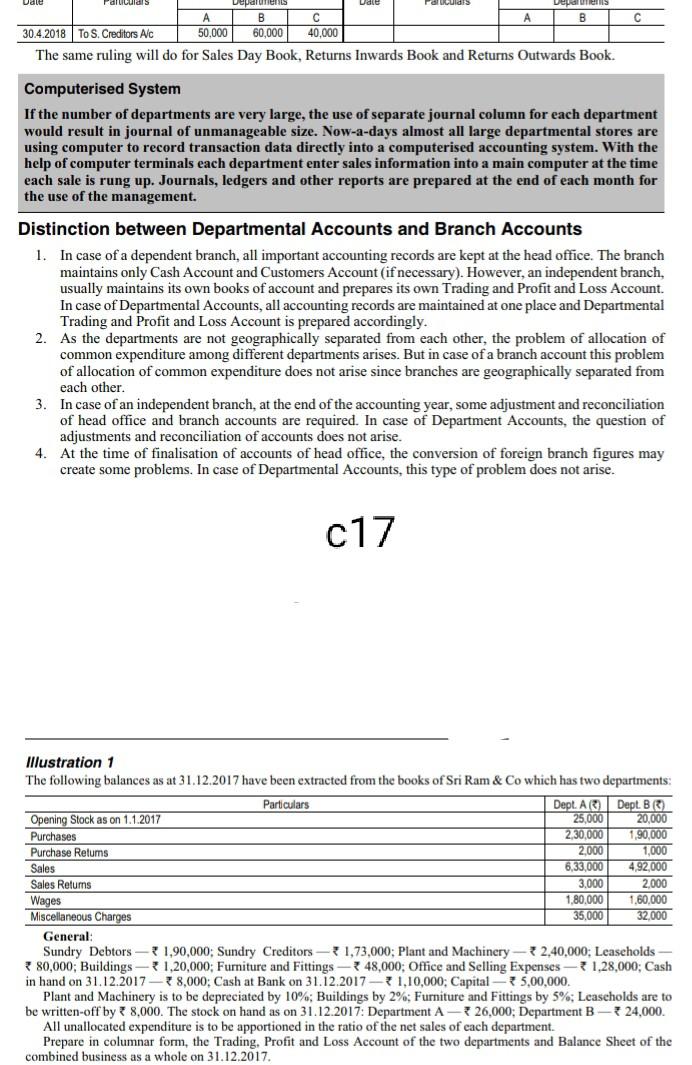

Dale Faruculas Udle rauidis A B B C 30.4.2018 To S. Creditors Alc 50,000 60,000 40,000 The same ruling will do for Sales Day Book,

Dale Faruculas Udle rauidis A B B C 30.4.2018 To S. Creditors Alc 50,000 60,000 40,000 The same ruling will do for Sales Day Book, Returns Inwards Book and Returns Outwards Book. Computerised System If the number of departments are very large, the use of separate journal column for each department would result in journal of unmanageable size. Now-a-days almost all large departmental stores are using computer to record transaction data directly into a computerised accounting system. With the help of computer terminals each department enter sales information into a main computer at the time each sale is rung up. Journals, ledgers and other reports are prepared at the end of each month for the use of the management. Distinction between Departmental Accounts and Branch Accounts 1. In case of a dependent branch, all important accounting records are kept at the head office. The branch maintains only Cash Account and Customers Account (if necessary). However, an independent branch, usually maintains its own books of account and prepares its own Trading and Profit and Loss Account In case of Departmental Accounts, all accounting records are maintained at one place and Departmental Trading and Profit and Loss Account is prepared accordingly. 2. As the departments are not geographically separated from each other, the problem of allocation of common nexpenditure among different departments arises. But in case of a branch account this problem of allocation of common expenditure does not arise since branches are geographically separated from each other. 3. In case of an independent branch, at the end of the accounting year, some adjustment and reconciliation of head office and branch accounts are required. In case of Department Accounts, the question of adjustments and reconciliation of accounts does not arise. 4. At the time of finalisation of accounts of head office, the conversion of foreign branch figures may create some problems. In case of Departmental Accounts, this type of problem does not arise. c17 Illustration 1 The following balances as at 31.12.2017 have been extracted from the books of Sri Ram & Co which has two departments: Particulars Dept. A) Dept. B Opening Stock as on 1.1.2017 25,000 20.000 Purchases 2,30,000 1,90,000 Purchase Returns 2000 1,000 Sales 6,33,000 4.92.000 Sales Returns 3,000 2,000 Wages 1,80,000 1,60,000 Miscellaneous Charges 35,000 32.000 General: Sundry Debtors - 1,90,000; Sundry Creditors - 1,73,000; Plant and Machinery * 2,40,000: Leaseholds - *80,000; Buildings - 31,20,000; Furniture and Fittings + 48,000; Office and Selling Expenses * 1,28,000; Cash in hand on 31.12.201738,000: Cash at Bank on 31.12.2017-31.10,000; Capital - 5,00,000 Plant and Machinery is to be depreciated by 10%; Buildings by 2%; Furniture and Fittings by 5%; Leaseholds are to be written-off by + 8,000. The stock on hand as on 31.12.2017: Department A-26,000; Department B-24,000. All unallocated expenditure is to be apportioned in the ratio of the net sales of cach department Prepare in columnar form, the Trading, Profit and Loss Account of the two departments and Balance Sheet of the combined business as a whole on 31.12.2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started