Dare2Dream Donuts Inc. (D2DD) is a CCPC owned by Alec & Isla Smook. As their tax advisor, you are currently completing D2DD's corporate tax

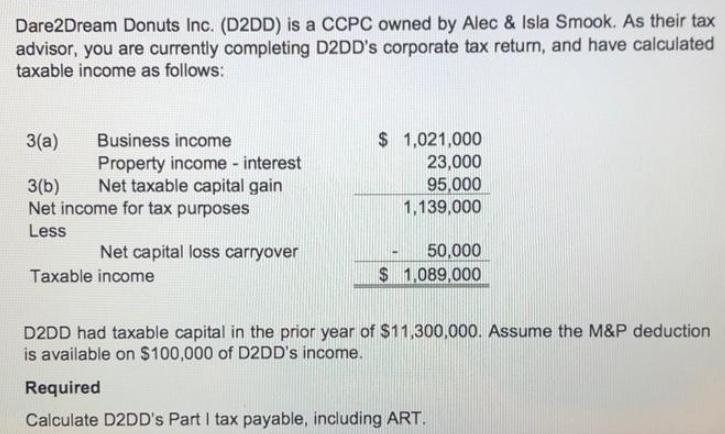

Dare2Dream Donuts Inc. (D2DD) is a CCPC owned by Alec & Isla Smook. As their tax advisor, you are currently completing D2DD's corporate tax return, and have calculated taxable income as follows: $ 1,021,000 23,000 95,000 1,139,000 3(a) Business income Property income - interest Net taxable capital gain Net income for tax purposes 3(b) Less Net capital loss carryover 50,000 Taxable income $ 1,089,000 D2DD had taxable capital in the prior year of $11,300,000. Assume the M&P deduction is available on $100,000 of D2DD's income. Required Calculate D2DD's Part I tax payable, including ART.

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Tax Type Marginal Tax Rate Effective Tax Rate ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started