Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Danny Nawrocki purchased an annuity for $120,000. The annuity pays $18,000 a year for 10 years. How much of each payment must Danny include

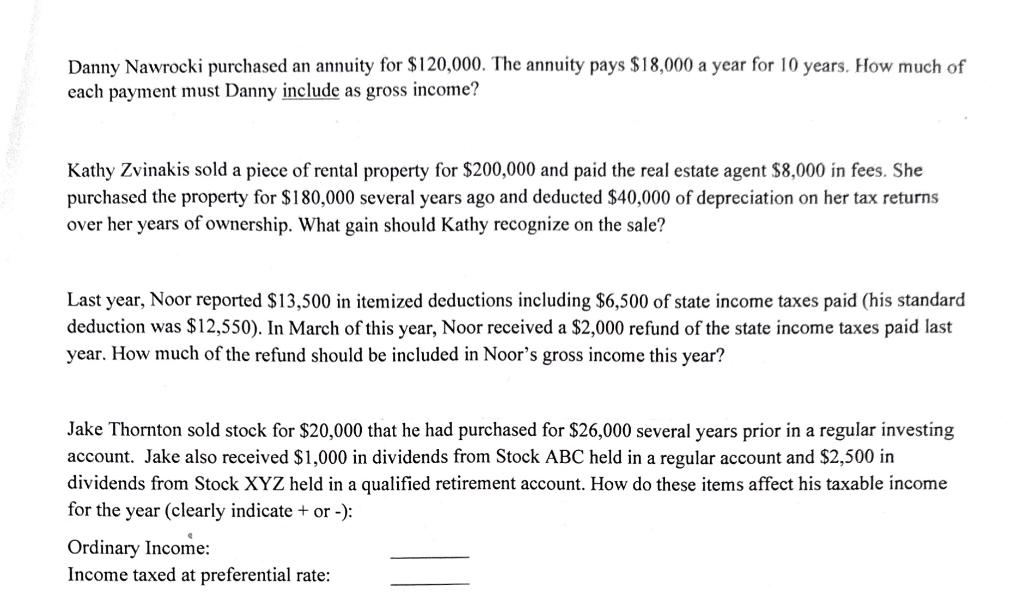

Danny Nawrocki purchased an annuity for $120,000. The annuity pays $18,000 a year for 10 years. How much of each payment must Danny include as gross income? Kathy Zvinakis sold a piece of rental property for $200,000 and paid the real estate agent $8,000 in fees. She purchased the property for $180,000 several years ago and deducted $40,000 of depreciation on her tax returns over her years of ownership. What gain should Kathy recognize on the sale? Last year, Noor reported $13,500 in itemized deductions including $6,500 of state income taxes paid (his standard deduction was $12,550). In March of this year, Noor received a $2,000 refund of the state income taxes paid last year. How much of the refund should be included in Noor's gross income this year? Jake Thornton sold stock for $20,000 that he had purchased for $26,000 several years prior in a regular investing account. Jake also received $1,000 in dividends from Stock ABC held in a regular account and $2,500 in dividends from Stock XYZ held in a qualified retirement account. How do these items affect his taxable income for the year (clearly indicate + or -): Ordinary Income: Income taxed at preferential rate:

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine how much of each payment Danny must include as gross income we need to use the exclusion ratio method The exclusion ratio is calculated b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started