Answered step by step

Verified Expert Solution

Question

1 Approved Answer

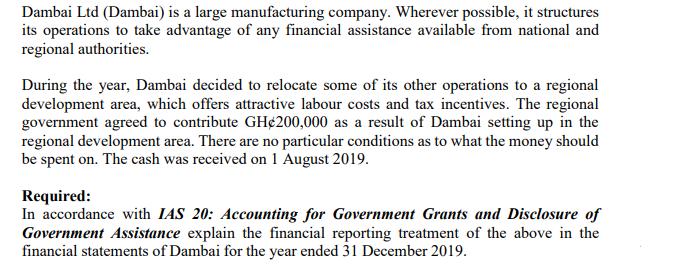

Dambai Ltd (Dambai) is a large manufacturing company. Wherever possible, it structures its operations to take advantage of any financial assistance available from national

Dambai Ltd (Dambai) is a large manufacturing company. Wherever possible, it structures its operations to take advantage of any financial assistance available from national and regional authorities. During the year, Dambai decided to relocate some of its other operations to a regional development area, which offers attractive labour costs and tax incentives. The regional government agreed to contribute GH200,000 as a result of Dambai setting up in the regional development area. There are no particular conditions as to what the money should be spent on. The cash was received on 1 August 2019. Required: In accordance with IAS 20: Accounting for Government Grants and Disclosure of Government Assistance explain the financial reporting treatment of the above in the financial statements of Dambai for the year ended 31 December 2019.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a IFRS 15 Revenue from Contracts with Customers Very few candidates were able to understand and suggest correctly appropriate accounting treatment Man...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started