Answered step by step

Verified Expert Solution

Question

1 Approved Answer

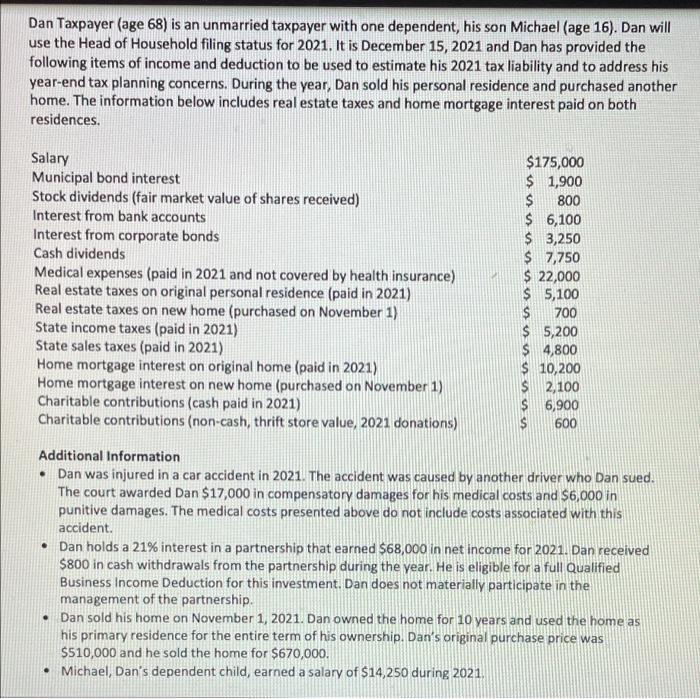

Dan Taxpayer (age 68) is an unmarried taxpayer with one dependent, his son Michael (age 16). Dan will use the Head of Household filing

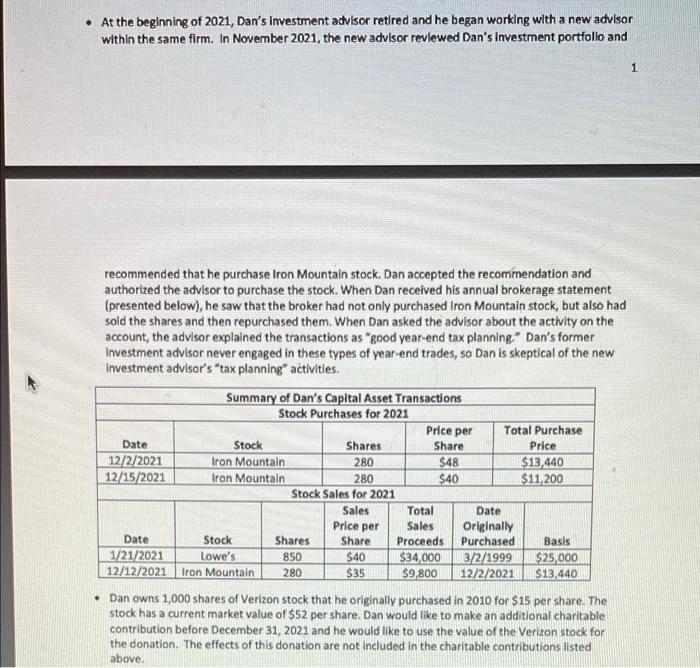

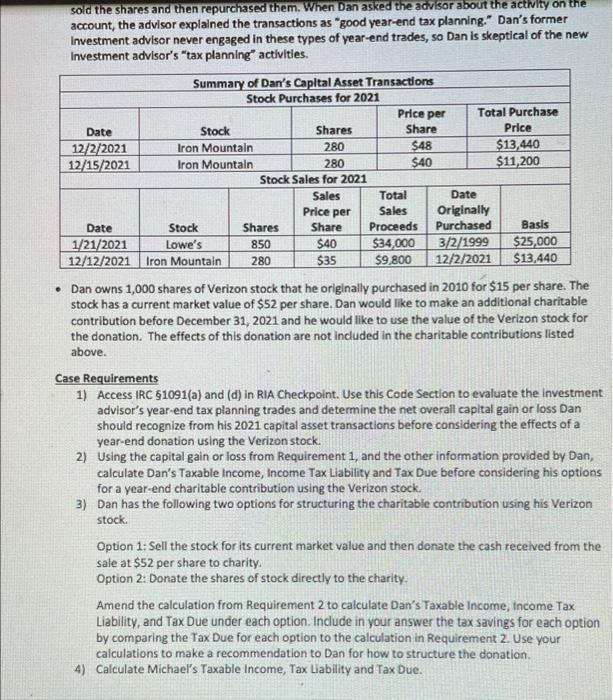

Dan Taxpayer (age 68) is an unmarried taxpayer with one dependent, his son Michael (age 16). Dan will use the Head of Household filing status for 2021. It is December 15, 2021 and Dan has provided the following items of income and deduction to be used to estimate his 2021 tax liability and to address his year-end tax planning concerns. During the year, Dan sold his personal residence and purchased another home. The information below includes real estate taxes and home mortgage interest paid on both residences. Salary Municipal bond interest Stock dividends (fair market value of shares received) Interest from bank accounts Interest from corporate bonds Cash dividends Medical expenses (paid in 2021 and not covered by health insurance) Real estate taxes on original personal residence (paid in 2021) Real estate taxes on new home (purchased on November 1) State income taxes (paid in 2021) State sales taxes (paid in 2021) Home mortgage interest on original home (paid in 2021) Home mortgage interest on new home (purchased on November 1) Charitable contributions (cash paid in 2021) Charitable contributions (non-cash, thrift store value, 2021 donations) . $175,000 $ 1,900 $ 800 $ 6,100 $3,250 $ 7,750 $ 22,000 $ 5,100 $ 700 $ 5,200 $4,800 Additional Information Dan was injured in a car accident in 2021. The accident was caused by another driver who Dan sued. The court awarded Dan $17,000 in compensatory damages for his medical costs and $6,000 in punitive damages. The medical costs presented above do not include costs associated with this accident. $ 10,200 $ 2,100 $ 6,900 600 Dan holds a 21% interest in a partnership that earned $68,000 in net income for 2021. Dan received $800 in cash withdrawals from the partnership during the year. He is eligible for a full Qualified Business Income Deduction for this investment. Dan does not materially participate in the management of the partnership. . Dan sold his home on November 1, 2021. Dan owned the home for 10 years and used the home as his primary residence for the entire term of his ownership. Dan's original purchase price was $510,000 and he sold the home for $670,000. Michael, Dan's dependent child, earned a salary of $14,250 during 2021. . At the beginning of 2021, Dan's investment advisor retired and he began working with a new advisor within the same firm. In November 2021, the new advisor reviewed Dan's Investment portfolio and recommended that he purchase Iron Mountain stock. Dan accepted the recommendation and authorized the advisor to purchase the stock. When Dan received his annual brokerage statement (presented below), he saw that the broker had not only purchased Iron Mountain stock, but also had sold the shares and then repurchased them. When Dan asked the advisor about the activity on the account, the advisor explained the transactions as "good year-end tax planning." Dan's former Investment advisor never engaged in these types of year-end trades, so Dan is skeptical of the new investment advisor's "tax planning" activities. Date 12/2/2021 12/15/2021 Summary of Dan's Capital Asset Transactions Stock Purchases for 2021 Stock Iron Mountain Iron Mountain Date 1/21/2021 12/12/2021 Iron Mountain Stock Lowe's Shares 280 280 Stock Sales for 2021 Sales Price per Share $40 $35 Shares 850 280 Price per Share $48 $40 Total Purchase Price $13,440 $11,200 Total Date Sales Originally Proceeds Purchased $34,000 3/2/1999 $9,800 12/2/2021 Basis $25,000 $13,440 Dan owns 1,000 shares of Verizon stock that he originally purchased in 2010 for $15 per share. The stock has a current market value of $52 per share. Dan would like to make an additional charitable contribution before December 31, 2021 and he would like to use the value of the Verizon stock for the donation. The effects of this donation are not included in the charitable contributions listed above. 1 sold the shares and then repurchased them. When Dan asked the advisor about the activity on the account, the advisor explained the transactions as "good year-end tax planning." Dan's former Investment advisor never engaged in these types of year-end trades, so Dan is skeptical of the new Investment advisor's "tax planning" activities. Date 12/2/2021 12/15/2021 Summary of Dan's Capital Asset Transactions Stock Purchases for 2021 Stock Iron Mountain Iron Mountain Stock Lowe's Date 1/21/2021 12/12/2021 Iron Mountain Shares 280 280 Stock Sales for 2021 Sales Shares 850 280 Price per Share $40 $35 Price per Share $48 $40 Total Sales Proceeds $34,000 $9,800 Total Purchase Price $13,440 $11,200 Date Originally Purchased 3/2/1999 12/2/2021 Basis $25,000 $13,440 Dan owns 1,000 shares of Verizon stock that he originally purchased in 2010 for $15 per share. The stock has a current market value of $52 per share. Dan would like to make an additional charitable contribution before December 31, 2021 and he would like to use the value of the Verizon stock for the donation. The effects of this donation are not included in the charitable contributions listed above. Case Requirements 1) Access IRC 1091(a) and (d) in RIA Checkpoint. Use this Code Section to evaluate the investment advisor's year-end tax planning trades and determine the net overall capital gain or loss Dan should recognize from his 2021 capital asset transactions before considering the effects of a year-end donation using the Verizon stock. 2) Using the capital gain or loss from Requirement 1, and the other information provided by Dan, calculate Dan's Taxable Income, Income Tax Liability and Tax Due before considering his options for a year-end charitable contribution using the Verizon stock. 3) Dan has the following two options for structuring the charitable contribution using his Verizon stock. Option 1: Sell the stock for its current market value and then donate the cash received from the sale at $52 per share to charity. Option 2: Donate the shares of stock directly to the charity. Amend the calculation from Requirement 2 to calculate Dan's Taxable income, Income Tax Liability, and Tax Due under each option. Include in your answer the tax savings for each option by comparing the Tax Due for each option to the calculation in Requirement 2. Use your calculations to make a recommendation to Dan for how to structure the donation. 4) Calculate Michael's Taxable Income, Tax Liability and Tax Due.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To address the case requirements lets go through each step Requirement 1 Evaluating YearEnd Tax Planning Trades According to IRC 51091a and d we need to evaluate the investment advisors yearend tax pl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started