Daryl Kearns saved $270,000 during the 25 years that he worked for a major corporation. Now he has retired at the age of 50 and

Daryl Kearns saved $270,000 during the 25 years that he worked for a major corporation. Now he has retired at the age of 50 and has begun to draw a comfortable pension check every month. He wants to ensure the financial security of his retirement by investing his savings wisely and is currently considering two investment opportunities. Both investments require an initial payment of $185,500. The following table presents the estimated cash inflows for the two alternatives:

| | Year 1 | Year 2 | Year 3 | Year 4 |

| Opportunity #1 | $ | 55,685 | | $ | 58,840 | | $ | 78,930 | | $ | 101,350 | |

| Opportunity #2 | | 103,200 | | | 109,650 | | | 17,900 | | | 15,000 | |

| |

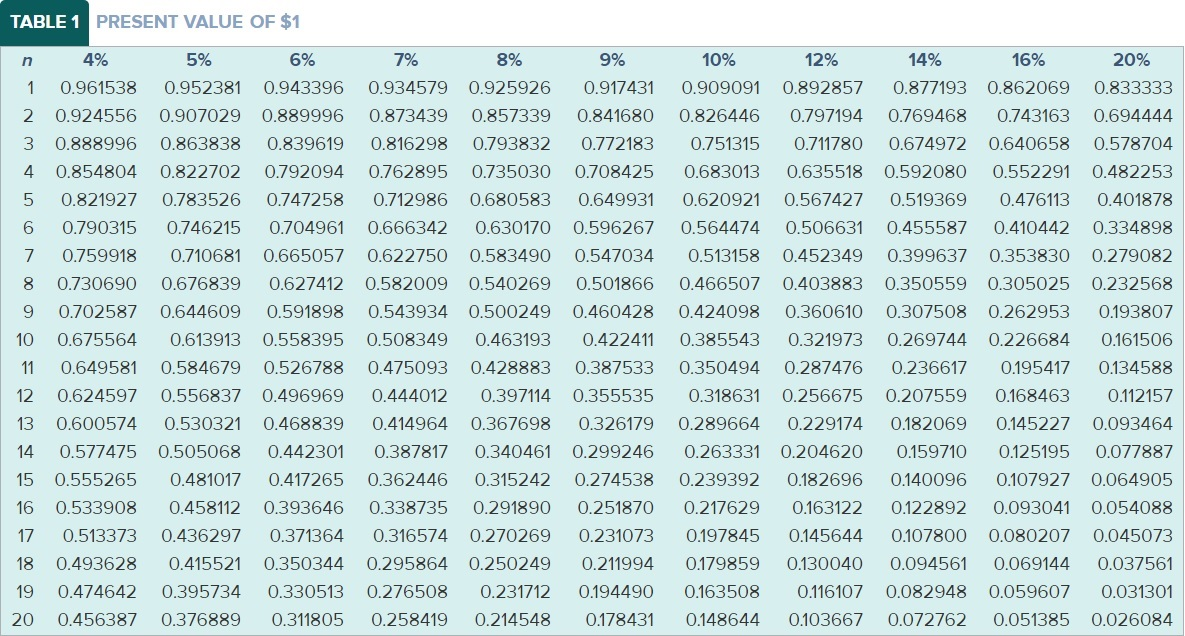

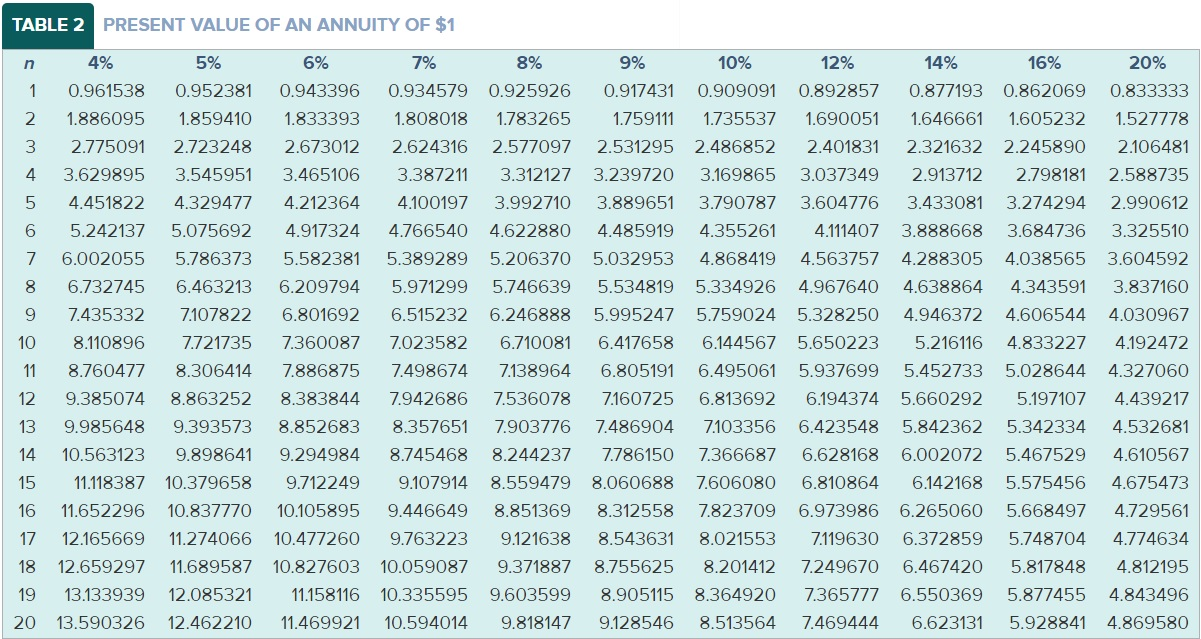

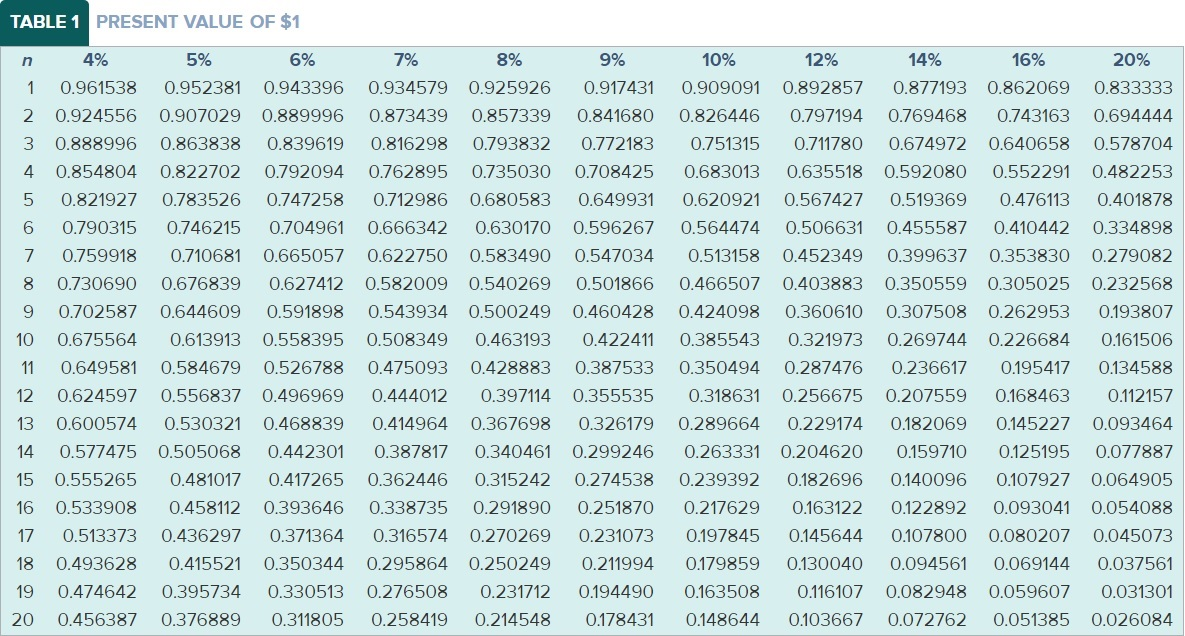

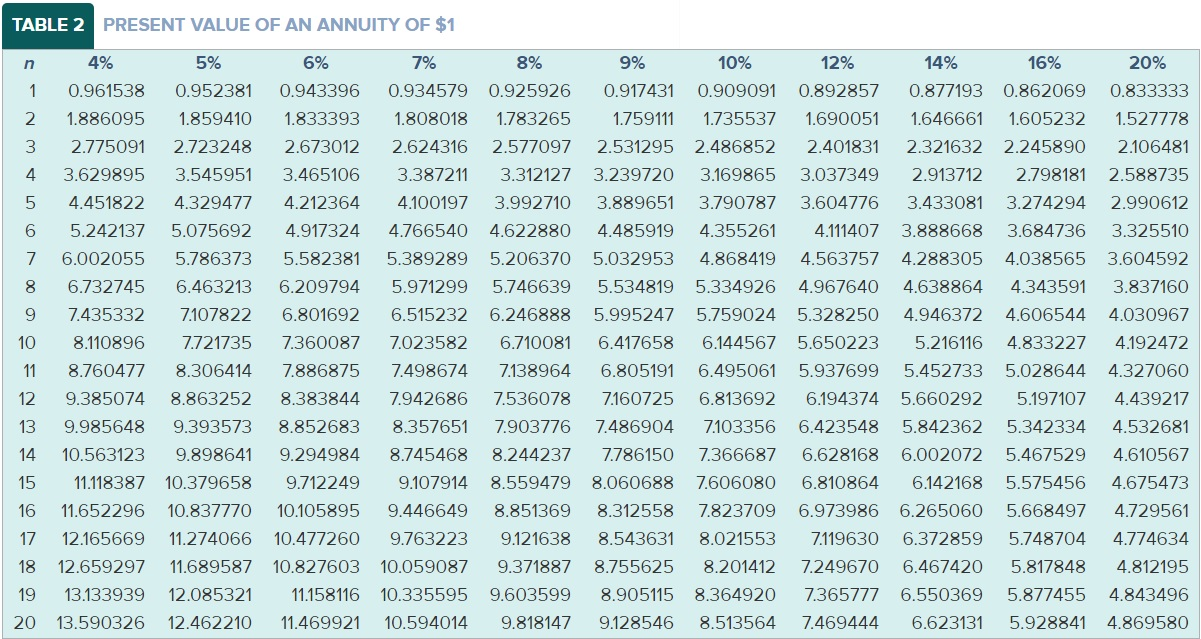

Mr. Kearns decides to use his past average return on mutual fund investments as the discount rate; it is 12 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)

Required

-

Compute the net present value of each opportunity. Which should Mr. Kearns adopt based on the net present value approach?

-

Compute the payback period for each opportunity. Which should Mr. Kearns adopt based on the payback approach?

TABLE 1 PRESENT VALUE OF $1 n 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0.743163 0.694444 3 0.888996 0.863838 0.839619 0.816298 0.793832 0.772183 0.751315 0.711780 0.674972 0.640658 0.578704 4 0.854804 0.822702 0.792094 0.762895 0.735030 0.708425 0.683013 0.635518 0.592080 0.552291 0.482253 5 0.821927 0.783526 0.747258 0.712986 0.680583 0.649931 0.620921 0.567427 0.519369 0.476113 0.401878 6 0.790315 0.746215 0.704961 0.666342 0.630170 0.596267 0.564474 0.506631 0.455587 0.410442 0.334898 7 0.759918 0.710681 0.665057 0.622750 0.583490 0.5470340.513158 0.452349 0.399637 0.353830 0.279082 8 0.730690 0.6768390.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0.350559 0.305025 0.232568 9 0.702587 0.644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.307508 0.262953 0.193807 10 0.675564 0.613913 0.558395 0.508349 0.463193 0.422411 0.385543 0.321973 0.269744 0.226684 0.161506 11 0.649581 0.584679 0.526788 0.475093 0.428883 0.3875330.350494 0.287476 0.236617 0.195417 0.134588 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.2075590.168463 0.112157 13 0.600574 0.530321 0.468839 0.414964 0.367698 0.326179 0.289664 0.229174 0.182069 0.145227 0.093464 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0.263331 0.204620 0.159710 0.125195 0.077887 15 0.555265 0.481017 0.417265 0.362446 0.315242 0.274538 0.239392 0.182696 0.140096 0.107927 0.064905 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.2176290.163122 0.122892 0.093041 0.054088 17 0.513373 0.436297 0.371364 0.316574 0.270269 0.231073 0.197845 0.145644 0.107800 0.080207 0.045073 18 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 0.179859 0.130040 0.094561 0.069144 0.037561 190.474642 0.395734 0.330513 0.276508 0.231712 0.194490 0.163508 0.116107 0.082948 0.059607 0.031301 20 0.456387 0.376889 0.311805 0.2584190.214548 0.178431 0.148644 0.103667 0.072762 0.051385 0.026084 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 n 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 2 1.886095 1.859410 1.833393 1.808018 1.783265 1.759111 1.735537 1.690051 1.646661 1.605232 1.527778 3 2.775091 2.723248 2.673012 2.624316 2.577097 2.531295 2.486852 2.401831 2.321632 2.245890 2.106481 4 3.629895 3.545951 3.465106 3.387211 3.312127 3.239720 3.169865 3.0373492.913712 2.798181 2.588735 5 4.451822 4.329477 4.212364 4.100197 3.992710 3.889651 3.790787 3.604776 3.433081 3.274294 2.990612 6 5.242137 5.075692 4.917324 4.766540 4.622880 4.4859194.355261 4.111407 3.888668 3.684736 3.325510 7 6.002055 5.786373 5.582381 5.389289 5.206370 5.032953 4.868419 4.563757 4.288305 4.038565 3.604592 6.732745 6.463213 6.209794 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 4.343591 3.837160 9 7.435332 7107822 6.801692 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 4.606544 4.030967 8.110896 7.721735 7.360087 7023582 6.710081 6.417658 6.144567 5.650223 5.216116 4.833227 4.192472 8.760477 8.306414 7.886875 7.498674 7.138964 6.805191 6.495061 5.937699 5.452733 5.028644 4.327060 12 9.385074 8.863252 8.383844 7.942686 7.536078 7.160725 6.813692 6.194374 5.660292 5.197107 4.439217 13 9.985648 9.393573 8.852683 8.357651 7.903776 7.486904 7103356 6.423548 5.842362 5.342334 4.532681 14 10.563123 9.898641 9.294984 8.745468 8.244237 7.786150 7.366687 6.628168 6.002072 5.467529 4.610567 15 11.118387 10.379658 9.7122499.107914 8.559479 8.060688 7.606080 6.810864 6.142168 5.575456 4.675473 16 11.652296 10.837770 10.105895 9.4466498.851369 8.312558 7.8237096.973986 6.265060 5.668497 4.729561 17 12.165669 11.274066 10.477260 9.763223 9.121638 8.543631 8.021553 7119630 6.372859 5.748704 4.774634 18 12.659297 11.689587 10.827603 10.059087 9.371887 8.755625 8.201412 7.249670 6.467420 5.817848 4.812195 1913.133939 12.085321 11.158116 10.335595 9.6035998.905115 8.364920 7.365777 6.550369 5.877455 4.843496 20 13.590326 12.462210 11.469921 10.594014 9.818147 9.128546 8.513564 7.469444 6.623131 5.928841 4.869580