Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION You are due to meet with a potential new client, Mr Rowntree, who will shortly turn 30 years old. He has recently opened

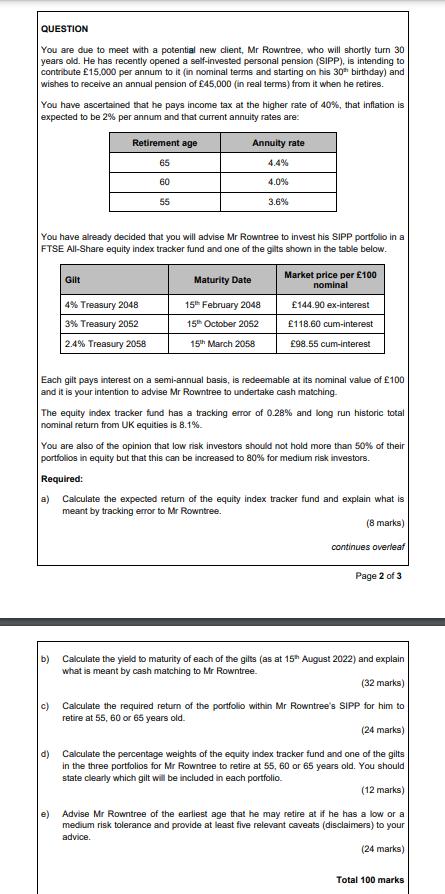

QUESTION You are due to meet with a potential new client, Mr Rowntree, who will shortly turn 30 years old. He has recently opened a self-invested personal pension (SIPP), is intending to contribute 15,000 per annum to it (in nominal terms and starting on his 30th birthday) and wishes to receive an annual pension of 45,000 (in real terms) from it when he retires. You have ascertained that he pays income tax at the higher rate of 40%, that inflation is expected to be 2% per annum and that current annuity rates are: Retirement age Gilt 65 60 55 4% Treasury 2048 3% Treasury 2052 2.4% Treasury 2058 Annuity rate You have already decided that you will advise Mr Rowntree to invest his SIPP portfolio in a FTSE All-Share equity index tracker fund and one of the gilts shown in the table below. 4.4% 4.0% 3.6% Maturity Date 15th February 2048 15th October 2052 15th March 2058 Market price per 100 nominal 144.90 ex-interest 118.60 cum-interest 98.55 cum-interest Each gilt pays interest on a semi-annual basis, is redeemable at its nominal value of 100 and it is your intention to advise Mr Rowntree to undertake cash matching. The equity index tracker fund has a tracking error of 0.28% and long run historic total nominal return from UK equities is 8.1%. You are also of the opinion that low risk investors should not hold more than 50% of their portfolios in equity but that this can be increased to 80% for medium risk investors. Required: a) Calculate the expected return of the equity index tracker fund and explain what is meant by tracking error to Mr Rowntree. (8 marks) continues overleaf Page 2 of 3 b) Calculate the yield to maturity of each of the gilts (as at 15th August 2022) and explain what is meant by cash matching to Mr Rowntree. (32 marks) c) Calculate the required return of the portfolio within Mr Rowntree's SIPP for him to retire at 55, 60 or 65 years old. (24 marks) d) Calculate the percentage weights of the equity index tracker fund and one of the gilts in the three portfolios for Mr Rowntree to retire at 55, 60 or 65 years old. You should state clearly which gilt will be included in each portfolio. (12 marks) e) Advise Mr Rowntree of the earliest age that he may retire at if he has a low or a medium risk tolerance and provide at least five relevant caveats (disclaimers) to your advice. marks) Total 100 marks

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

There are numerous normal tweak strategies including the accompanying which is a fragmented rundown Plentifulness adjustment AM The stature ie the strength or power of the sign transporter is shifted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started