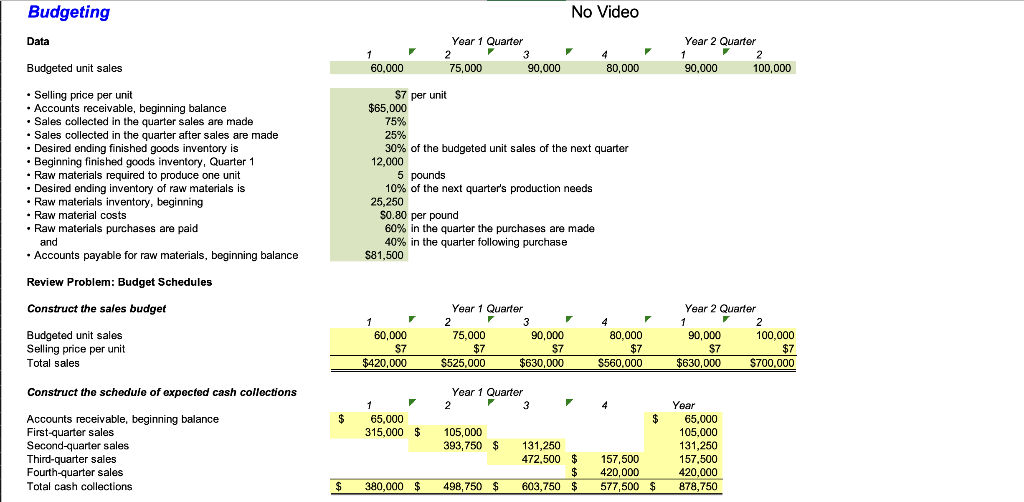

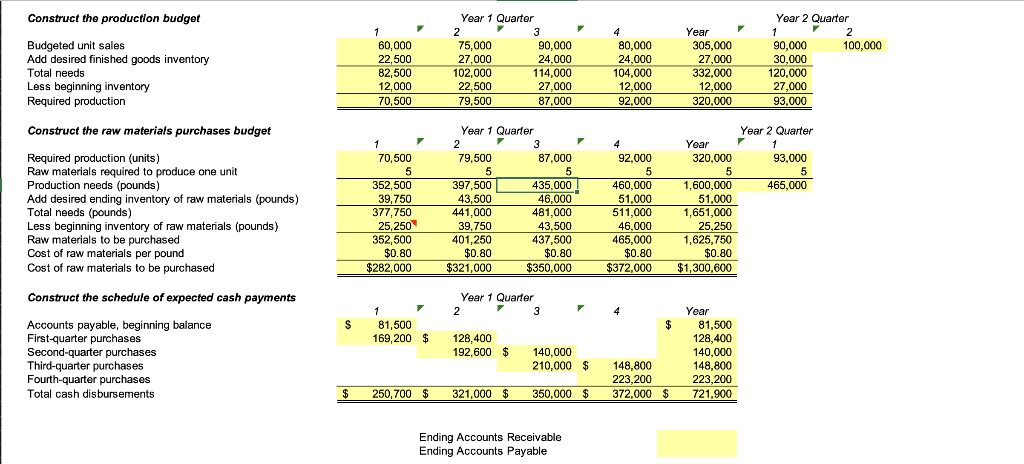

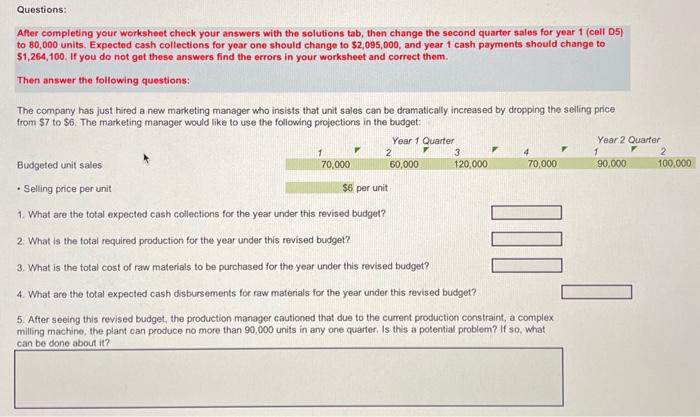

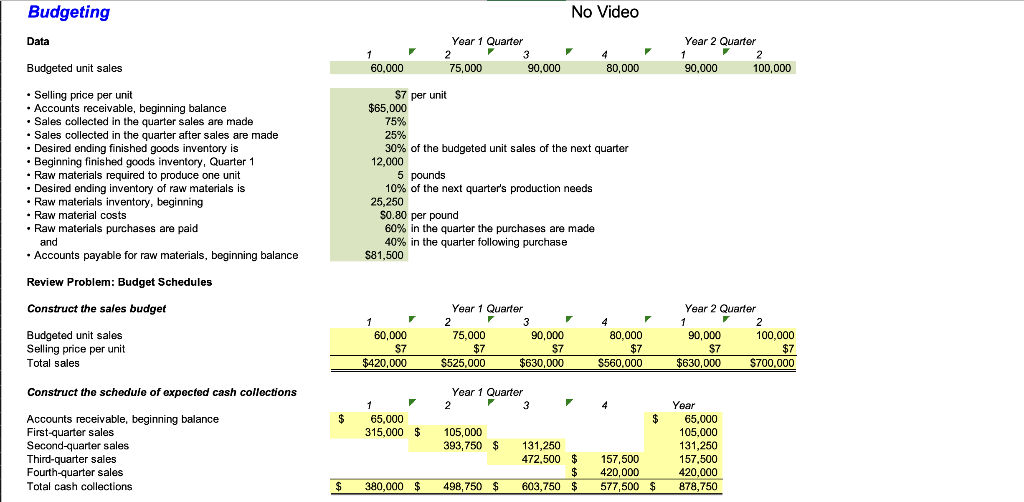

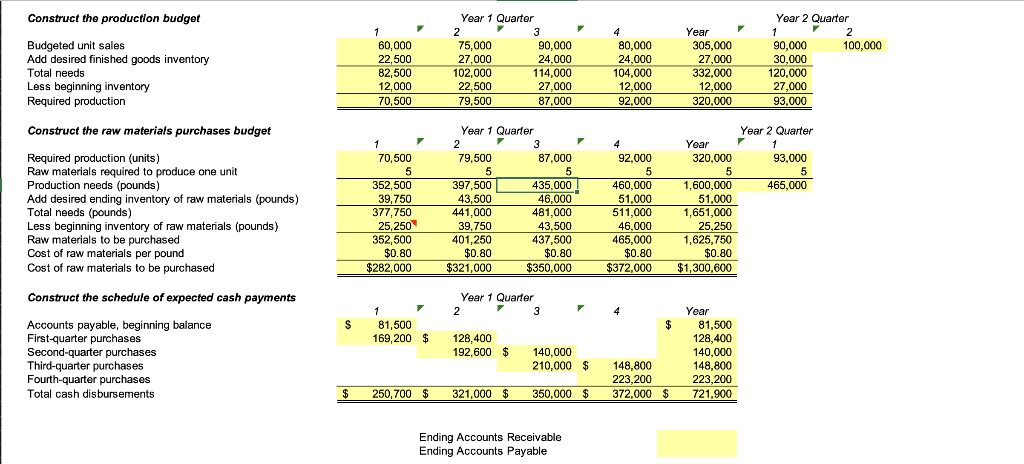

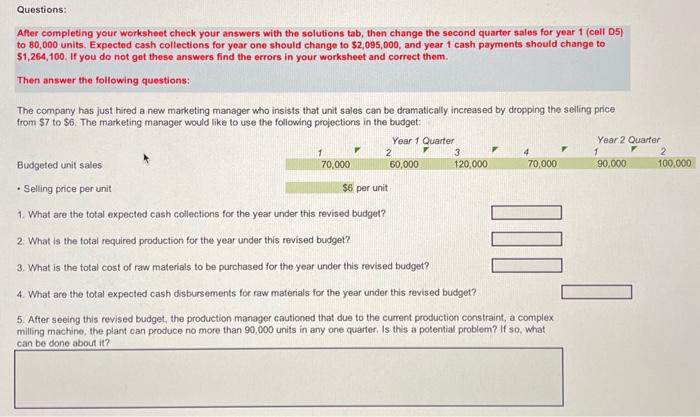

Data Budgeted unit sales 1160,00080,0002Year1Quarter75,00090,0004 - Selling price per unit \$7 per unit - Accounts receivable, beginning balance $65,000 - Sales collected in the quarter sales are made - Sales collected in the quarter after sales are made 75% - Desired ending finished goods inventory is 30% of the budgeted unit sales of the next quarter - Beginning finished goods inventory, Quarter 1 12,000 - Raw materials required to produce one unit 5 pounds - Desired ending inventory of raw materials is 10% of the next quarter's production needs - Raw materials inventory, beginning - Raw material costs - Raw materials purchases are paid and - Accounts payable for raw materials, beginning balance Review Problem: Budget Schedules Construct the sales budget Budgeted unit sales Selling price per unit Total sales Construct the scheduie of expected cash collections Accounts receivable, beginning balance First-quarter sales Second-quarter sales Third-quarter sales Fourth-quarter sales Total cash collections Ending Accounts Receivable Ending Accounts Payable After completing your worksheet check your answers with the solutions tab, then change the second quarter sales for year 1 (cell D5) to 80,000 units. Expected cash collections for year one should change to $2,095,000, and year 1 cash payments should change to $1,264,100. If you do not got these answers find the errors in your worksheet and correct them. Then answer the following questions: The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $7 to $6. The marketing manager would like to use the following projections in the budget: Data Budgeted unit sales 1160,00080,0002Year1Quarter75,00090,0004 - Selling price per unit \$7 per unit - Accounts receivable, beginning balance $65,000 - Sales collected in the quarter sales are made - Sales collected in the quarter after sales are made 75% - Desired ending finished goods inventory is 30% of the budgeted unit sales of the next quarter - Beginning finished goods inventory, Quarter 1 12,000 - Raw materials required to produce one unit 5 pounds - Desired ending inventory of raw materials is 10% of the next quarter's production needs - Raw materials inventory, beginning - Raw material costs - Raw materials purchases are paid and - Accounts payable for raw materials, beginning balance Review Problem: Budget Schedules Construct the sales budget Budgeted unit sales Selling price per unit Total sales Construct the scheduie of expected cash collections Accounts receivable, beginning balance First-quarter sales Second-quarter sales Third-quarter sales Fourth-quarter sales Total cash collections Ending Accounts Receivable Ending Accounts Payable After completing your worksheet check your answers with the solutions tab, then change the second quarter sales for year 1 (cell D5) to 80,000 units. Expected cash collections for year one should change to $2,095,000, and year 1 cash payments should change to $1,264,100. If you do not got these answers find the errors in your worksheet and correct them. Then answer the following questions: The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $7 to $6. The marketing manager would like to use the following projections in the budget