Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Daniel Jackson is investing $8,500 in a bank CD that pays a 10 percent annual interest rate. How much will the CD be worth at

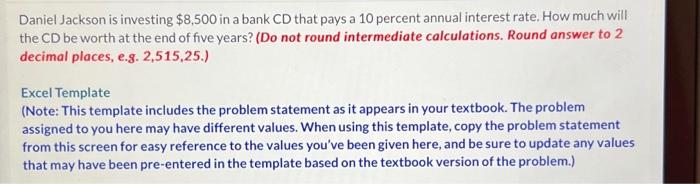

Daniel Jackson is investing $8,500 in a bank CD that pays a 10 percent annual interest rate. How much will the CD be worth at the end of five years? (Do not round intermediate calculations. Round answer to 2 decimal places, e.g. 2,515,25.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started