Question

Dandy Pandas Japan affiliated company presents a capital structure which is also its target capital structure, which calls for 50% debt and 50% common equity.

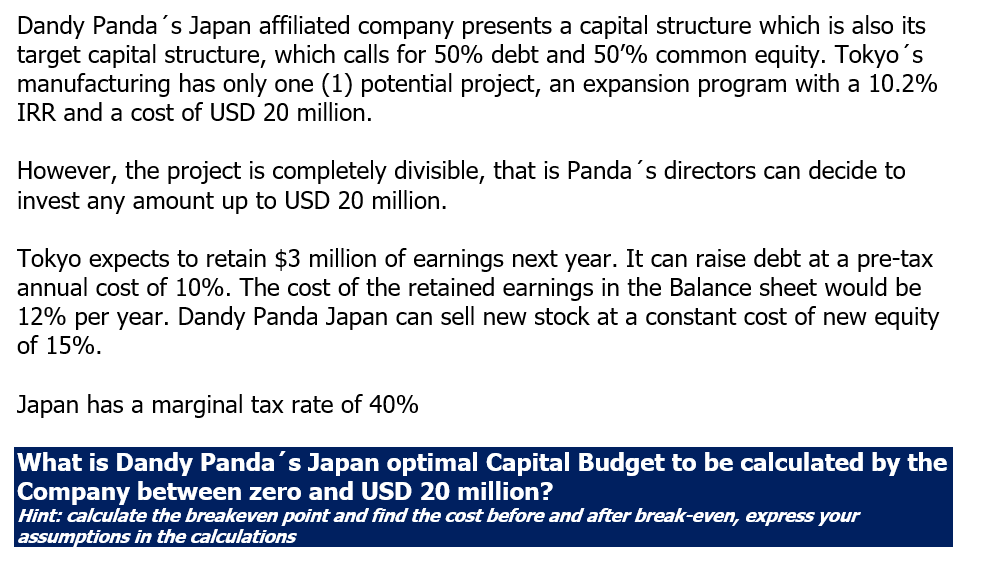

Dandy Pandas Japan affiliated company presents a capital structure which is also its target capital structure, which calls for 50% debt and 50% common equity. Tokyos manufacturing has only one (1) potential project, an expansion program with a 10.2% IRR and a cost of USD 20 million. However, the project is completely divisible, that is Pandas directors can decide to invest any amount up to USD 20 million. Tokyo expects to retain $3 million of earnings next year. It can raise debt at a pre-tax annual cost of 10%. The cost of the retained earnings in the Balance sheet would be 12% per year. Dandy Panda Japan can sell new stock at a constant cost of new equity of 15%. Japan has a marginal tax rate of 40% What is Dandy Pandas Japan optimal Capital Budget to be calculated by the Company between zero and USD 20 million? Hint: calculate the breakeven point and find the cost before and after break-even, express your assumptions in the calculations

Dandy Pandas Japan affiliated company presents a capital structure which is also its target capital structure, which calls for 50% debt and 50% common equity. Tokyos manufacturing has only one (1) potential project, an expansion program with a 10.2% IRR and a cost of USD 20 million. However, the project is completely divisible, that is Pandas directors can decide to invest any amount up to USD 20 million. Tokyo expects to retain $3 million of earnings next year. It can raise debt at a pre-tax annual cost of 10%. The cost of the retained earnings in the Balance sheet would be 12% per year. Dandy Panda Japan can sell new stock at a constant cost of new equity of 15%. Japan has a marginal tax rate of 40% What is Dandy Pandas Japan optimal Capital Budget to be calculated by the Company between zero and USD 20 million? Hint: calculate the breakeven point and find the cost before and after break-even, express your assumptions in the calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started