Question

Dandarion company started its operation in 2020, it has been operating for 6 years now since the formation of the company. The first few

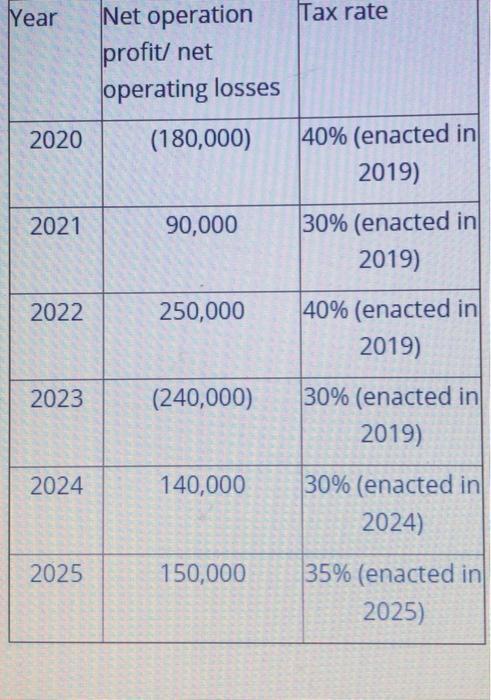

Dandarion company started its operation in 2020, it has been operating for 6 years now since the formation of the company. The first few years were not as profitable as the board of directors expected. The following represents the net operating profit/losses reported by Dandarion for the first 6 years of operation: Net operation profit/ net operating losses Year Tax rate 2020 (180,000) 40% (enacted in 2019) 2021 90,000 30% (enacted in 2019) 2022 250,000 40% (enacted in 2019) 2023 (240,000) 30% (enacted in 2019) 2024 140,000 30% (enacted in 2024) 2025 150,000 35% (enacted in 2025)

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Computation of tax expense Year Net Operating Profit Loss Tax Rate Tax Amount 2020 1800...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App