Answered step by step

Verified Expert Solution

Question

1 Approved Answer

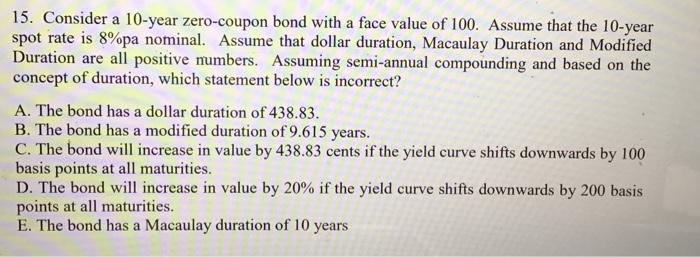

15. Consider a 10-year zero-coupon bond with a face value of 100. Assume that the 10-year spot rate is 8%pa nominal. Assume that dollar

15. Consider a 10-year zero-coupon bond with a face value of 100. Assume that the 10-year spot rate is 8%pa nominal. Assume that dollar duration, Macaulay Duration and Modified Duration are all positive numbers. Assuming semi-annual compounding and based on the concept of duration, which statement below is incorrect? A. The bond has a dollar duration of 438.83. B. The bond has a modified duration of 9.615 years. C. The bond will increase in value by 438.83 cents if the yield curve shifts downwards by 100 basis points at all maturities. D. The bond will increase in value by 20% if the yield curve shifts downwards by 200 basis points at all maturities. E. The bond has a Macaulay duration of 10 years

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

As the Macaulay Duration of a zero coupon bond is the same as its maturity Macaulay Du...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started