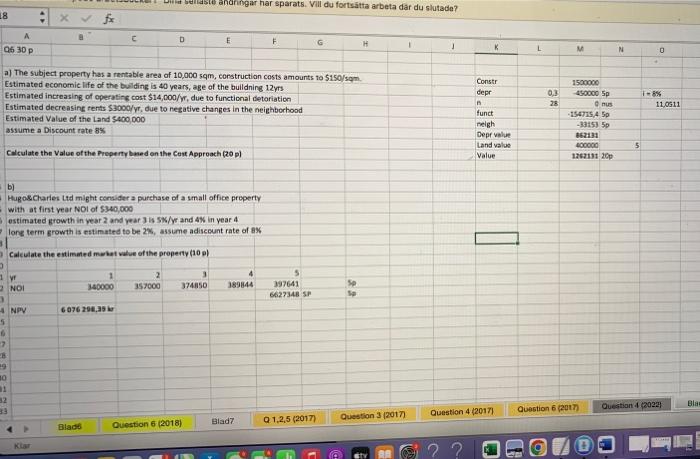

Danasta andringar har sparats. Vill du fortstta arbeta dr du slutade? x fx A C D E F G H J 06 30 p a) The subject property has a rentable area of 10,000 sqm, construction costs amounts to $150/sqm. Estimated economic life of the building is 40 years, age of the buildning 12yrs Estimated increasing of operating cost $14,000/yr, due to functional detoriation Estimated decreasing rents $3000/yr, due to negative changes in the neighborhood Estimated Value of the Land $400,000 assume a Discount rate 8% Calculate the Value of the Property based on the Cost Approach (20p) b) Hugo&Charles Ltd might consider a purchase of a small office property with at first year NOI of $340,000 estimated growth in year 2 and year 3 is 5%/yr and 4% in year 4 long term growth is estimated to be 2%, assume adiscount rate of 8% Calculate the estimated market value of the property (10p) 0 4 1 yr 1 340000 2 357000 3 374850 389844 2 NOI 3 4 NPV 6076 298,39 kr 5 6 7 Question 6 (2018) 18 -B 29 10 1 12 Klar Blade Blad7 5 397641 6627348 SP Q 1,2,5 (2017) Sp Sp Question 3 (2017) K Constr depr n funct neigh Depr value Land value Value Question 4 (2017) L 0,3 28 M 1500000 -450000 5p mus -154715,4 50 -33153 5p 862133 400000 1262131 20p Question 6 (2017) N 5 0 1-8% 11,0511 Question 4 (2022) Blas Danasta andringar har sparats. Vill du fortstta arbeta dr du slutade? x fx A C D E F G H J 06 30 p a) The subject property has a rentable area of 10,000 sqm, construction costs amounts to $150/sqm. Estimated economic life of the building is 40 years, age of the buildning 12yrs Estimated increasing of operating cost $14,000/yr, due to functional detoriation Estimated decreasing rents $3000/yr, due to negative changes in the neighborhood Estimated Value of the Land $400,000 assume a Discount rate 8% Calculate the Value of the Property based on the Cost Approach (20p) b) Hugo&Charles Ltd might consider a purchase of a small office property with at first year NOI of $340,000 estimated growth in year 2 and year 3 is 5%/yr and 4% in year 4 long term growth is estimated to be 2%, assume adiscount rate of 8% Calculate the estimated market value of the property (10p) 0 4 1 yr 1 340000 2 357000 3 374850 389844 2 NOI 3 4 NPV 6076 298,39 kr 5 6 7 Question 6 (2018) 18 -B 29 10 1 12 Klar Blade Blad7 5 397641 6627348 SP Q 1,2,5 (2017) Sp Sp Question 3 (2017) K Constr depr n funct neigh Depr value Land value Value Question 4 (2017) L 0,3 28 M 1500000 -450000 5p mus -154715,4 50 -33153 5p 862133 400000 1262131 20p Question 6 (2017) N 5 0 1-8% 11,0511 Question 4 (2022) Blas