Daniel and Avery Emory

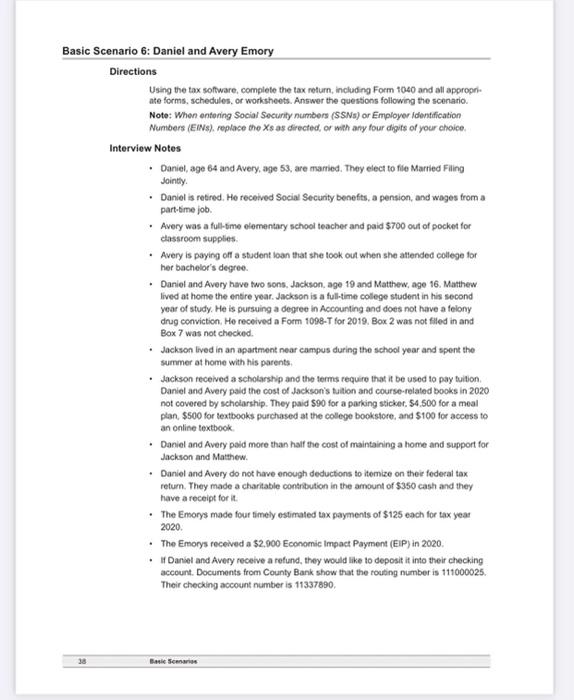

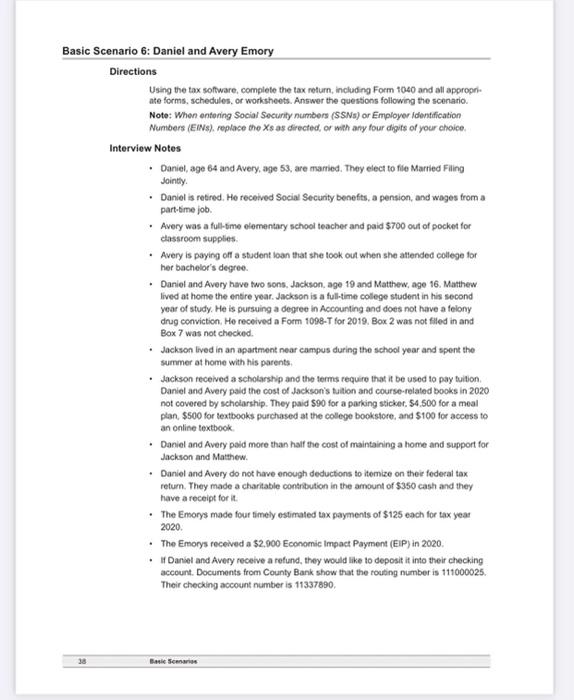

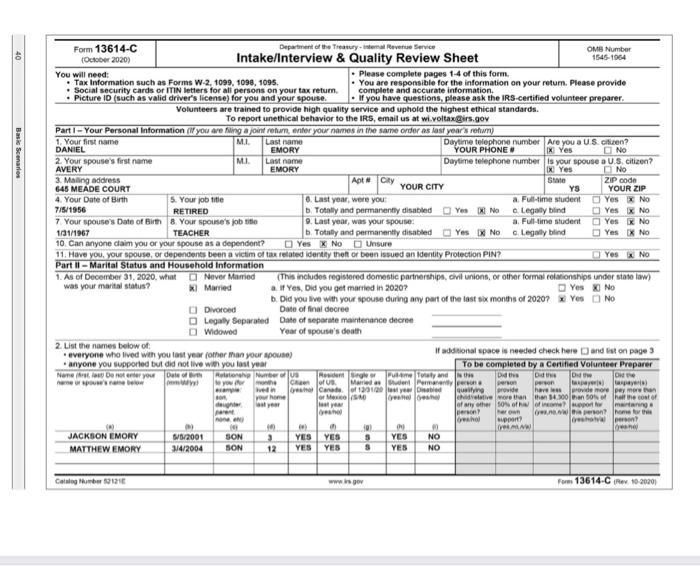

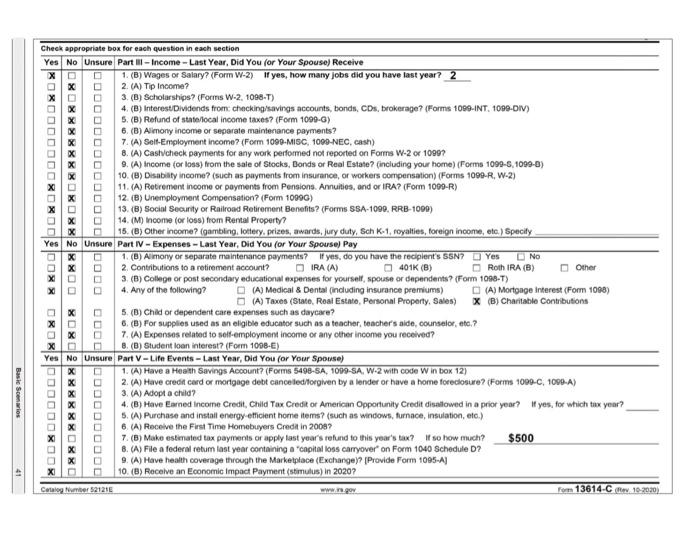

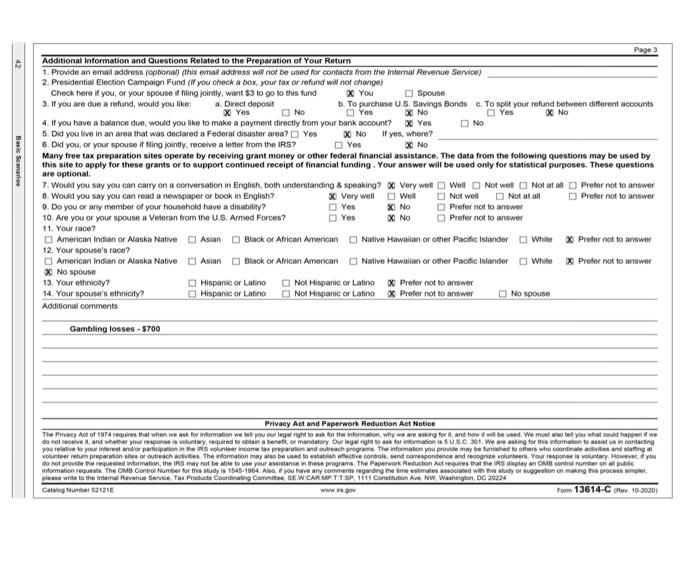

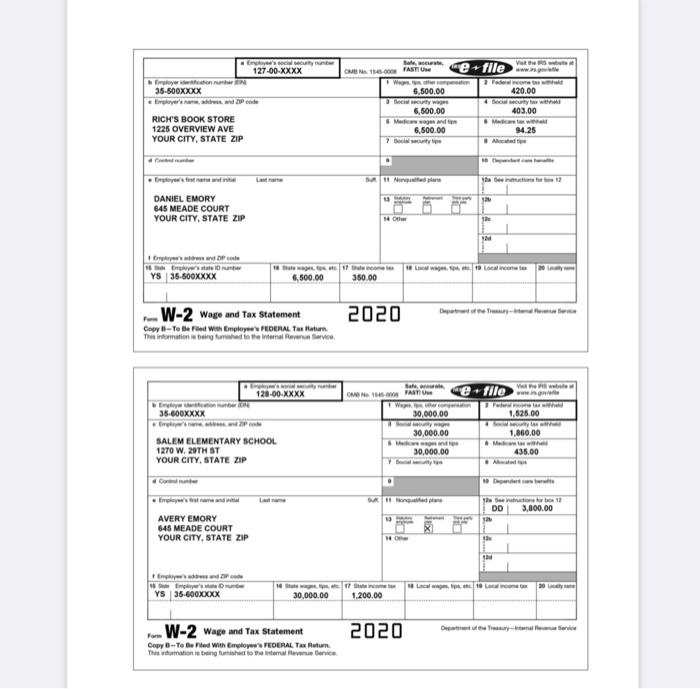

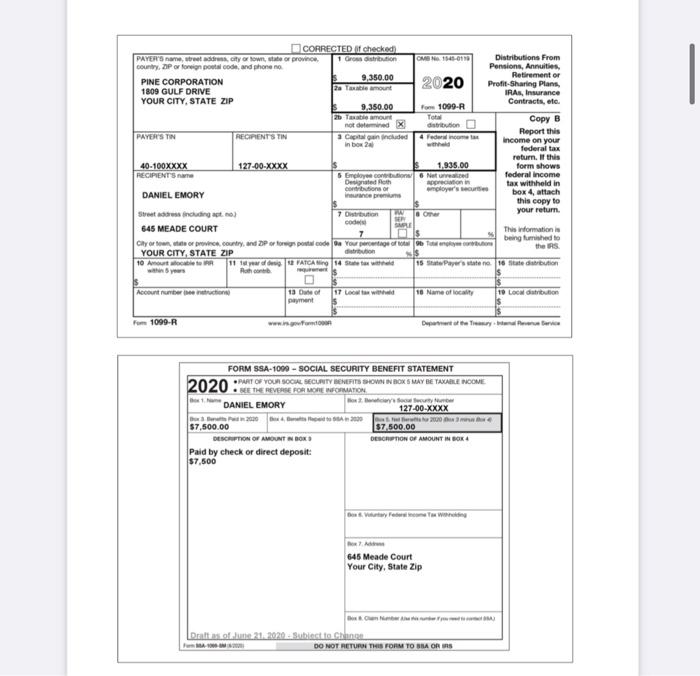

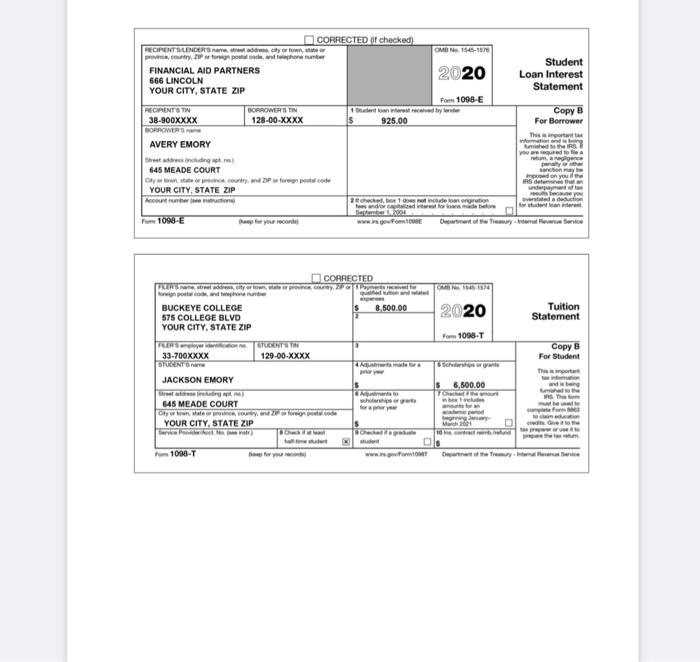

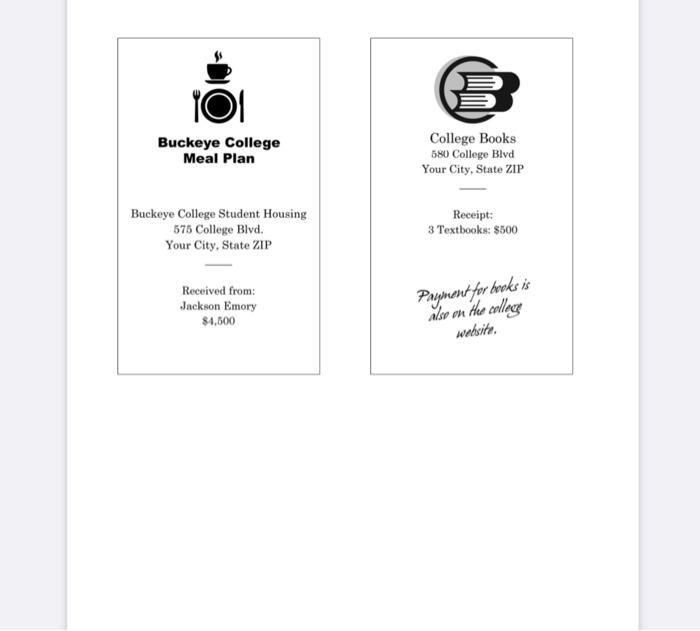

Basic Scenario 6: Daniel and Avery Emory Directions Using the tax software, complete the tax return, including Form 1040 and all appropri ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entoring Social Security numbers (SSNs) or Employer identification Numbers (EIN), replace the Xs as directed, or with any four digits of yo your choice Interview Notes Daniel, age 64 and Avery, age 53, are married. They elect to file Marled Filing Jointly Daniel is retired. He received Social Security benefits, a pension, and wages from a part-time job. Avery was a full-time elementary school teacher and paid $700 out of pocket for classroom supplies Avery is paying off a student toan that she look out when she attended college for her bachelor's degree . Daniel and Avery have two sons, Jackson, age 19 and Matthew, age 16. Matthew lived at home the entire year. Jackson is a full-time college student in his second year of study. He is pursuing a degree in Accounting and does not have a felony drug conviction. He received a Form 1098-T for 2019. Box 2 was not filed in and Box 7 was not checked. Jackson lived in an apartment near campus during the school year and spent the summer at home with his parents Jackson received a scholarship and the terms require that I be used to pay tuition Daniel and Avery paid the cost of Jackson's tuition and course-related books in 2020 not covered by scholarship. They paid $90 for a parking sticker. 54.500 for a meal plan $500 for textbooks purchased at the college bookstore, and $100 for access to an online textbook Daniel and Avery paid more than half the cost of maintaining a home and support for Jackson and Matthew Daniel and Avery do not have enough deductions to itemize on their federal tax return. They made a charitable contribution in the amount of $350 cash and they have a receipt for it The Emorys made four timely estimated tax payments of $125 each for tax year 2020 The Emorys received a $2.900 Economic Impact Payment (EIP) in 2020, Daniel and Avery receive a refund, they would like to deposit it into their checking account. Documents from County Bank show that the routing number is 111000025. Thoir checking account number is 11337890 38 Basse 40 Basic Scenarios MI Form 13614-C Department of the Treasurystal Revenue Service OMB Number (October 2020) Intake/Interview & Quality Review Sheet 1545-1964 You will need: Please complete pages 1-4 of this form. Tax Information such as Forms W-2, 1099, 1098, 1095 You are responsible for the information on your retum. Please provide Social security cards or ITIN letters for all persons on your tax retum. complete and accurate information. Picture ID (such as valid driver's license) for you and your spouse. If you have questions, please ask the IRS certified volunteer preparer. Volunteers are trained to provide high quality service and uphold the highest ethical standards. To report unethical behavior to the IRS, email us at wi.voltaxgirs.gov Part 1 - Your Personal Information (If you are filing a joint return, enter your names in the same order as last year's refum) 1. Your first name MI Last name Daytime telephone number Are you a US citizen? DANIEL EMORY YOUR PHONE X Yes No 2. Your spouse's first name Last name Daytime telephone number is your spouse a US citizen? AVERY EMORY X Yes NO 3. Maling address Apt Cry State ZIP code 645 MEADE COURT YOUR CITY YS YOUR ZIP 4. Your Date of Birth 5. Your job title 0. Last year, were you a Full-time student Yes No 7/5/1956 RETIRED Totally and permanently disabled Yes Noa Legally Blind Yes x No 7 Your spouse's Date of Birth 8 Your spouse's job site 9. Last year, was your spouse a Full-time student Yes No 1/31/1967 TEACHER b. Totally and permanently disabled Yes x No Legally blind Yes No 10. Can anyone claim you or your spouse as a dependent? Yes No Unsure 11. Have you, your spouse, or dependents been a victim of tax related idently theft or been issued an identity Protection PIN? Yes No Part 11 - Marital Status and Household Information 1. As of December 31, 2020, what Never Married (This includes registered domestic partnerships, Civil unions, or other formal rolationships under stase law) was your marital status? X Married a If Yes, Did you get married in 2020? Yes No b. Did you live with your spouse during any part of the last six months of 20207 x Yes No Divorod Date of final decreo Legaly Separated Date of separate maintenance degree o Widowed Year of spouse's death 2. List the names below of everyone who lived with you last year (other than your spouse) If additional space is needed check here and list on page 3 anyone you supported but did not live with you last year To be completed by a Certified Volunteer Preparer Nanetto Donnter your De Relation Number US Red Pay and the Did the De Wo you or Der JUB Married out Pamper wer Oh Canade of 139120 wye Disabled provide more paymer your home or|SMO be have wore than than 4.000 Dan SON hat he cost of de of any other son oth of por mag. person Weront me who support w ? LAW JACKSON EMORY S8/2001 SON YES YES YES NO MATTHEW EMORY 3/4/2004 SON 12 YES YES YES NO 3 : Catalog Humber 0121 www.gov Form 13614-Rex 10-20201 DO XXX XOXOO000 DOXXO IDDODDDDDDD Check appropriate box for each question in each section Yes No Unsure Part -Income-Last Year, Did You for Your Spouse) Receive 1. (B) Wages or Salary? (Form W-2) If yes, how many jobs did you have last year? 2 X 2. (A) Tip Income? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) Interest Dividends from checking savings accounts, bonds, CDs, brokerage? (Forms 1000-INT. 1000-01) 5. (B) Refund of state local income taxes? (Form 1099-G) 6. (B) Alimony income or separate maintenance payments? x 7. (A) Self-Employment income? (Form 1099-MISC, 1099-NEC, cash) X 8. (A) Cast check payments for any work performed not reported on Forms W-2 or 10997 X 9. (A) Income (or loss) from the sale of Stocks, Bonds or Real Estate (including your home) (Forms 1099-8 1090-8) 10. (B) Disability income? (such as payments from insurance, or workers compensation) (Forms 1099-R, W-2) 11. (A) Retrement income or payments from Pensions. Annuities, and or IRA? (Form 1099-R) X 12. (B) Unemployment Compensation? (Form 1099G) 13. (B) Social Security or Railroad Retirement Benefits 2 (Forms SSA-1090, RRB-1000) 14. (M) income for loss) from Rental Property? x 15. (B) Other income? (gambling, lottery, prizes, awards, jury duty, Sch K-1, royalties, foreign income, etc.) Specify Yes No Unsure Part IV - Expenses - Last Year, Did You (or Your Spouse) Pay X 1. (B) Alimony or separate maintenance payments? If yes, do you have the recipient's SSN? Yes No 2. Contributions to a retirement account? IRA (A) 401K (B) Roth IRA (B) Other 3. (B) College or post secondary educational expenses for yourself, spouse or dependents? (Form 1098-T) 4. Any of the following? (A) Medical & Dental (including insurance premiums) (A) Mortgage Interest (Form 1098) (A) Taxes (Stato, Real Estate, Personal Property, Sales) X (B) Charitable Contributions x 5. (B) Chid or dependent care expenses such as daycare? 6. (B) For supplies used as an eligible educator such as a teacher teacher's side, counselor etc.? X 7. (A) Expenses related to self-employment income or any other income you received? 8. (B) Student loan interest? (Form 1098-E) Yes No Unsure Part V-Life Events - Last Year, Did You (or Your Spouse) X 1. (A) Have a Health Savings Account? (Forms 5498-5A, 1099-SA, W-2 with code w in box 12) 2. (A) Have credit card or mortgage debt canceled forgiven by alender or have a home foreclosure? (Forms 1000-C, 1099-A) X D 3. (A) Adopt a child? x 4. (B) Have Earned Income Credit Child Tax Credit or American Opportunity Credit disallowed in a prior year? If yes, for which tax year? X 5. (A) Purchase and install energy efficient home items? (such as windows, furnace, insulation, etc.) 6. (A) Receive the First Time Homebuyers Creditin 2008? 7. (B) Make estimated tax payments or apply last year's refund to this year's tax? If so how much? $500 X 8. (A) File a federal retum last year containing a capital loss carryover on Form 1040 Schedule D? 9. (A) Have health coverage through the Marketplace (Exchange Provide Form 1095-AJ 10. (B) Receive an Economic Impact Payment (stimulus) in 2020? Catalog Number 21215 Form 13614.C 10-2020) 100XX DOXXXX DODO DXX XOX DOCO Basis Scenios DDDD XOD 100 X No Basic Scenarios Page 3 Additional Information and Questions related to the Preparation of Your Return 1. Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service) 2. Presidential Election Campaign Fund (If you check a box, your tax or refund will not change) Check here if you, or your spouself filing jointly, want $3 to go to this fund X You Spouse 3. If you are due a refund, would you like: a. Direct deposit . To purchase U.S. Savings Bondsc. To split your refund between different accounts X Yes No Yes Yes X No 4. If you have a balance due, would you like to make a payment directly from your bank account? X Yes NO 5. Did you live in an area that was declared a Federal disaster area? Yes X No If yes, where? 6. Did you, or your spouse if filing jointly, receive a letter from the IRS? Yes x No Many free tax preparation sites operate by receiving grant money or other federal financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued receipt of financial funding. Your answer will be used only for statistical purposes. These questions are optional 7. Would you say you can carry on a conversation in English, both understanding & Speaking? x Very well Well Not well Not at all Prefer not to answer 8. Would you say you can read a newspaper or book in English x Very well. We Not well Not at all Prefer not to answer 9. Do you or any member of your household have a disability? Yes XI No Prefer not to answer 10. Are you or your spouse a Veteran from the U.S. Armed Forces? Yes X No Prefer not to answer 11. Your race? American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander White X Prefer not to answer 12. Your spouse's race? American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander White X Prefer not to answer No spouse 13. Your ethnicity? Hispanic or Latino Not Hispanic or Latino X Prefer not to answer 14. Your spouse's ethnicity? Hispanic or Latino Not Hispanic or Latino X Prefer not to answer No spouse Additional comments Gambling losses - $700 Privacy Act and Paperwork Reduction Act Notice The Privacy Act of 1974 requires that when we ask for information we you our legal right to ask for the nation, why we are sig for it and how it will be used. We must tell you what could happen if we do not receive, and whether your response is voluntary required to obtain a better mandatory Our legal right to ask for Information is SUSC 301 We are asking for this information to sit in contacting you relative to your interest and or pain in the volunteer income tax preparation and outreach programe. The formation you provide may be turned to others who coordinate activities and staffing vous retum preparation shes or outreach acts. The information may also be used to establish afective control and correspondence and recognize volunteers. Your response is voluntary. However, you do not provide the requested information, the may not be able to use your assistance in these programs. The paperwork Reduction Act requires the display an OMB control rumber on public information requests. The OMD Control Number for this study is 1545.1964. Also you have any comments regarding the time estimates asociated win this study or suggestion on making this process single please write to the emal Revenue Service Tax Products Coordinating Commi SEW.CARMP.T.T.SP. 1111 Constitution Ave NW. Washington, DC 20224 Catalog Number 21216 Form 13614-C 10-20201 Employee's 127-00-XXXX M18.00 FASTIU View e filen 420.00 35-500XXXX 6,500.00 403.00 RICH'S BOOK STORE 1225 OVERVIEW AVE YOUR CITY, STATE ZIP 6,500.00 5 Mega 6,500.00 94.26 Letrare DANIEL EMORY 645 MEADE COURT YOUR CITY, STATE ZIP ser Este YS 35-500XXXX 16. The con la 6,500.00 350.00 2020 Deste fryhend entera W-2 Wage and Tax Statement Copy-To Be With Employee FEDERAL Tax Return This information is being the to the Internal Revenue Service 120-00-XXXX Bali, OM 1 PAT e file 36.600XXXX 1,625,00 30.000.00 30,000.00 1,860.00 SALEM ELEMENTARY SCHOOL 1270 W. 29TH ST YOUR CITY, STATE ZIP 30,000.00 435.00 Deporter 12 DD 3,800.00 AVERY EMORY 645 MEADE COURT YOUR CITY, STATE ZIP HO he En and Empley's YS 36-600xxxx 30,000.00 1,200.00 W-2 wage and Tax Statement 2020 Copy - To Belied with Employee's FEDERAL Tax Return This formation is being used to the normal Revenue Service CORRECTED I checked PAYER'Stref, town, state or province 1 Girona Grudin OMEN 1540-0119 Distributions From country. Por foreign postal code and phone no Pensions, Annuities 9,350.00 Retirement or PINE CORPORATION 2020 1809 GULF DRIVE Profit Sharing Plans IRAS, Insurance YOUR CITY, STATE ZIP Contracts, etc. 9.350.00 For 1099-R 2 Tastem Total not determined X Copy B PAYER'S TIN RECIPENT'S TIN Report this 3 Capital gannaded 4 Federal income ta Inbox24 Income on your federal tax return. If this 40-100XXXX 127-00-XXXX 1.935.00 form shows RECIPENT'S 5 Employee contro Need federal Income Durgitat us Apron carbon or tax withheld in DANIEL EMORY box 4 attach this copy to Street dress including at. ) 7 Distribution Omer your return 645 MEADE COURT SM This Information City or to prove country and Propostalden Your porter Tycoon being lumised to YOUR CITY STATE ZIP 10 Amour 11 FATCA in 14 State to withheld 15 State Payers state no 18 state carbution Roth Account Number 13 Date of 17 ct with payment 18 Name of 10 Location Fm 1099-R 2020: FORM SSA-1000 - SOCIAL SECURITY BENEFIT STATEMENT PART OF YOUR SOCIAL SECURITY BENEFITS SHOW IN BOX S MAY BE TABLE NONE NE THE REVERSE FOR MORE INFORMATION cowy DANIEL EMORY 127-00-XXXX 2000 $7,500.00 $7,500.00 DESCRIPTION OF AMOUNT BOX DESCRIPTION OF AMOUNT IN BOK Paid by check or direct deposit: $7,500 645 Meade Court Your City, State Zip Draft ole 21.2020 - Subiect to change DO NOT RETURN THIS FORM TO BRA ORRS CORRECTED ( checked OM 1545-1578 RECIPENT BLENDERS, y or low, province, country, ZIP for postal code and phone number FINANCIAL AID PARTNERS 666 LINCOLN YOUR CITY, STATE ZIP 2020 Student Loan Interest Statement Form 1098-E BORROWERS 128-00-XXXX 925.00 PECIENTS TH 38-900XXXX BORROWERS AVERY EMORY Copy B For Borrower importa kumised to the IRS you were to file wegen para ante ed on you the underpantan you verste descon 645 MEADE COURT Chytown or court, and Propostal code YOUR CITY STATE ZIP Account number one 2eed 1 does not include gration Form 1098- Department of the Treatynderleverance CORRECTED FORSy or town, CO2 8.500.00 2020 Tuition Statement From 100-T BUCKEYE COLLEGE 575 COLLEGE BLVO YOUR CITY, STATE ZIP Free SONT IN 33-700XXXX 129-00-XXXX SIRENE JACKSON EMORY For Student ht 645 MEADE COURT Cywonale YOUR CITY STATE ZIP om 6,500.00 db TOINE btw Tham com March De to the condimend 10 almente www.fo 1000-T TOI Buckeye College Meal Plan College Books 580 College Blvd Your City, State ZIP Buckeye College Student Housing 575 College Blvd. Your City, State ZIP Receipt: 3 Textbooks: $500 Received from: Jackson Emory 84,500 Payment for books is also en the college website, Basic Scenario 6: Test Questions 11. What is the amount of Daniel and Avery's standard deduction? 12. What is the total amount of adjustments on the Emorys' tax return? a $250 b. $925 c. $1,175 d. $1,475 13. What is the total amount of the Emorys' refundable American opportunity credit? 14. Jackson qualifies Daniel and Avery to claim the credit for other dependents a True b. False 15. What is the total amount of federal income tax withholding? a $1,525 b. $1,935 c. $1.945 d. $3,880 16. How much of Daniel's Social Security is taxable? a. $0 b. $3,750 c. $6,375 d. $7,500 17. Daniel and Avery cannot claim Jackson for the earned income credit because he did not live with them for more than half the year and does not meet the residency test a. True, Jackson only lived with his parents during the summer, which was less than six months b. False Attendance at school is considered a temporary absence and those months are counted as time that Jackson lived with his parents for the earned income credit Basic Scenario 6: Daniel and Avery Emory Directions Using the tax software, complete the tax return, including Form 1040 and all appropri ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entoring Social Security numbers (SSNs) or Employer identification Numbers (EIN), replace the Xs as directed, or with any four digits of yo your choice Interview Notes Daniel, age 64 and Avery, age 53, are married. They elect to file Marled Filing Jointly Daniel is retired. He received Social Security benefits, a pension, and wages from a part-time job. Avery was a full-time elementary school teacher and paid $700 out of pocket for classroom supplies Avery is paying off a student toan that she look out when she attended college for her bachelor's degree . Daniel and Avery have two sons, Jackson, age 19 and Matthew, age 16. Matthew lived at home the entire year. Jackson is a full-time college student in his second year of study. He is pursuing a degree in Accounting and does not have a felony drug conviction. He received a Form 1098-T for 2019. Box 2 was not filed in and Box 7 was not checked. Jackson lived in an apartment near campus during the school year and spent the summer at home with his parents Jackson received a scholarship and the terms require that I be used to pay tuition Daniel and Avery paid the cost of Jackson's tuition and course-related books in 2020 not covered by scholarship. They paid $90 for a parking sticker. 54.500 for a meal plan $500 for textbooks purchased at the college bookstore, and $100 for access to an online textbook Daniel and Avery paid more than half the cost of maintaining a home and support for Jackson and Matthew Daniel and Avery do not have enough deductions to itemize on their federal tax return. They made a charitable contribution in the amount of $350 cash and they have a receipt for it The Emorys made four timely estimated tax payments of $125 each for tax year 2020 The Emorys received a $2.900 Economic Impact Payment (EIP) in 2020, Daniel and Avery receive a refund, they would like to deposit it into their checking account. Documents from County Bank show that the routing number is 111000025. Thoir checking account number is 11337890 38 Basse 40 Basic Scenarios MI Form 13614-C Department of the Treasurystal Revenue Service OMB Number (October 2020) Intake/Interview & Quality Review Sheet 1545-1964 You will need: Please complete pages 1-4 of this form. Tax Information such as Forms W-2, 1099, 1098, 1095 You are responsible for the information on your retum. Please provide Social security cards or ITIN letters for all persons on your tax retum. complete and accurate information. Picture ID (such as valid driver's license) for you and your spouse. If you have questions, please ask the IRS certified volunteer preparer. Volunteers are trained to provide high quality service and uphold the highest ethical standards. To report unethical behavior to the IRS, email us at wi.voltaxgirs.gov Part 1 - Your Personal Information (If you are filing a joint return, enter your names in the same order as last year's refum) 1. Your first name MI Last name Daytime telephone number Are you a US citizen? DANIEL EMORY YOUR PHONE X Yes No 2. Your spouse's first name Last name Daytime telephone number is your spouse a US citizen? AVERY EMORY X Yes NO 3. Maling address Apt Cry State ZIP code 645 MEADE COURT YOUR CITY YS YOUR ZIP 4. Your Date of Birth 5. Your job title 0. Last year, were you a Full-time student Yes No 7/5/1956 RETIRED Totally and permanently disabled Yes Noa Legally Blind Yes x No 7 Your spouse's Date of Birth 8 Your spouse's job site 9. Last year, was your spouse a Full-time student Yes No 1/31/1967 TEACHER b. Totally and permanently disabled Yes x No Legally blind Yes No 10. Can anyone claim you or your spouse as a dependent? Yes No Unsure 11. Have you, your spouse, or dependents been a victim of tax related idently theft or been issued an identity Protection PIN? Yes No Part 11 - Marital Status and Household Information 1. As of December 31, 2020, what Never Married (This includes registered domestic partnerships, Civil unions, or other formal rolationships under stase law) was your marital status? X Married a If Yes, Did you get married in 2020? Yes No b. Did you live with your spouse during any part of the last six months of 20207 x Yes No Divorod Date of final decreo Legaly Separated Date of separate maintenance degree o Widowed Year of spouse's death 2. List the names below of everyone who lived with you last year (other than your spouse) If additional space is needed check here and list on page 3 anyone you supported but did not live with you last year To be completed by a Certified Volunteer Preparer Nanetto Donnter your De Relation Number US Red Pay and the Did the De Wo you or Der JUB Married out Pamper wer Oh Canade of 139120 wye Disabled provide more paymer your home or|SMO be have wore than than 4.000 Dan SON hat he cost of de of any other son oth of por mag. person Weront me who support w ? LAW JACKSON EMORY S8/2001 SON YES YES YES NO MATTHEW EMORY 3/4/2004 SON 12 YES YES YES NO 3 : Catalog Humber 0121 www.gov Form 13614-Rex 10-20201 DO XXX XOXOO000 DOXXO IDDODDDDDDD Check appropriate box for each question in each section Yes No Unsure Part -Income-Last Year, Did You for Your Spouse) Receive 1. (B) Wages or Salary? (Form W-2) If yes, how many jobs did you have last year? 2 X 2. (A) Tip Income? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) Interest Dividends from checking savings accounts, bonds, CDs, brokerage? (Forms 1000-INT. 1000-01) 5. (B) Refund of state local income taxes? (Form 1099-G) 6. (B) Alimony income or separate maintenance payments? x 7. (A) Self-Employment income? (Form 1099-MISC, 1099-NEC, cash) X 8. (A) Cast check payments for any work performed not reported on Forms W-2 or 10997 X 9. (A) Income (or loss) from the sale of Stocks, Bonds or Real Estate (including your home) (Forms 1099-8 1090-8) 10. (B) Disability income? (such as payments from insurance, or workers compensation) (Forms 1099-R, W-2) 11. (A) Retrement income or payments from Pensions. Annuities, and or IRA? (Form 1099-R) X 12. (B) Unemployment Compensation? (Form 1099G) 13. (B) Social Security or Railroad Retirement Benefits 2 (Forms SSA-1090, RRB-1000) 14. (M) income for loss) from Rental Property? x 15. (B) Other income? (gambling, lottery, prizes, awards, jury duty, Sch K-1, royalties, foreign income, etc.) Specify Yes No Unsure Part IV - Expenses - Last Year, Did You (or Your Spouse) Pay X 1. (B) Alimony or separate maintenance payments? If yes, do you have the recipient's SSN? Yes No 2. Contributions to a retirement account? IRA (A) 401K (B) Roth IRA (B) Other 3. (B) College or post secondary educational expenses for yourself, spouse or dependents? (Form 1098-T) 4. Any of the following? (A) Medical & Dental (including insurance premiums) (A) Mortgage Interest (Form 1098) (A) Taxes (Stato, Real Estate, Personal Property, Sales) X (B) Charitable Contributions x 5. (B) Chid or dependent care expenses such as daycare? 6. (B) For supplies used as an eligible educator such as a teacher teacher's side, counselor etc.? X 7. (A) Expenses related to self-employment income or any other income you received? 8. (B) Student loan interest? (Form 1098-E) Yes No Unsure Part V-Life Events - Last Year, Did You (or Your Spouse) X 1. (A) Have a Health Savings Account? (Forms 5498-5A, 1099-SA, W-2 with code w in box 12) 2. (A) Have credit card or mortgage debt canceled forgiven by alender or have a home foreclosure? (Forms 1000-C, 1099-A) X D 3. (A) Adopt a child? x 4. (B) Have Earned Income Credit Child Tax Credit or American Opportunity Credit disallowed in a prior year? If yes, for which tax year? X 5. (A) Purchase and install energy efficient home items? (such as windows, furnace, insulation, etc.) 6. (A) Receive the First Time Homebuyers Creditin 2008? 7. (B) Make estimated tax payments or apply last year's refund to this year's tax? If so how much? $500 X 8. (A) File a federal retum last year containing a capital loss carryover on Form 1040 Schedule D? 9. (A) Have health coverage through the Marketplace (Exchange Provide Form 1095-AJ 10. (B) Receive an Economic Impact Payment (stimulus) in 2020? Catalog Number 21215 Form 13614.C 10-2020) 100XX DOXXXX DODO DXX XOX DOCO Basis Scenios DDDD XOD 100 X No Basic Scenarios Page 3 Additional Information and Questions related to the Preparation of Your Return 1. Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service) 2. Presidential Election Campaign Fund (If you check a box, your tax or refund will not change) Check here if you, or your spouself filing jointly, want $3 to go to this fund X You Spouse 3. If you are due a refund, would you like: a. Direct deposit . To purchase U.S. Savings Bondsc. To split your refund between different accounts X Yes No Yes Yes X No 4. If you have a balance due, would you like to make a payment directly from your bank account? X Yes NO 5. Did you live in an area that was declared a Federal disaster area? Yes X No If yes, where? 6. Did you, or your spouse if filing jointly, receive a letter from the IRS? Yes x No Many free tax preparation sites operate by receiving grant money or other federal financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued receipt of financial funding. Your answer will be used only for statistical purposes. These questions are optional 7. Would you say you can carry on a conversation in English, both understanding & Speaking? x Very well Well Not well Not at all Prefer not to answer 8. Would you say you can read a newspaper or book in English x Very well. We Not well Not at all Prefer not to answer 9. Do you or any member of your household have a disability? Yes XI No Prefer not to answer 10. Are you or your spouse a Veteran from the U.S. Armed Forces? Yes X No Prefer not to answer 11. Your race? American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander White X Prefer not to answer 12. Your spouse's race? American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander White X Prefer not to answer No spouse 13. Your ethnicity? Hispanic or Latino Not Hispanic or Latino X Prefer not to answer 14. Your spouse's ethnicity? Hispanic or Latino Not Hispanic or Latino X Prefer not to answer No spouse Additional comments Gambling losses - $700 Privacy Act and Paperwork Reduction Act Notice The Privacy Act of 1974 requires that when we ask for information we you our legal right to ask for the nation, why we are sig for it and how it will be used. We must tell you what could happen if we do not receive, and whether your response is voluntary required to obtain a better mandatory Our legal right to ask for Information is SUSC 301 We are asking for this information to sit in contacting you relative to your interest and or pain in the volunteer income tax preparation and outreach programe. The formation you provide may be turned to others who coordinate activities and staffing vous retum preparation shes or outreach acts. The information may also be used to establish afective control and correspondence and recognize volunteers. Your response is voluntary. However, you do not provide the requested information, the may not be able to use your assistance in these programs. The paperwork Reduction Act requires the display an OMB control rumber on public information requests. The OMD Control Number for this study is 1545.1964. Also you have any comments regarding the time estimates asociated win this study or suggestion on making this process single please write to the emal Revenue Service Tax Products Coordinating Commi SEW.CARMP.T.T.SP. 1111 Constitution Ave NW. Washington, DC 20224 Catalog Number 21216 Form 13614-C 10-20201 Employee's 127-00-XXXX M18.00 FASTIU View e filen 420.00 35-500XXXX 6,500.00 403.00 RICH'S BOOK STORE 1225 OVERVIEW AVE YOUR CITY, STATE ZIP 6,500.00 5 Mega 6,500.00 94.26 Letrare DANIEL EMORY 645 MEADE COURT YOUR CITY, STATE ZIP ser Este YS 35-500XXXX 16. The con la 6,500.00 350.00 2020 Deste fryhend entera W-2 Wage and Tax Statement Copy-To Be With Employee FEDERAL Tax Return This information is being the to the Internal Revenue Service 120-00-XXXX Bali, OM 1 PAT e file 36.600XXXX 1,625,00 30.000.00 30,000.00 1,860.00 SALEM ELEMENTARY SCHOOL 1270 W. 29TH ST YOUR CITY, STATE ZIP 30,000.00 435.00 Deporter 12 DD 3,800.00 AVERY EMORY 645 MEADE COURT YOUR CITY, STATE ZIP HO he En and Empley's YS 36-600xxxx 30,000.00 1,200.00 W-2 wage and Tax Statement 2020 Copy - To Belied with Employee's FEDERAL Tax Return This formation is being used to the normal Revenue Service CORRECTED I checked PAYER'Stref, town, state or province 1 Girona Grudin OMEN 1540-0119 Distributions From country. Por foreign postal code and phone no Pensions, Annuities 9,350.00 Retirement or PINE CORPORATION 2020 1809 GULF DRIVE Profit Sharing Plans IRAS, Insurance YOUR CITY, STATE ZIP Contracts, etc. 9.350.00 For 1099-R 2 Tastem Total not determined X Copy B PAYER'S TIN RECIPENT'S TIN Report this 3 Capital gannaded 4 Federal income ta Inbox24 Income on your federal tax return. If this 40-100XXXX 127-00-XXXX 1.935.00 form shows RECIPENT'S 5 Employee contro Need federal Income Durgitat us Apron carbon or tax withheld in DANIEL EMORY box 4 attach this copy to Street dress including at. ) 7 Distribution Omer your return 645 MEADE COURT SM This Information City or to prove country and Propostalden Your porter Tycoon being lumised to YOUR CITY STATE ZIP 10 Amour 11 FATCA in 14 State to withheld 15 State Payers state no 18 state carbution Roth Account Number 13 Date of 17 ct with payment 18 Name of 10 Location Fm 1099-R 2020: FORM SSA-1000 - SOCIAL SECURITY BENEFIT STATEMENT PART OF YOUR SOCIAL SECURITY BENEFITS SHOW IN BOX S MAY BE TABLE NONE NE THE REVERSE FOR MORE INFORMATION cowy DANIEL EMORY 127-00-XXXX 2000 $7,500.00 $7,500.00 DESCRIPTION OF AMOUNT BOX DESCRIPTION OF AMOUNT IN BOK Paid by check or direct deposit: $7,500 645 Meade Court Your City, State Zip Draft ole 21.2020 - Subiect to change DO NOT RETURN THIS FORM TO BRA ORRS CORRECTED ( checked OM 1545-1578 RECIPENT BLENDERS, y or low, province, country, ZIP for postal code and phone number FINANCIAL AID PARTNERS 666 LINCOLN YOUR CITY, STATE ZIP 2020 Student Loan Interest Statement Form 1098-E BORROWERS 128-00-XXXX 925.00 PECIENTS TH 38-900XXXX BORROWERS AVERY EMORY Copy B For Borrower importa kumised to the IRS you were to file wegen para ante ed on you the underpantan you verste descon 645 MEADE COURT Chytown or court, and Propostal code YOUR CITY STATE ZIP Account number one 2eed 1 does not include gration Form 1098- Department of the Treatynderleverance CORRECTED FORSy or town, CO2 8.500.00 2020 Tuition Statement From 100-T BUCKEYE COLLEGE 575 COLLEGE BLVO YOUR CITY, STATE ZIP Free SONT IN 33-700XXXX 129-00-XXXX SIRENE JACKSON EMORY For Student ht 645 MEADE COURT Cywonale YOUR CITY STATE ZIP om 6,500.00 db TOINE btw Tham com March De to the condimend 10 almente www.fo 1000-T TOI Buckeye College Meal Plan College Books 580 College Blvd Your City, State ZIP Buckeye College Student Housing 575 College Blvd. Your City, State ZIP Receipt: 3 Textbooks: $500 Received from: Jackson Emory 84,500 Payment for books is also en the college website, Basic Scenario 6: Test Questions 11. What is the amount of Daniel and Avery's standard deduction? 12. What is the total amount of adjustments on the Emorys' tax return? a $250 b. $925 c. $1,175 d. $1,475 13. What is the total amount of the Emorys' refundable American opportunity credit? 14. Jackson qualifies Daniel and Avery to claim the credit for other dependents a True b. False 15. What is the total amount of federal income tax withholding? a $1,525 b. $1,935 c. $1.945 d. $3,880 16. How much of Daniel's Social Security is taxable? a. $0 b. $3,750 c. $6,375 d. $7,500 17. Daniel and Avery cannot claim Jackson for the earned income credit because he did not live with them for more than half the year and does not meet the residency test a. True, Jackson only lived with his parents during the summer, which was less than six months b. False Attendance at school is considered a temporary absence and those months are counted as time that Jackson lived with his parents for the earned income credit