Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Daphne Brigerton, CFA has been asked to evaluate the upcoming new issue of VSB, a U.S.-b year for the previous three years. Large companies

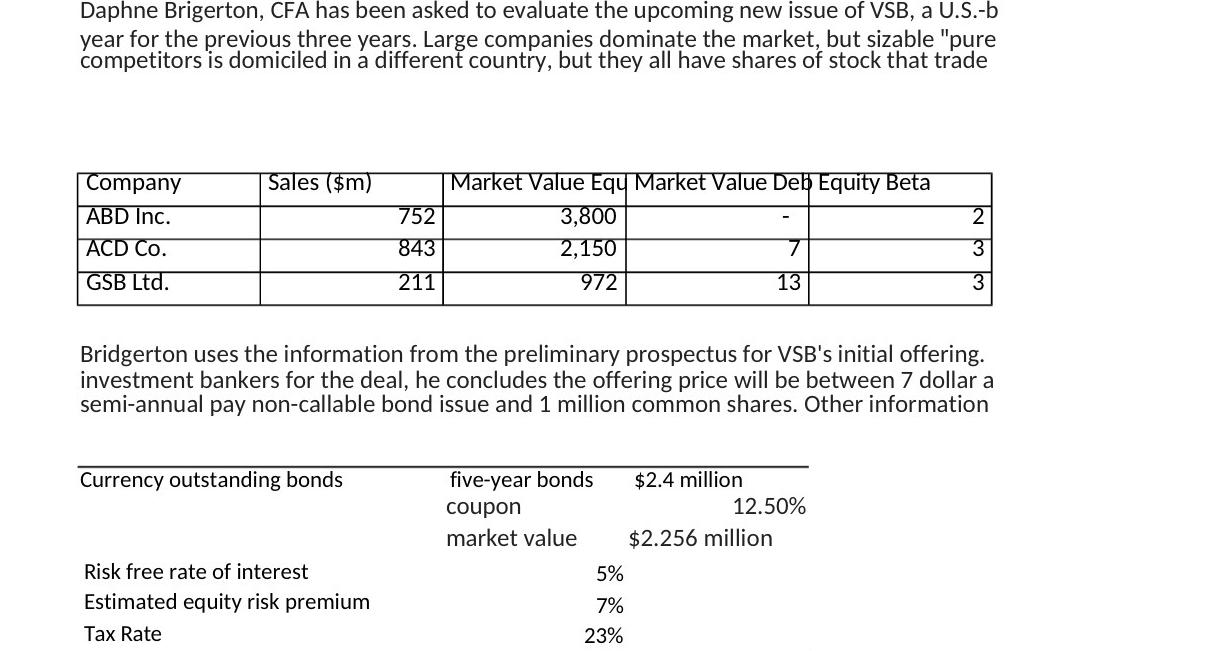

Daphne Brigerton, CFA has been asked to evaluate the upcoming new issue of VSB, a U.S.-b year for the previous three years. Large companies dominate the market, but sizable "pure competitors is domiciled in a different country, but they all have shares of stock that trade Company ABD Inc. ACD Co. GSB Ltd. Sales ($m) Currency outstanding bonds 752 843 211 Risk free rate of interest Estimated equity risk premium Tax Rate Market Value Equ Market Value Deb Equity Beta 3,800 2,150 972 Bridgerton uses the information from the preliminary prospectus for VSB's initial offering. investment bankers for the deal, he concludes the offering price will be between 7 dollar a semi-annual pay non-callable bond issue and 1 million common shares. Other information five-year bonds coupon market value 5% 7% 23% $2.4 million 7 13 12.50% $2.256 million 2 3 3 Another stock to being analyzed is Paragon with data below. Selected Market Information (%) Yield on U.S. 10-year Treasury bond Yield on Paragon 10-year goovernment bond Annualized standard deviation of Paragon stock index Annualized standard deviation of Paragon dollar-denominated government bond 1. Compute asset betas for ABD, ACD, GSB, respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the asset beta also known as the unlevered beta we need to remove the effect of debt fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started