Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dan D . Vito is the risk manager for a regional chain of grocery stores. A common financial loss for the grocery chain is food

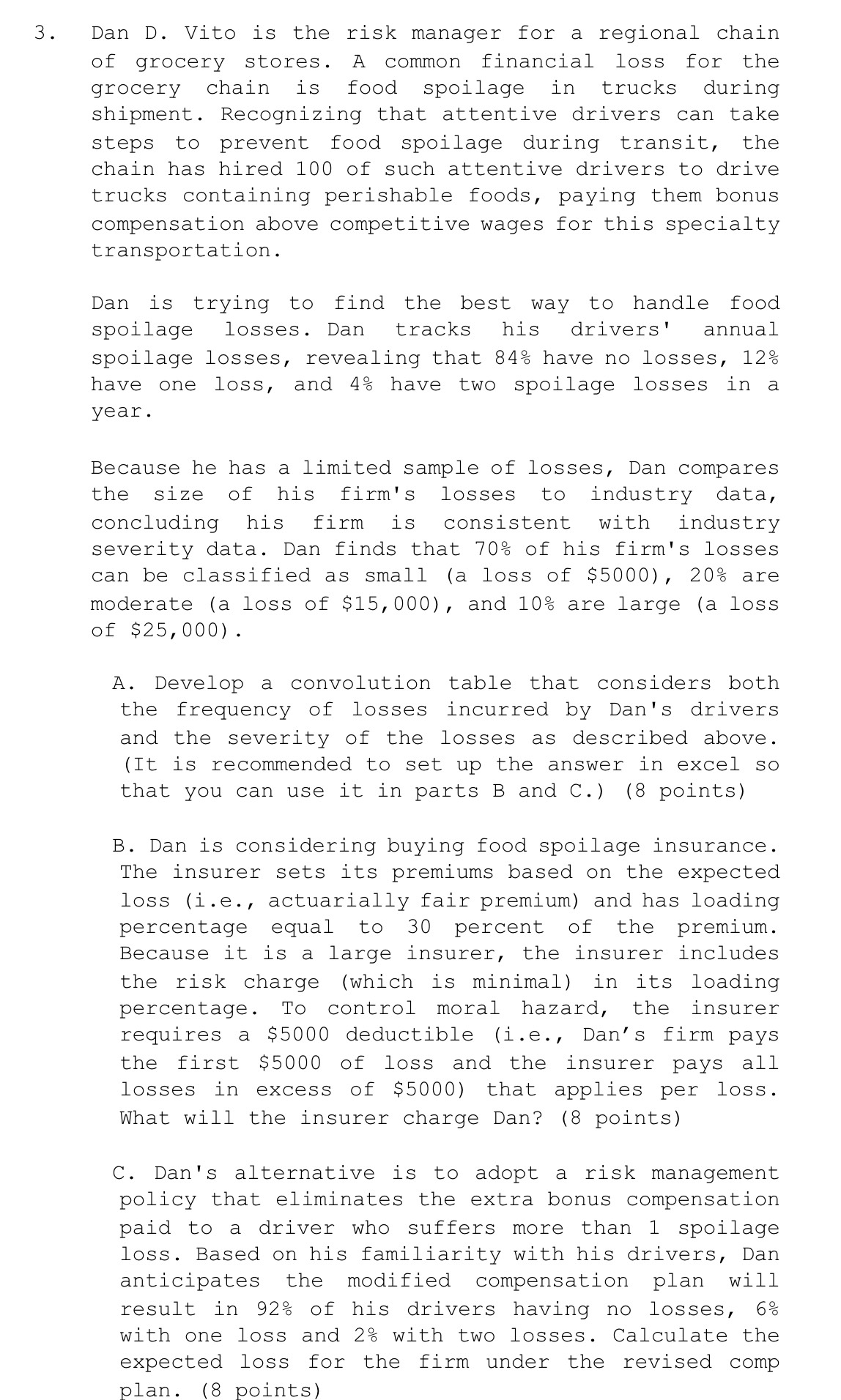

Dan D Vito is the risk manager for a regional chain of grocery stores. A common financial loss for the grocery chain is food spoilage in trucks during shipment. Recognizing that attentive drivers can take steps to prevent food spoilage during transit, the chain has hired of such attentive drivers to drive trucks containing perishable foods, paying them bonus compensation above competitive wages for this specialty transportation.

Dan is trying to find the best way to handle food spoilage losses. Dan tracks his drivers' annual spoilage losses, revealing that have no losses, have one loss, and have two spoilage losses in a year.

Because he has a limited sample of losses, Dan compares the size of his firm's losses to industry data, concluding his firm is consistent with industry severity data. Dan finds that of his firm's losses can be classified as small a loss of $ are moderate a loss of $ and are large a loss of $

A Develop a convolution table that considers both the frequency of losses incurred by Dan's drivers and the severity of the losses as described above. It is recommended to set up the answer in excel so that you can use it in parts B and C points

B Dan is considering buying food spoilage insurance. The insurer sets its premiums based on the expected loss ie actuarially fair premium and has loading percentage equal to percent of the premium. Because it is a large insurer, the insurer includes the risk charge which is minimal in its loading percentage. To control moral hazard, the insurer requires a $ deductible ie Dan's firm pays the first $ of loss and the insurer pays all losses in excess of $ that applies per loss. What will the insurer charge Dan? points

C Dan's alternative is to adopt a risk management policy that eliminates the extra bonus compensation paid to a driver who suffers more than spoilage loss. Based on his familiarity with his drivers, Dan anticipates the modified compensation plan will result in of his drivers having no losses, with one loss and with two losses. Calculate the expected loss for the firm under the revised comp plan. points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started