Question

Dallas and Weiss formed a partnership to manage rental properties, by investing $161,000 and $189,000, respectively. During its first year, the partnership recorded profit of

Dallas and Weiss formed a partnership to manage rental properties, by investing $161,000 and $189,000, respectively. During its first year, the partnership recorded profit of $457,000.

Required:

Prepare calculations showing how the profit should be allocated to the partners under each of the following plans for sharing profit and losses:

a. The partners failed to agree on a method of sharing profit.

b. The partners agreed to share profits and losses in proportion to their initial investments.

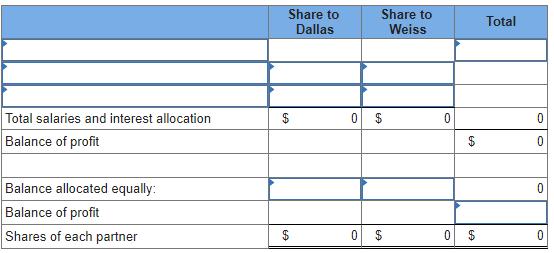

c. The partners agreed to share profit by allowing a $150,000 per year salary allowance to Dallas, an $80,000 per year salary allowance to Weiss, 25% interest on their initial investments, and sharing the balance equally. (Leave no cell blank. Enter 0 if the answer is zero.)

Share to Dallas Share to Weiss Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started