Question

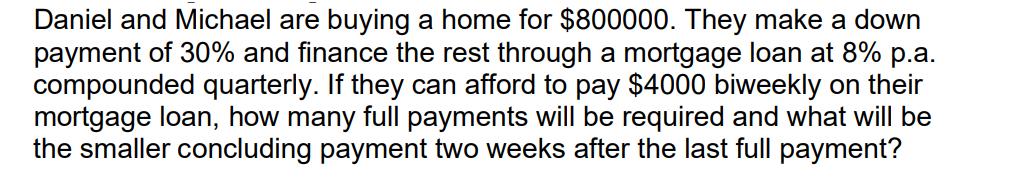

Daniel and Michael are buying a home for $800000. They make a down payment of 30% and finance the rest through a mortgage loan

Daniel and Michael are buying a home for $800000. They make a down payment of 30% and finance the rest through a mortgage loan at 8% p.a. compounded quarterly. If they can afford to pay $4000 biweekly on their mortgage loan, how many full payments will be required and what will be the smaller concluding payment two weeks after the last full payment?

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the number of full payments required we first need to determine the principal amount financed after the down payment The down payment is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance

Authors: Thomas Garman, Raymond Forgue

12th edition

9781305176409, 1133595839, 1305176405, 978-1133595830

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App