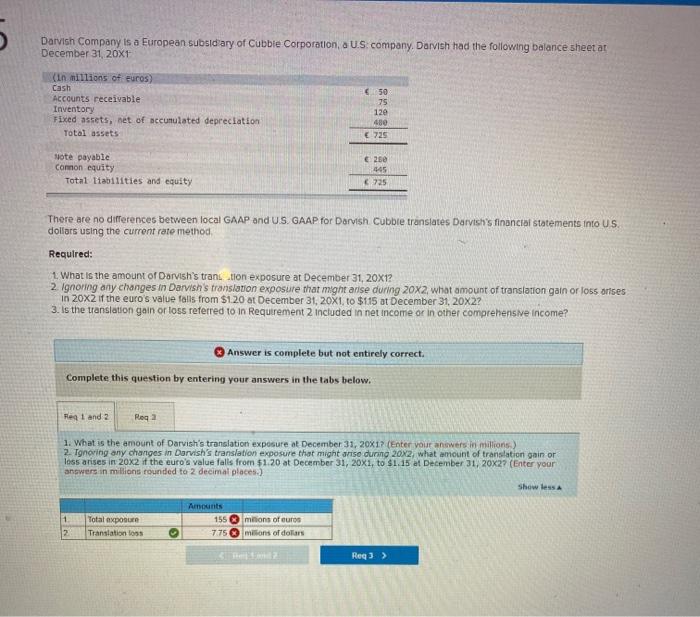

Darvish Company is a European subsidiary of Cubbie Corporation, a U.S.company. Darvish had the following balance sheet ar December 31, 20X1 (in millions of euros) Cash Accounts receivable Inventory Fixed assets, net of accumulated depreciation Total assets 50 75 12e 480 725 Note payable Comon equity Total liabilities and equity ce 445 6725 There are no differences between local GAAP and US GAAP for Darvish Cubble translates Darvish's financial statements into US. dollars using the current rate method Required: 1 What is the amount of Darvish's trans ton exposure at December 31, 20X1? 2. Ignoring any changes in Darvish's translation exposure that might arise during 20x2 what amount of translation gain or loss arises in zox2 if the euro's value falls from $1.20 at December 31, 20X1. to $115 at December 31, 20X2? 3. Is the translation gain or loss referred to in Requirement 2 included in net income or in other comprehensive income? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 2 1. What is the amount of Darvish's translation exposure at December 31, 2017 (Enter your answers in millions) 2. Ignoring any changes in Darvish's translation exposure that might arise during 20x2, what amount of translation gain or loss arises in 20x2 if the euro's value falls from $1.20 at December 31, 20x1, to $1.15 at December 31, 20X27 (Enter your answers in millions rounded to 2 decimal places.) Show less 1 Total pour Translations Amounts 155 milions of euros 775 millions of dollars 2 Reg 3 > Darvish Company is a European subsidiary of Cubbie Corporation, a U.S.company. Darvish had the following balance sheet ar December 31, 20X1 (in millions of euros) Cash Accounts receivable Inventory Fixed assets, net of accumulated depreciation Total assets 50 75 12e 480 725 Note payable Comon equity Total liabilities and equity ce 445 6725 There are no differences between local GAAP and US GAAP for Darvish Cubble translates Darvish's financial statements into US. dollars using the current rate method Required: 1 What is the amount of Darvish's trans ton exposure at December 31, 20X1? 2. Ignoring any changes in Darvish's translation exposure that might arise during 20x2 what amount of translation gain or loss arises in zox2 if the euro's value falls from $1.20 at December 31, 20X1. to $115 at December 31, 20X2? 3. Is the translation gain or loss referred to in Requirement 2 included in net income or in other comprehensive income? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 2 1. What is the amount of Darvish's translation exposure at December 31, 2017 (Enter your answers in millions) 2. Ignoring any changes in Darvish's translation exposure that might arise during 20x2, what amount of translation gain or loss arises in 20x2 if the euro's value falls from $1.20 at December 31, 20x1, to $1.15 at December 31, 20X27 (Enter your answers in millions rounded to 2 decimal places.) Show less 1 Total pour Translations Amounts 155 milions of euros 775 millions of dollars 2 Reg 3 >