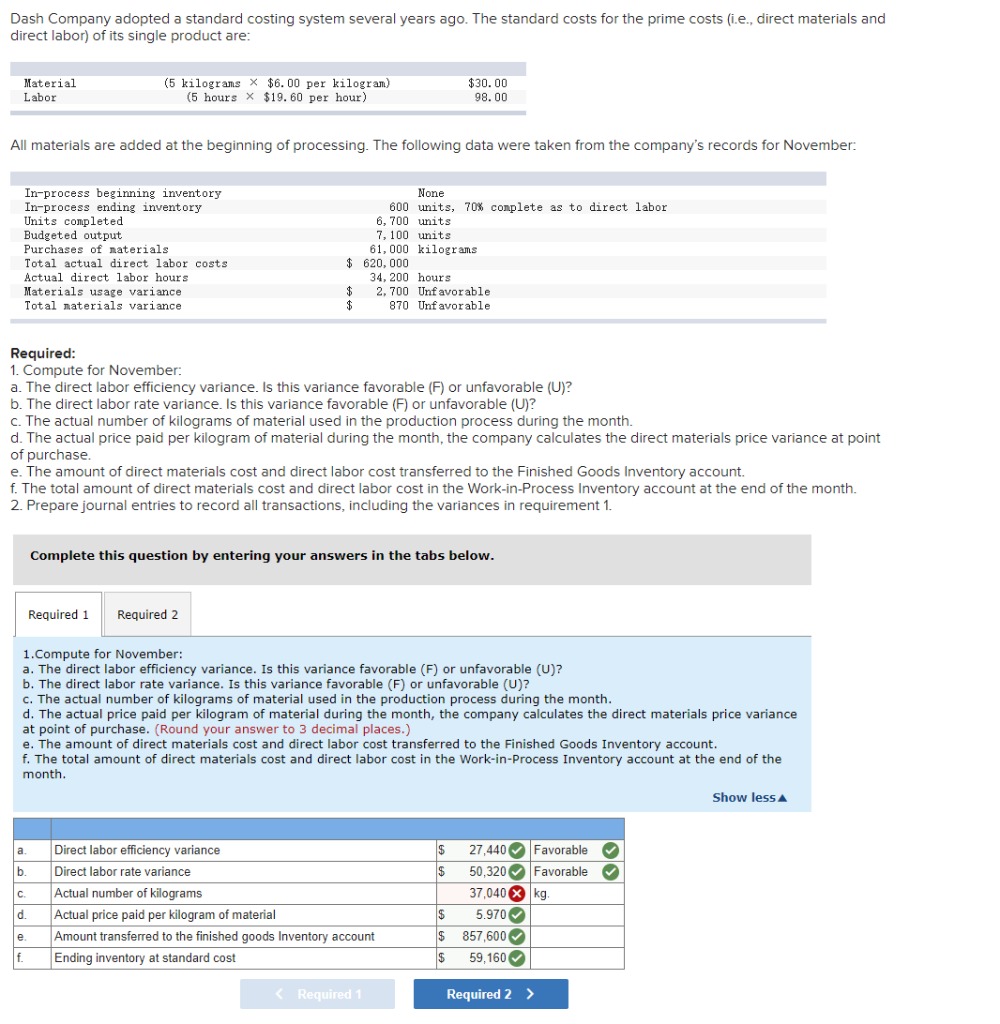

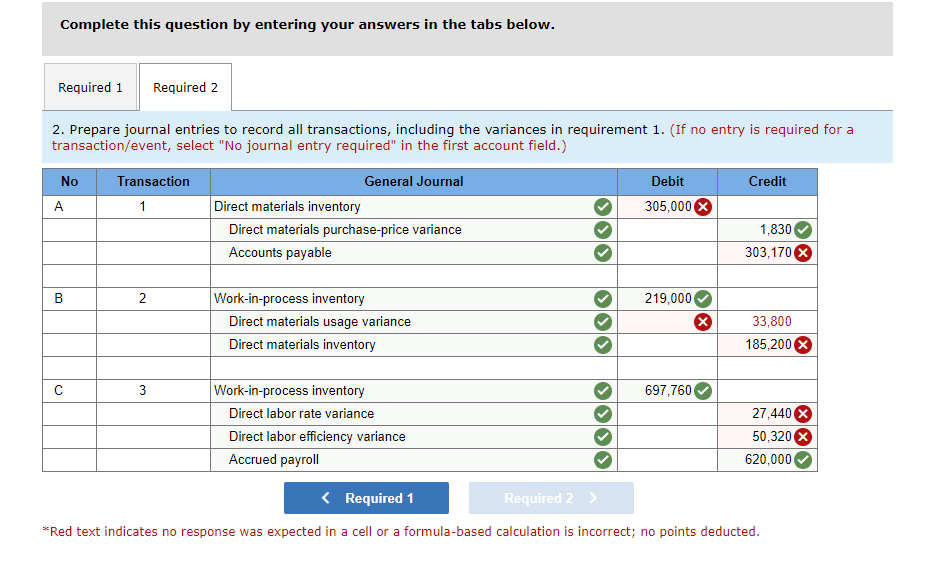

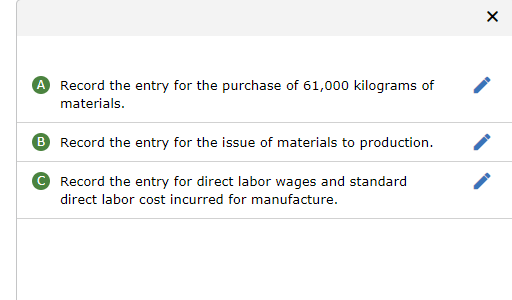

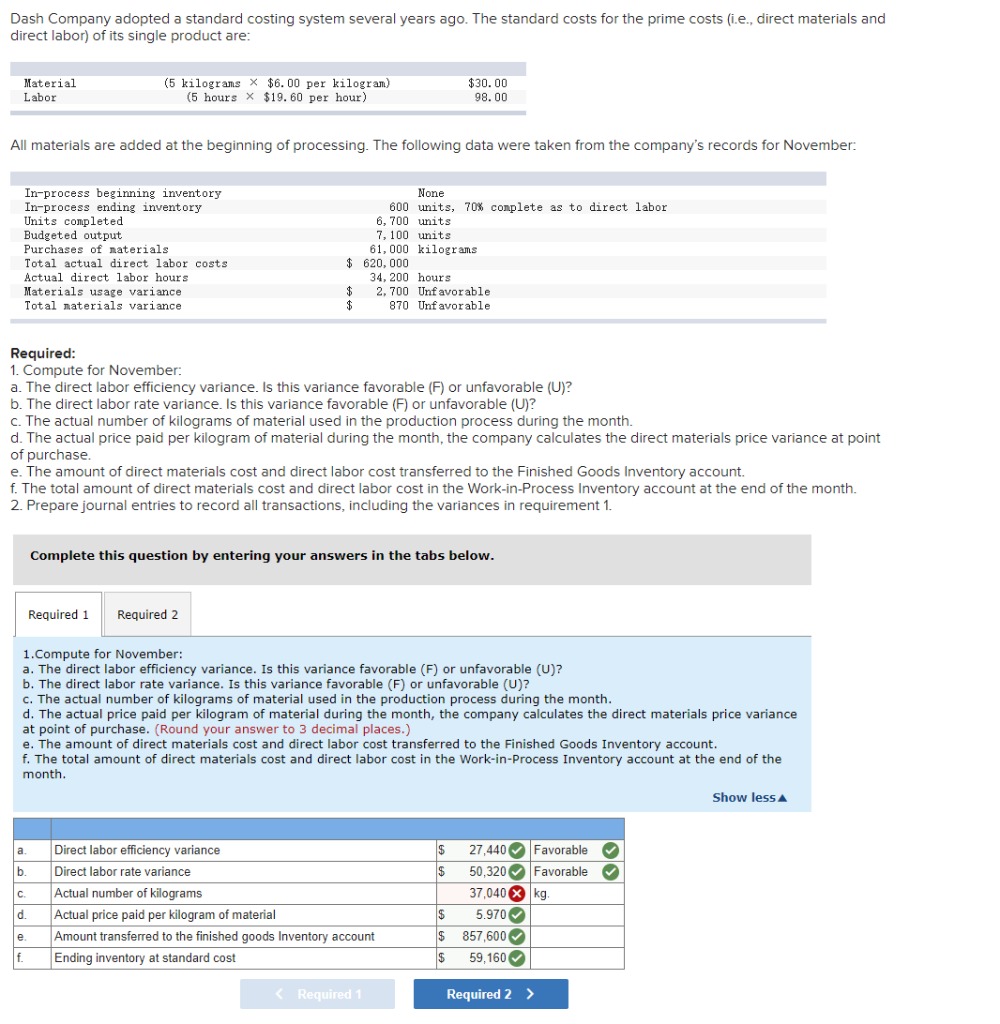

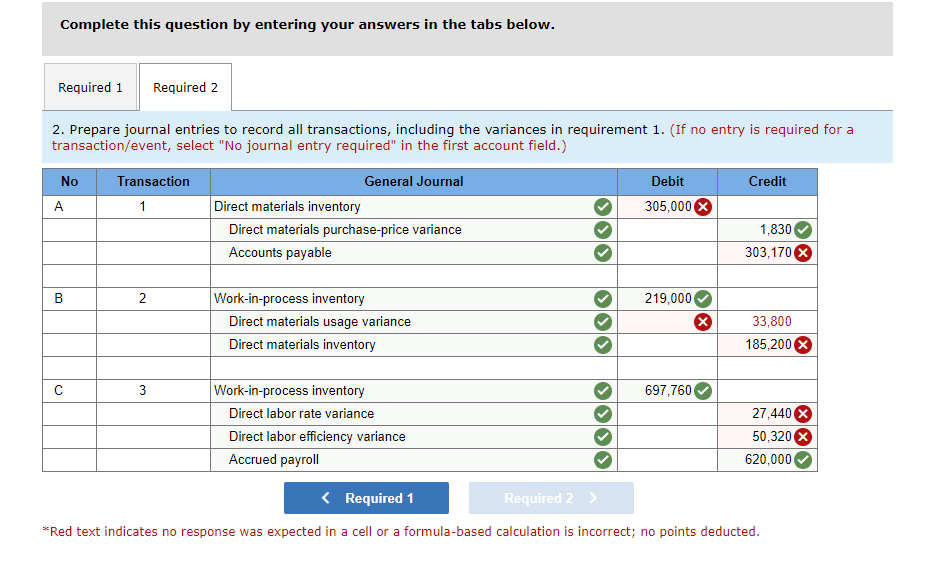

Dash Company adopted a standard costing system several years ago. The standard costs for the prime costs (.e., direct materials and direct labor) of its single product are: $30.00 Material Labor (5 kilograms X $6.00 per kilogram) (5 hours x $19.60 per hour) 98.00 All materials are added at the beginning of processing. The following data were taken from the company's records for November: In-process beginning inventory In-process ending inventory Units completed Budgeted output Purchases of materials Total actual direct labor costs Actual direct labor hours Materials usage variance Total materials variance None 600 units, 70% complete as to direct labor 6, 700 units 7,100 units 61,000 kilograms $ 620,000 34, 200 hours 2,700 Unfavorable $ 870 Unfavorable Required: 1. Compute for November: a. The direct labor efficiency variance. Is this variance favorable (F) or unfavorable (U)? b. The direct labor rate variance. Is this variance favorable (F) or unfavorable (U)? c. The actual number of kilograms of material used in the production process during the month. d. The actual price paid per kilogram of material during the month, the company calculates the direct materials price variance at point of purchase. e. The amount of direct materials cost and direct labor cost transferred to the Finished Goods Inventory account. f. The total amount of direct materials cost and direct labor cost in the Work-in-Process Inventory account at the end of the month. 2. Prepare journal entries to record all transactions, including the variances in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 1.Compute for November: a. The direct labor efficiency variance. Is this variance favorable (F) or unfavorable (U)? b. The direct labor rate variance. Is this variance favorable (F) or unfavorable (U)? c. The actual number of kilograms of material used in the production process during the month. d. The actual price paid per kilogram of material during the month, the company calculates the direct materials price variance at point of purchase. (Round your answer to 3 decimal places.) e. The amount of direct materials cost and direct labor cost transferred to the Finished Goods Inventory account. f. The total amount of direct materials cost and direct labor cost in the Work-in-Process Inventory account at the end of the month. Show less a b C Direct labor efficiency variance Direct labor rate variance Actual number of kilograms Actual price paid per kilogram of material Amount transferred to the finished goods Inventory account Ending inventory at standard cost $ 27,440 Favorable $ 50,320 Favorable 37,040 kg $ 5.970 $ 857,600 $ 59,160 d. e f. Complete this question by entering your answers in the tabs below. Required 1 Required 2 2. Prepare journal entries to record all transactions, including the variances in requirement 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction General Journal Debit Credit A 1 Direct materials inventory 305,000 X Direct materials purchase-price variance 1,830 Accounts payable 303,170 X B B 2 219,000 Work-in-process inventory Direct materials usage variance Direct materials inventory 33,800 185,200 X 3 Work-in-process inventory 697,760 Direct labor rate variance Direct labor efficiency variance OO 27,440 50,320 620,000 Accrued payroll