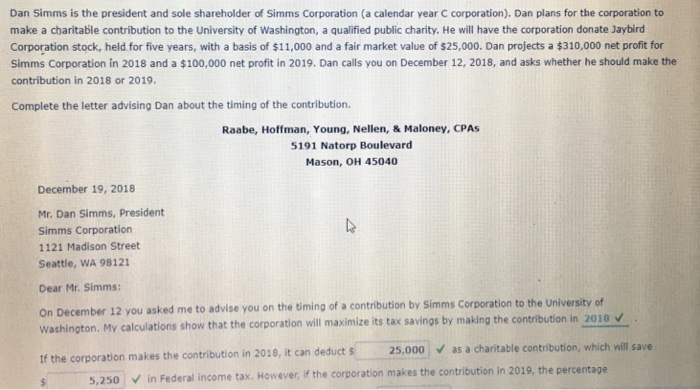

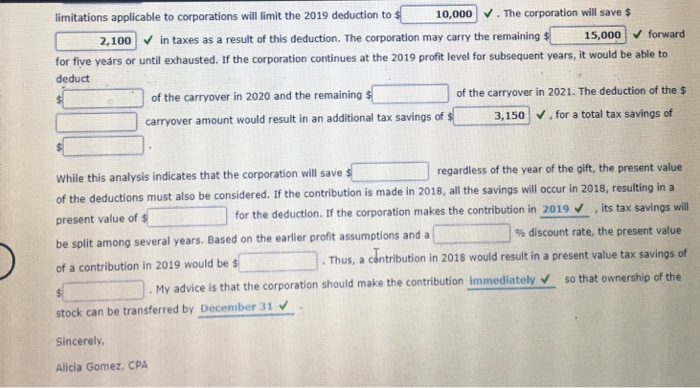

Dan Simms is the president and sole shareholder of Simms Corporation (a calendar year C corporation). Dan plans for the corporation to make a charitable contribution to the University of Washington, a qualified public charity. He will have the corporation donate Jaybird Corporation stock, held for five years, with a basis of $11,000 and a fair market value of $25,000. Dan projects a $310,000 net profit for Simms Corporation in 2018 and a $100,000 net profit in 2019. Dan calls you on December 12, 2018, and asks whether he should make the contribution in 2018 or 2019. Complete the letter advising Dan about the timing of the contribution Raabe, Hoffman, Young, Nellen, & Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 December 19, 2018 Mr. Dan Simms, President Simms Corporation 1121 Madison Street Seattle, WA 98121 Dear Mr. Simms: On December 12 you asked me to advise you on the timing of a contribution by Simms Corporation to the University cf Washington. My calculations show that the corporation wi the contribution in 2018 V 25,000 as a charitable contribution, which will save If the corporation makes the contribution in 2018, it can deduct s2 5,250 in Federal income tax. However, if the corporation makes the contribution in 2019, the percentage limitations applicable to corporations will limit the 2019 deduction to 10,000 . The corporation will save $ 2,100 in taxes as a result of this deduction. The corporation may carry the remaining 15,000 forward for five years or until exhausted. If the corporation continues at the 2019 profit level for subsequent years, it would be able to deduct of the carryover in 2020 and the remaining carryover amount would result in an additional tax savings of of the carryover in 2021. The deduction of the $ 3,150 ,for a total tax savings of regardless of the year of the gift, the present value eductions must also be considered. If the contribution is made in 2018, all the savings will occur in 2018, resulting in a While this analysis indicates that the corporation will save for the deduction, If the corporation makes the contribution in 2019 , its tax savings will present value of % discount rate, the present value Thus, a centribution in 2018 would result in a present value tax savings of My advice is that the corporation should make the contribution immediately so that ownership of the be split among several years. Based on the earlier profit assumptions and a of a contribution in 2019 would be stock can be transferred by December 31 Sincerely Alicia Gomez, CPA